Transportation keeps the global economy moving. Any operational disruptions have wider consequences for society, making the management of the associated risks a priority that should transcend industry boundaries

View this complete post...

John Hennessy III,

P.E.

Transportation keeps the global economy moving. Any operational disruptions have wider consequences for society, making the management of the associated risks a priority that should transcend industry boundaries

View this complete post...

After years of underinvestment, infrastructure is having a moment in the policy discussion. Across North America, policy-makers are moving toward using public sector infrastructure investment as a strategy for promoting economic growth, while private infrastructure developers are seeking projects that yield healthy investment returns – returns that are harder to find over the long-term while low growth rates remain the dominant macro-narrative. This focus on infrastructure investment’s potential benefits is laudable, reflecting the advice of top economists and the emerging limits of other policy tools. Such investment, if well-targeted and well-executed, can be a path to achieve near-term economic policy objectives while dramatically improving the foundation for long-term economic prosperity.

View this complete post...

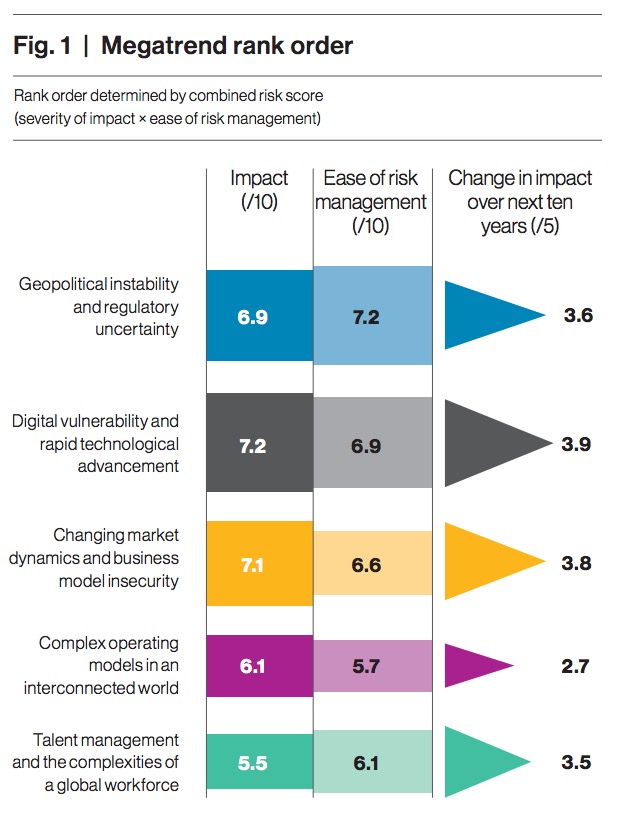

Global consumption of petroleum and other liquid fuels is estimated to have grown by 1.4 million b/d in 2015. EIA expects global consumption to increase by 1.5 million b/d in 2016 and by 1.4 million b/d in 2017, mostly driven by growth in countries outside of the Organization for Economic Cooperation and Development (OECD). Non-OECD consumption growth was 0.9 million b/d in 2015, and it is expected to be 1.2 million b/d in 2016 and 1.3 million b/d in 2017.

View this complete post...

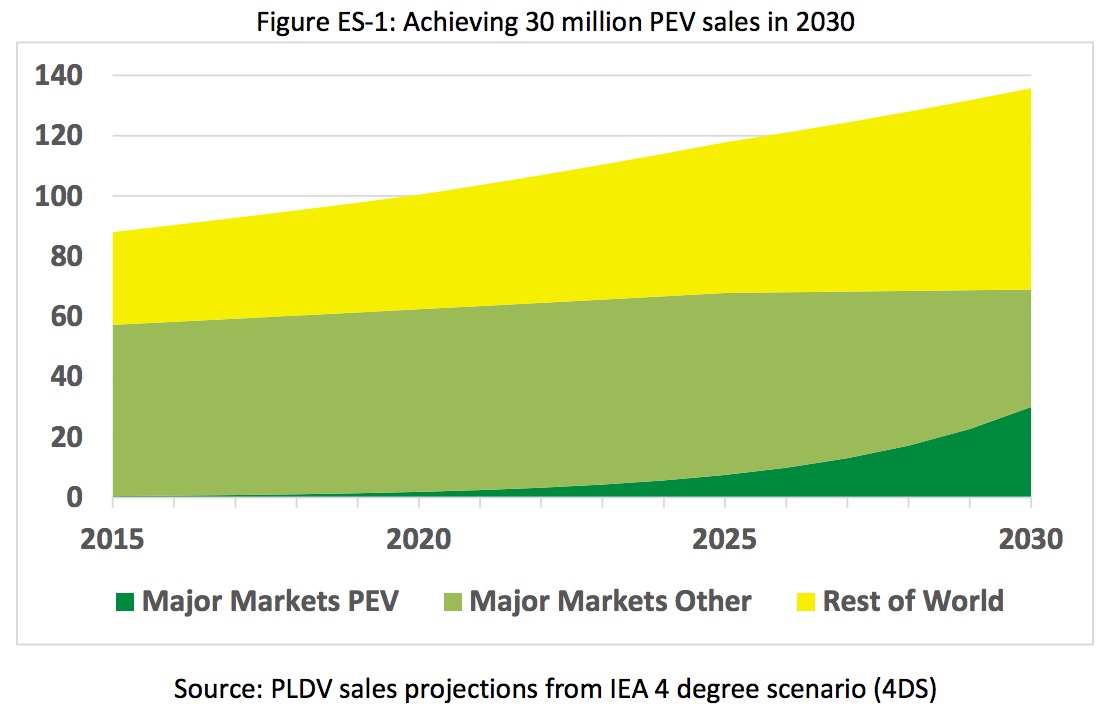

This paper explores recent trends in the market penetration of plug-in electric vehicles (PEVs) in selected countries around the world, and the implications of this for a potential transition to a fairly dominant PEV market presence within the next 15 years.

View this complete post...

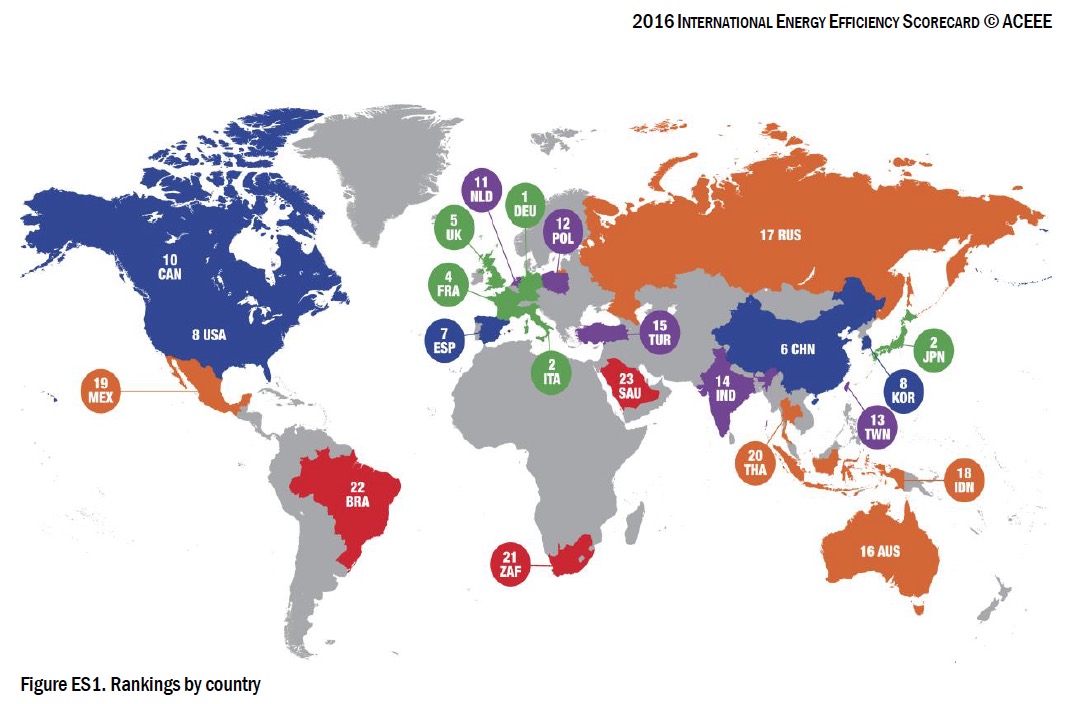

The third edition of ACEEE’s International Energy Efficiency Scorecard examines the efficiency policies and performance of 23 of the world’s top energy-consuming countries. Together these countries represent 75% of all the energy consumed on the planet and over 80% of the world’s gross domestic product (GDP) in 2013. We evaluated and scored each country’s efficiency policies and how efficiently its buildings, industry, and transportation sectors use energy.

View this complete post...

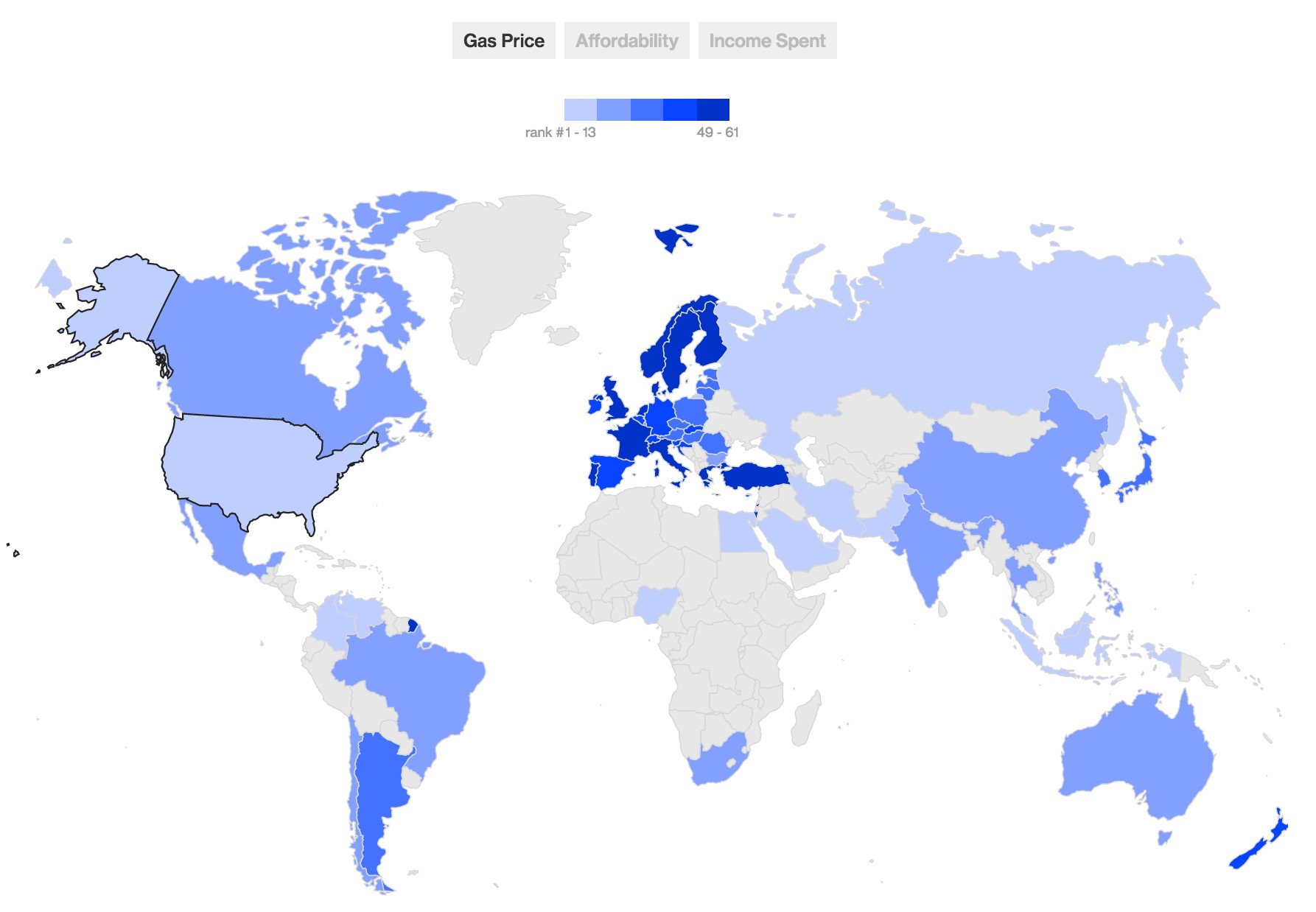

With transit bills, electric cars and other non-gas-guzzling transportation options reeling from late-2014’s sudden drop in oil prices, a lot of us are wondering just how cheap our gasoline really is. A new interactive report released by Bloomberg ranks the affordability of gasoline around the world, showing how we stack up against our international peers.

View this complete post...

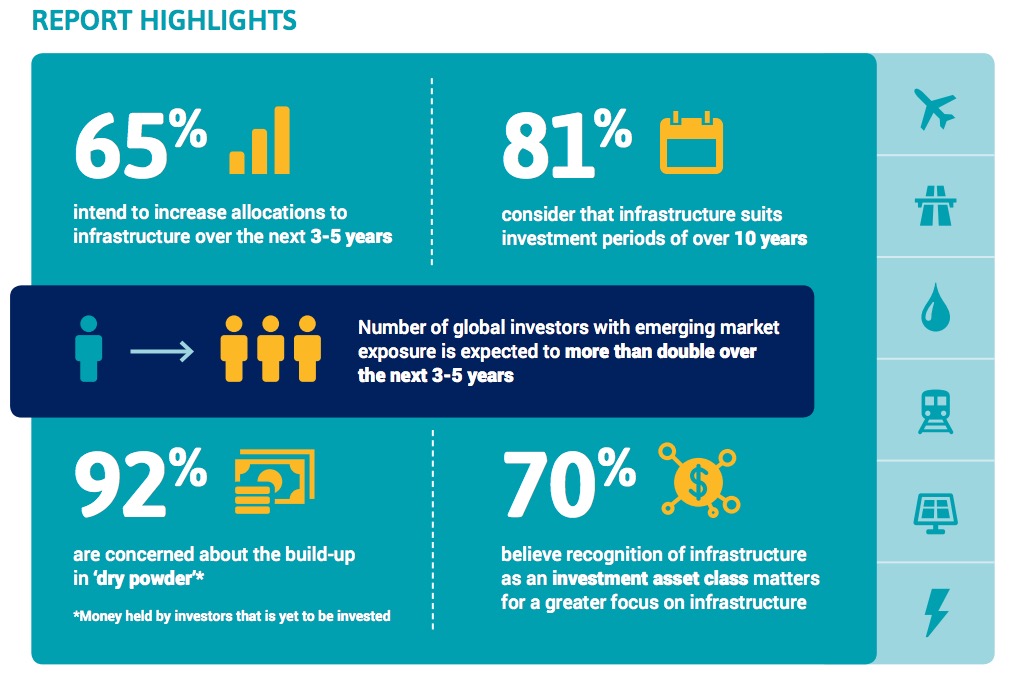

This factsheet outlines key insights that will help policy and market makers understand how to meet investor expectations and expand the infrastructure market.

View this complete post...

Thom talks to caller Bob about the fact that we should all be upset by our national need to invest in infrastructure.

View this complete post...

PWC

OXFORD ECONOMICS

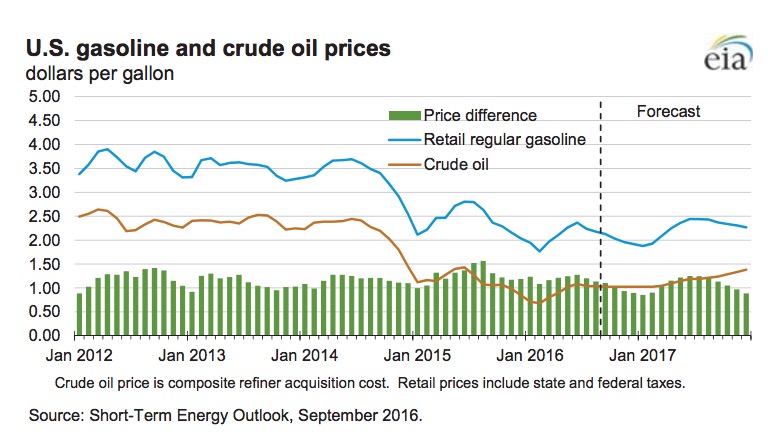

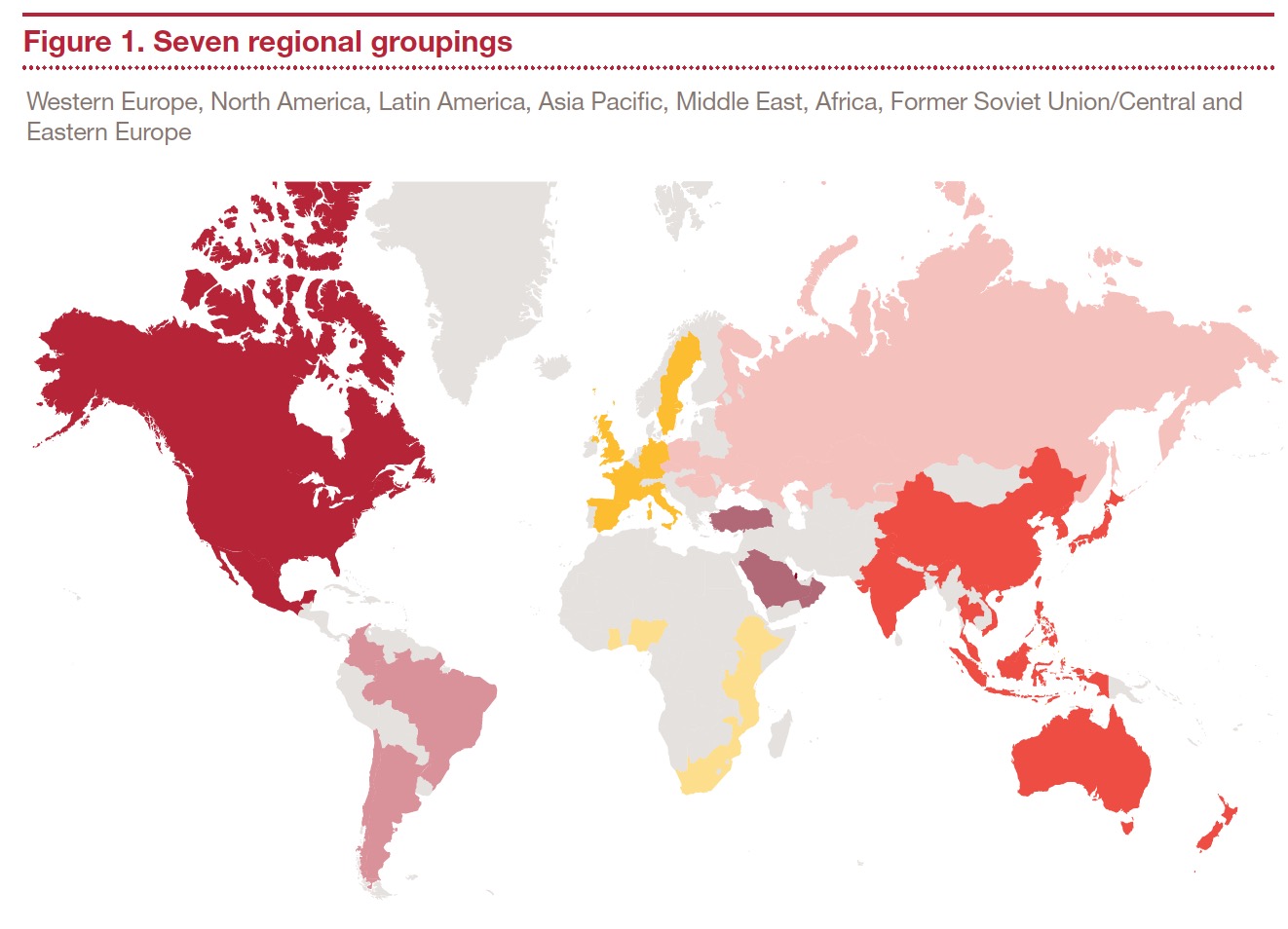

Oxford Economics estimates that if conditions stay as they are – what we are calling the baseline projection – capital project and infrastructure spending growth will likely remain low, hovering at about 2%, over the coming year, before inching up in 2017 and reaching about 5% in 2020. The improvement would be driven mainly by higher oil. However, even at 5% growth, infrastructure spending growth would be well below its double-digit levels before the global financial crisis.

Follow InfrastructureUSA

Video, stills and tales. Share images of the Infra in your community that demands attention. Post your ideas about national Infra issues. Go ahead. Show Us Your Infra! Upload and instantly share your message.

Is the administration moving fast enough on Infra issues? Are Americans prepared to pay more taxes for repairs? Should job creation be the guiding determination? Vote now!

What do the experts think? This is where the nation's public policy organizations, trade associations and think tanks weigh in with analysis on Infra issues. Tell them what you think. Ask questions. Share a different view.

The Infra Blog offers cutting edge perspective on a broad spectrum of Infra topics. Frequent updates and provocative posts highlight hot button topics -- essential ingredients of a national Infra dialogue.

It is encouraging to finally see clear signs of federal action to support a comprehensive US infrastructure investment plan.

Now more than ever, our advocacy is needed to keep stakeholders informed and connected, and to hold politicians to their promises to finally fix our nation’s ailing infrastructure.

We have already engaged nearly 280,000 users, and hoping to add many more as interest continues to grow.

We require your support in order to rise to this occasion, to make the most of this opportunity. Please consider making a tax-deductible donation to InfrastructureUSA.org.

Steve Anderson

Managing Director

SteveAnderson@InfrastructureUSA.org

917-940-7125