CG/LA INFRASTRUCTURE

2022 Transforming Mass Transit

Dynamic innovation in transit – especially as it relates to user experience and service delivery – will drive global innovation over the next five years. Rail transit is the infrastructure segment on the front lines of safe mobility and has the potential to drastically reduce carbon emissions and help the world achieve critical 2030 environmental goals. Passenger behavior, ridership and transit trends have changed rapidly over the years, and never more-so than in the past 24 months with the onset and eventual decline of the COVID-19 pandemic. The challenge now is to seize this opportunity to harness the need for change as an engine for innovation in the sector.

Dynamic innovation in transit – especially as it relates to user experience and service delivery – will drive global innovation over the next five years. Rail transit is the infrastructure segment on the front lines of safe mobility and has the potential to drastically reduce carbon emissions and help the world achieve critical 2030 environmental goals. Passenger behavior, ridership and transit trends have changed rapidly over the years, and never more-so than in the past 24 months with the onset and eventual decline of the COVID-19 pandemic. The challenge now is to seize this opportunity to harness the need for change as an engine for innovation in the sector.

With the global project pipeline for rail infrastructure development at US$5.5 trillion, investors cannot dispute the economic value of this sector.1 That capital represents over 300,000 km of new and upgraded rail networks across metro rail, tubes, light rail systems, high-speed railways, conventional commuter railways and freight and materials movement infrastructure.

From an economic and social standpoint, transit is critical to making cities healthy and bears the brunt of the challenges associated with the global economy slowly getting back on its feet. The ability of a farm to reach markets with its fresh produce, the power of a factory to export its goods to multiple markets, the ability of tourists to reach new destinations or the ability of migrant workers to get to their place of work all have an impact on the economic prosperity of a city, a region or a country.

This 2022 Report on US Transit Trends and Opportunities analyzes and introduces industry leaders and transit users to three key aspects of transit thought leadership. It is critical to be mindful that transit is fully at the intersection of traditional infrastructure and the Fourth Industrial Revolution (4IR). Driven by revolutionary transformations in digitization and electrification, transit is positioned as the solution to our mobility challenges.

But a lot needs to happen going forward:

- First, new forms of revenue generation will drive progress. It’s no longer possible for revenue to be fully subsidized by the public sector. This is an exciting area for innovation.

- Second, implementation of innovative technology drives priorities and is at the forefront of change. This is particularly true regarding user experience in terms of speed, safety and comfort. To steal a phrase from Steve Jobs: “you have to think very hard about the user experience.” Going forward, transit must do just that.

- Third, transit must meet the world’s environmental goals – from taking cars off the road, to the electrification of trains and facilities, including new modes of energy efficiency. In a sense, transit is the Gordian Knot of infrastructure: the sector with some of the deepest problems, and the greatest opportunities.

Note: The following analysis is informed by a survey of 101 transit leaders, in the US and globally, that was conducted by CG/LA Infrastructure in April, 2021.

This is how transit leaders drive change.

Part 1: New Forms of Revenue – From Premium Services to Value Capture

Transit revenue has traditionally come from user fees and public subsidies, such as ticket sales or tax collection. In major transit systems, the fair box generates only about 30% of a system’s overall budget, and the rest needs to come from somewhere else.

Case Study: Metropolitan Transportation Authority (MTA): Just before the shutdown, in February 2020, MTA released a financial plan through 2023, in which MTA projected cash deficits of $416 million, rising to $1.7 billion in 2023.

Those deficits increased significantly over the past two years, with MTA in October 2020 forecasting a budget deficit of $3.4 billion in 2020, $6.3 billion in 2021, $3.8 billion in 2022, $2.8 billion in 2023 and $3.1 billion in 2024. MTA has received funding in each of the subsequent economic relief packages under the past two presidents, and 2021 budget estimates have not yet been altered to reflect that.

As illustrated in the case of New York’s MTA, the US transit sector is in need of new forms of revenue generation. This section will look at new forms of revenue generation including land/air value capture and the use of performance contracting to create both new revenue streams and new levels of customer service. In our survey these two new forms of revenue generation were rated almost equally as having the highest potential for filling the revenue gap.

As illustrated in the case of New York’s MTA, the US transit sector is in need of new forms of revenue generation. This section will look at new forms of revenue generation including land/air value capture and the use of performance contracting to create both new revenue streams and new levels of customer service. In our survey these two new forms of revenue generation were rated almost equally as having the highest potential for filling the revenue gap.

Land/air value capture offers huge potential, both in terms of driving revenue from developing existing properties, and from the increase in land uplift from the development of new facilities. It is also useful to think of new work patterns, and that transit stations – as city centers become less attractive – begin to grow and diversify into satellite cities. In this sense, transit agencies are sitting on top of potential gold mines. The transit agencies have the opportunity to buy and bank the land around the station that will increase in value as the area starts to develop into these satellite cities. The agencies can then sell the land to developers to fund operating costs.

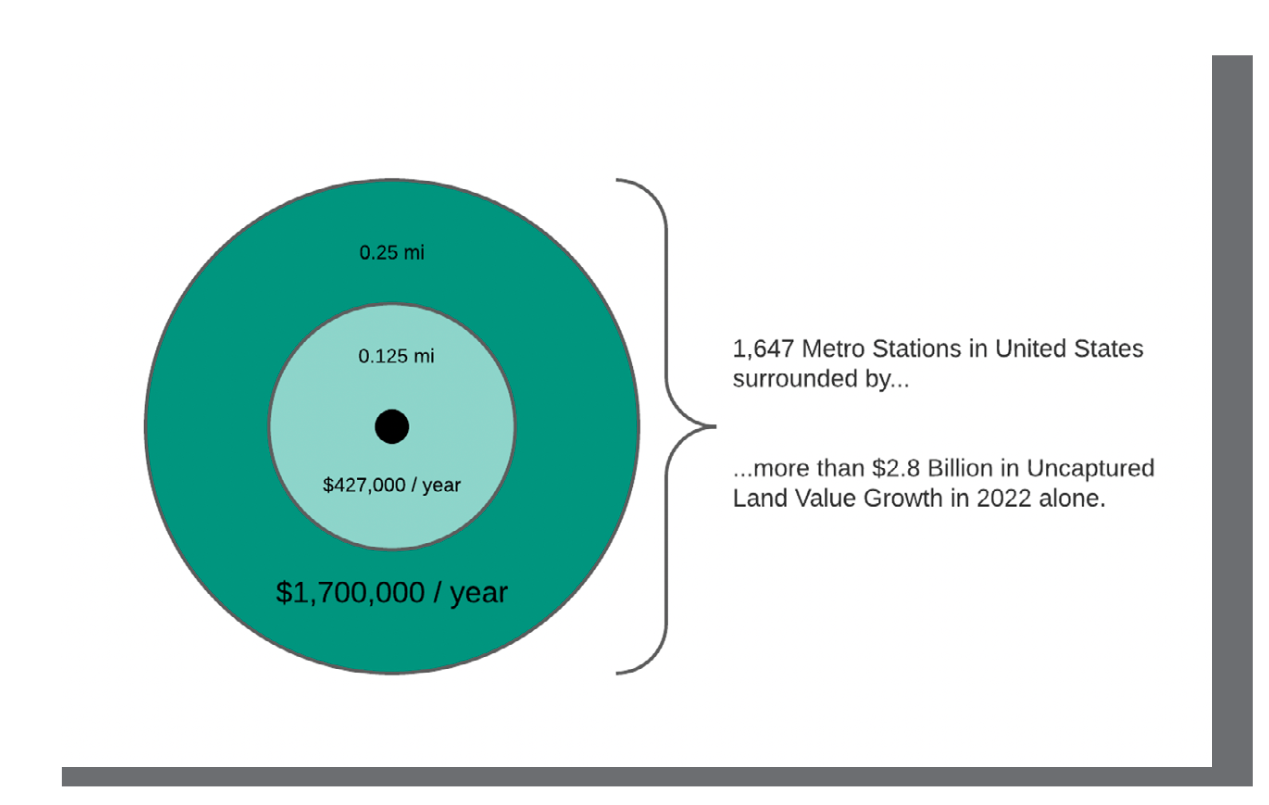

The graphic below represents a lower-bound representation of the potentially explosive market value of land-value capture around transit stations in the United States alone. This is a strategy that Asian transit systems have used for decades, banking land at the beginning of a project, and then selling that land for as much as 20 times the initial investment once the project is finished. We see a potentially booming business in the US in developing stations into commercial facilities, and in developing land around stations (which can also be taxed as land values increase). Land values can increase by as much as 100% within 2-3 years of a station’s completion or upgrading.

Vertical land capture considers cross-sector connectivity in the planning stage. For example, when considering a new transit station or light rail line, the transit authority and private developer work together to consider how best to use existing space to build efficient, multi-modal infrastructure that will serve several purposes. There is no reason that a commuter rail station should be built in the next decade that does not include connections to other forms of transit, commercial real estate, parking and even multi- family living complexes.

These hubs should also be built out with electric vehicle charging stations and 5G connectivity. In addition to taking advantage of land and air value capture, including these aspects into projects, makes them more profitable and exponentially increases potential return on investment. 5G tower build out is more profitable than 4G towers, in part, due to bandwidth differences. Comparing the two, 4G towers essentially serve anything within line of sight, while 5G towers have a much lower bandwidth, only extending about 1,000 yards on flat land (and even closer together on hilly terrain). That drastically increases the number of bankable towers that can be built to service a community.

These hubs should also be built out with electric vehicle charging stations and 5G connectivity. In addition to taking advantage of land and air value capture, including these aspects into projects, makes them more profitable and exponentially increases potential return on investment. 5G tower build out is more profitable than 4G towers, in part, due to bandwidth differences. Comparing the two, 4G towers essentially serve anything within line of sight, while 5G towers have a much lower bandwidth, only extending about 1,000 yards on flat land (and even closer together on hilly terrain). That drastically increases the number of bankable towers that can be built to service a community.

Performance contracting is another incredibly dynamic channel for moving investment into transit systems, especially as those systems – strapped by budgeting challenges – need to make the kinds of investments in digitization and electrification that are so critical to improving efficiency, user experience, and environmental leadership.

In performance contracting, a contractor or developer offers to replace aging infrastructure in a transit system, for example, with the provision that they receive a percentage of the revenue generated through cost savings over a predetermined time period.

To expand on the example, a developer might go to a transit system and replace all aging ticketing systems, motors, pumps, valves, tires, braking systems – essentially the guts of the transit system – over a three-year period. This would save the transit agency money in operating expenses, maintenance expenses and waste due to inefficiencies. The developer will do this on their investment with the provision that over that time period and for a certain amount of time after the work is done, the agency and the developer split all revenue 50/50 (or another ratio).

The US has more than $80 billion in “state of good repair” infrastructure, all of which is performance contractible – so why not utilize that tool when 100% of the revenue is currently going into maintenance and repair?

Reinventing how transit authorities can capture revenue is crucial to attracting private investment throughout the industry. As explained by a former transit executive, while there is no lack in financial resources, investors are toeing the risk assessment line due to the fallout over the last 24 months – and are looking for investments with short term gains.

Additionally, said CCR/Zurich Airports executive Andre Klamas, the public sector needs to play a role in re- establishing the confidence cycle for investors, decreasing the risk premium and encouraging use of private resources. Another former rolling-stock transit executive from the United States said that performance contracts and transit-oriented development projects are crucial for bringing in new investments, supplementing any federal or other public funding and bringing best practices into infrastructure development.

Speaking on project finance contracts and PPPs specifically, the executive expressed his support, but said that they only work when there is total cost of ownership pricing to avoid low bid situations.

Download full version: 2022 Transforming Mass Transit

About CG/LA Infrastructure

www.cg-la.com

“Infrastructure is at the heart of a country’s productivity, ingenuity, and ability to deliver value and prosperity to communities and individuals. Through thought leadership, advisory services, macroeconomic analysis, and our leadership forum event series, CG/LA provides public and private sector organizations with just in time tools delivering smart, sustainable, and strategic infrastructure locally and globally.”

Tags: CG/LA Infrastructure

RSS Feed

RSS Feed