UNITED STATES DEPARTMENT OF ENERGY

1. Introduction

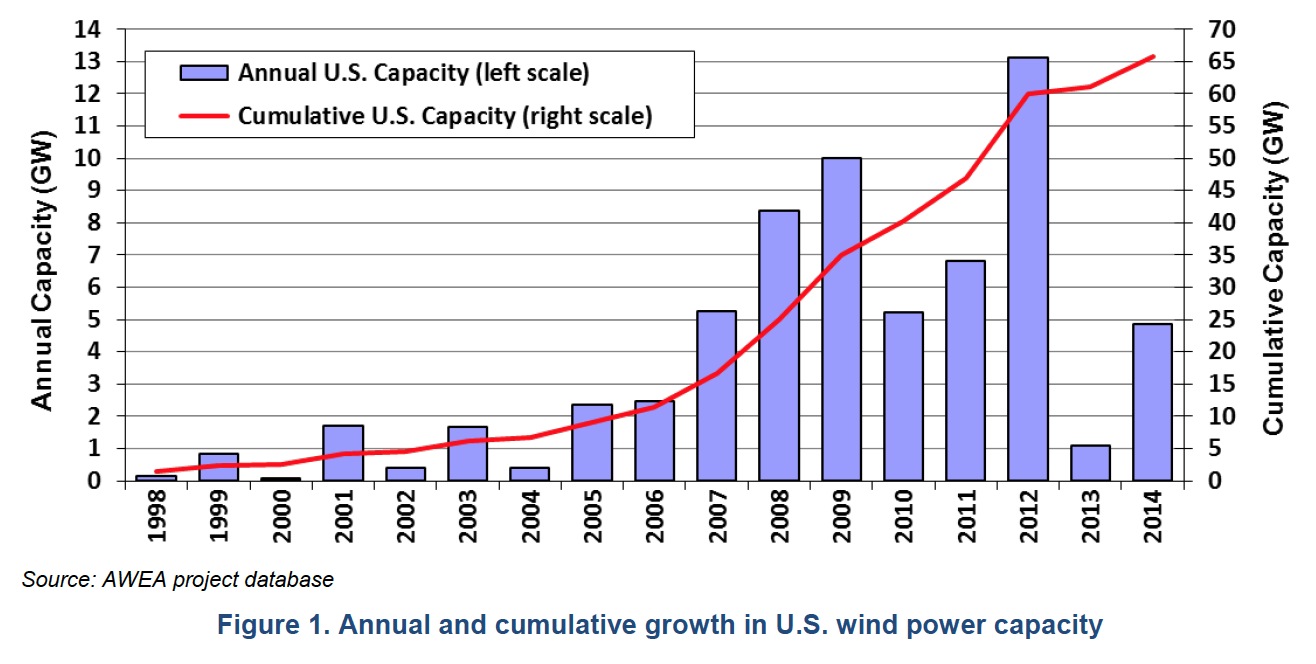

Annual wind power capacity additions in the United States rebounded in 2014, and continued growth through 2016 is anticipated. Recent and projected near-term growth is supported by the industry’s primary federal incentive—the production tax credit (PTC)—which is available for projects that began construction by the end of 2014. Wind additions are also being driven by recent improvements in the cost and performance of wind power technologies, which have resulted in the lowest power sales prices ever seen in the U.S. wind sector. Growing corporate demand for wind energy and state-level policies play important roles as well. Expectations for continued technological advancements and cost reductions may further boost future growth. At the same time, the prospects for growth beyond 2016 are uncertain. The PTC has expired, and its renewal remains in question. Continued low natural gas prices, modest electricity demand growth, and limited near-term demand from state renewables portfolio standards (RPS) have also put a damper on industry growth expectations. What these trends mean for wind power additions through the end of the decade and beyond will be dictated in part by future natural gas prices, fossil plant retirements, and policy decisions.

This annual report—now in its ninth year—provides a detailed overview of developments and trends in the U.S. wind power market, with a particular focus on 2014. The report begins with an overview of key installation-related trends: trends in U.S. wind power capacity growth; how that growth compares to other countries and generation sources; the amount and percentage of wind energy in individual states; the status of offshore wind power development; and the quantity of proposed wind power capacity in various interconnection queues in the United States. Next, the report covers an array of wind power industry trends, including: developments in turbine manufacturer market share; manufacturing and supply-chain developments; wind turbine and component imports into and exports from the United States; project financing developments; and trends among wind power project owners and power purchasers. The report then turns to a summary of wind turbine technology trends: turbine size, hub height, rotor diameter, specific power, and IEC Class. After that, the report discusses wind power performance, cost, and pricing trends. In so doing, it describes trends in project performance, wind turbine transaction prices, installed project costs, and operations and maintenance (O&M) expenses. It also reviews the prices paid for wind power in the United States and how those prices compare to short-term wholesale electricity prices and forecasts of future natural gas prices. Next, the report examines policy and market factors impacting the domestic wind power market, including federal and state policy drivers, transmission issues, and grid integration. The report concludes with a preview of possible near-term market developments.

This edition of the annual report updates data presented in previous editions while highlighting key trends and important new developments from 2014. New to this edition are the following: refinement of the manufacturing, supply chain, and domestic content assessments; discussion of the burgeoning trend of commercial wind energy purchases; and a comparison of recent and forecasted wind capacity growth with the trajectory analyzed in the DOE’s Wind Vision report released in 2015. The report concentrates on larger, utility-scale wind turbines, defined here as individual turbines that exceed 100 kW in size. The U.S. wind power sector is multifaceted, however, and also includes smaller, customer-sited wind turbines used to power residences, farms, and businesses. Data on these smaller turbines are not the focus of this report, although a brief discussion on Smaller Wind Turbines is provided on page 4. Further information on distributed wind power, which includes smaller wind turbines as well as the use of larger turbines in distributed applications, is available through a separate annual report funded by the U.S. Department of Energy (DOE). Additionally, because this report has an historical focus, and all U.S. wind power projects have been land-based, its treatment of trends in the offshore wind power sector is limited to a brief summary of recent developments.

Much of the data included in this report were compiled by Lawrence Berkeley National Laboratory (Berkeley Lab) from a variety of sources, including the American Wind Energy Association (AWEA), the U.S. Energy Information Administration (EIA), and the Federal Energy Regulatory Commission (FERC). The Appendix provides a summary of the many data sources used in the report, and a list of specific references follows the Appendix. Data on wind power capacity additions in the United States (as well as wind power projects) are based largely on information provided by AWEA, although minor methodological differences may yield slightly different numbers from AWEA (2015a) in some cases. In other cases, the data shown here represent only a sample of actual wind power projects installed in the United States; furthermore, the data vary in quality. As such, emphasis should be placed on overall trends, rather than on individual data points. Finally, each section of this document primarily focuses on historical market information, with an emphasis on 2014; with some limited exceptions (including the final section of the report), the report does not seek to forecast future trends.

Download full version (PDF): 2014 Wind Technologies Market Report

About the United States Department of Energy

Energy.gov

The mission of the Energy Department is to ensure America’s security and prosperity by addressing its energy, environmental and nuclear challenges through transformative science and technology solutions.

Tags: U.S. DOE, United States Department of Energy, Wind, Wind Energy

RSS Feed

RSS Feed