BOYD GROUP INTERNATIONAL

Summary

Air Traffic Control: NextGen Is Still NoGen

Air Traffic Control: NextGen Is Still NoGen

Fodder for the gullible. Despite slow/no growth in airline flights, anywhere between 15% and 20% of flights still arrive 15 minutes or more off the already ATC-padded carrier schedules. Every month. We can depend on it.

Go back five years. Or ten years. Compare what the FAA was saying then, with what it’s saying now about fixing the air traffic control system. It’s a time warp with today’s glowing projections of progress. Plan on more of the same in 2013.

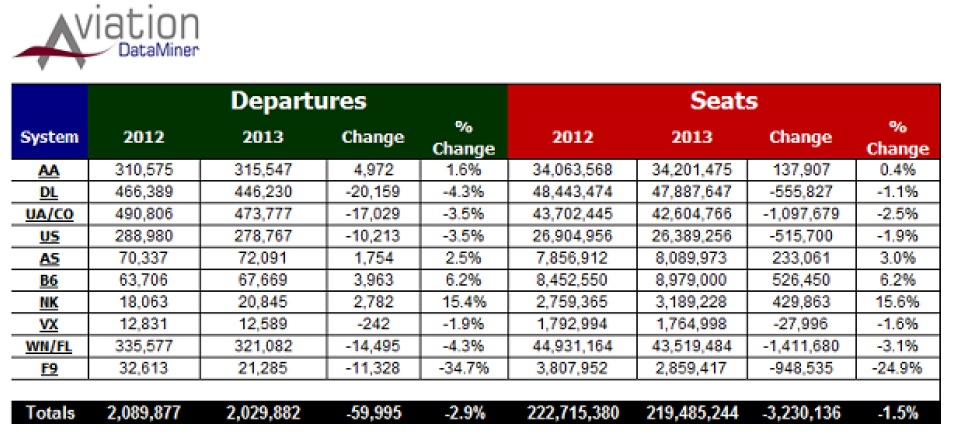

Airline Capacity: Down

There will be no overall capacity growth in 2013. The few carriers that are adding capacity are doing so in a geographically-focused manner.

Airline Fleets: New Mixes

The pull-down of “regional jets” (defined as CRJ and ERJ aircraft) will accelerate. Of the 1,400 such aircraft in North American fleets in 2012, approximately 1,000 will come out of fleets by 2017. The remainder will almost exclusively be CRJ-700/990 airliners.

Fallout on air service: mostly positive. (Discussed below.)

- Related: The pull-down of flight frequencies at RJ-centric hubs at Memphis and Cincinnati/Northern Kentucky is essentially the result of the deteriorating economics of 50-seat jets, and not due to the DL/NW merger, as much of the media conveniently claims.

Air Passenger Traffic – Down

It will track with airline capacity. Plan on between 2.0% – 2.5% down compared to year 2012.

Long Term Traffic Trends

Forget the FAA forecasts. Air passenger traffic is no longer a “fallout” result of economic metrics. Enplanements will increasingly be the result of the capacity airlines offer based on cost/benefit strategies.

- Data Snapshot: In 2017, the airports in the United States will experience almost 50 million fewer enplanements than the current FAA forecast predicts. That will affect facility and capacity needs.

Air Service Development

The economics of air service have changed. With the impending merger of American and US Airways, there will be just nine major scheduled airlines, and all have specific route strategies. The options and potential for new service recruitment are shrinking fast. Consultant studies to “find the right airline” will be right up there with ginning up a purchase contract on the Brooklyn Bridge.

- Draw Your Own Conclusions: In the future, will it really be necessary for a mid-size US airport to send staff to a speed-date event in China, for a 20-minute meeting with Southwest?

The “Regional Airline” Sector

It has been years since this segment of air transportation has been either “regional” or actually “airlines.” The reduction in 50-seat jets is concurrently eliminating the raison-d’etre for these operators’ existence.

Uncertainly: how far new pilot union scope clauses will allow outsourcing of flying to larger, essentially mainline-cabin aircraft such as E-Jets.

- Draw Your Own Conclusions: The trend toward outsourcing smaller airport operations to the cheapest contractor will continue to result in shortfalls in service quality, passenger satisfaction, and in the future – this is a third-rail nobody wants to touch – possibly ground efficiency. Pay rates below those of the airport janitorial staff for people with a zero career path do not attract the best-quality, motivated employees, regardless of counter arguments from airline financial departments.

Download full report (PDF): US Airline Industry 2013: Review of Key Changes. Challenges. Evolution.

About Boyd Group International

www.aviationplanning.com

“Boyd Group International is an activist firm, with an impact on aviation. Our team produces forecasts, trend analyses and insights utilized by airlines in the US and internationally. Aircraft and powerplant manufacturers call on us to accomplish new-platform feasibility and market-mission studies. Financial institutions call on us for insight and accurate, industry data and insight.”

Tags: Air Traffic Control, Boyd Group International, NextGen

RSS Feed

RSS Feed