MINETA TRANSPORTATION INSTITUTE

Introduction

Over the past several decades, the transportation revenues available from state and federal gas taxes have fallen significantly, especially in terms of inflation-adjusted dollars per mile traveled. At the same time, the transportation system requires critical—and expensive— system upgrades. Among other needs, a large portion of the national highway system requires major rehabilitation, and there is a growing desire at all levels of government to substantially upgrade and expand infrastructure to support public transit, walking, and bicycling, modes that have been relatively neglected in the past 50 years.

This dilemma of growing needs and shrinking revenues can be resolved in only two ways: either the nation must dramatically lower its goals for system preservation and enhancement, or new revenues must be raised. If the latter is to happen, legislators must be convinced that increasing taxes or fees is politically feasible. One portion of the political calculus that legislators make when deciding whether or not to raise new revenues is, of course, considering likely public support for—or opposition to—raising different kinds of taxes.

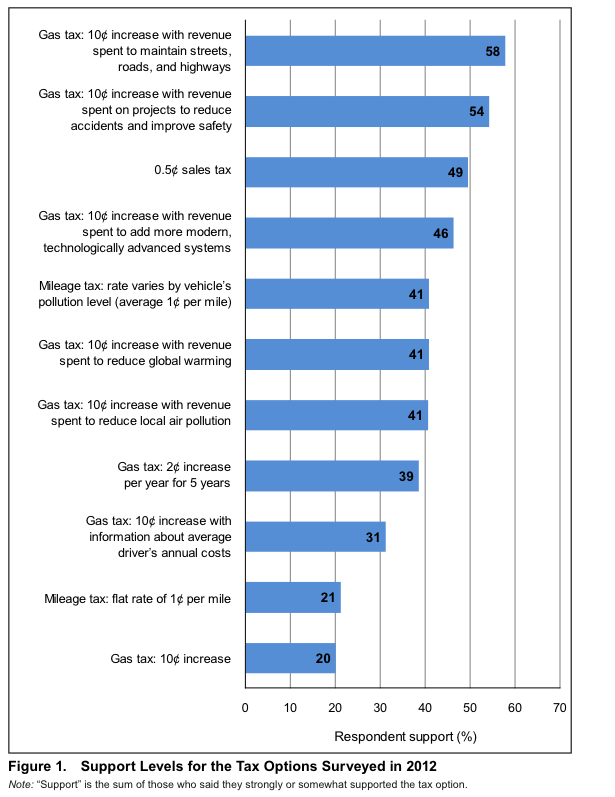

This report contributes to the understanding of current public sentiment about increasing transportation taxes by presenting the results of Year 3 of a telephone survey investigating public opinion about a variety of transportation tax options at the federal level. The specific taxes tested were 10 variations on raising the federal gas tax rate or creating a new mileage tax, as well as one option for creating a new federal sales tax. In addition, the survey collected standard socio-demographic data, some travel behavior data, and attitudinal data about how respondents view the quality of their local transportation system and their priorities for government spending on transportation in their state. All of this information was used to assess support levels for the tax options among different population subgroups.

The survey questionnaire described the various tax proposals in only general terms, so the study results cannot be assumed to reflect support for any actual proposal put forward. Nevertheless, the results show likely patterns of support and, more important, the public’s relative preferences among different transportation tax options.

For 2012, an important new emphasis in the survey project was to understand various perceptions related to public transit, including knowledge and opinions about federal taxes to support transit. Several new transit-related questions were added to explore respondents’ knowledge of whether different levels of government help to pay for transit, their opinion about whether gas tax revenues should be spent on transit, and their support for different Congressional options to raise additional revenues to improve and expand transit service.

Because the survey was the third year of a project to assess how public support for federal transportation taxes may change over time, most of the questions asked were identical to those in the earlier surveys carried out in 2010 and 2011.1 This report compares the results of the three surveys to establish how public views may have shifted over the past years.

The remaining chapters of the report contain the following material. Chapter II describes findings from other polling on similar transportation taxes, to provide context for understanding this survey’s results. Chapter III describes the survey methodology and presents an overview of the questionnaire and details on the implementation procedure. Detailed discussion of the survey findings for the different tax options and the transit- related questions follow in Chapter IV and Chapter V. Chapter VI summarizes key findings and suggests some implications of those findings for policymakers.

Read full report (PDF) here: What do Americans Think About Federal Tax Options

About Mineta Transportation Institute

transweb.sjsu.edu

“The Mineta Transportation Institute (MTI) conducts research, education, and information and technology transfer, focusing on multimodal surface transportation policy and management issues. It was established by Congress in 1991 as part of the Intermodal Surface Transportation Efficiency Act (ISTEA) and was reauthorized under TEA-21 and again under SAFETEA-LU. The Institute is funded by Congress through the US Department of Transportation’s (DOT) Research and Innovative Technology Administration, by the California Legislature through the Department of Transportation (Caltrans), and by other public and private grants and donations, including grants from the US Department of Homeland Security. DOT selected MTI as a National Center of Excellence following competitions in 2002 and 2006. The internationally respected members of the MTI Board of Trustees represent all major surface transportation modes. MTI’s focus on policy and management resulted from the Board’s assessment of the transportation industry’s unmet needs. That led directly to choosing the José State University College of Business as the Institute’s home.”

Tags: Federal Tax, highways, Mineta Transportation Institute, public transit, Roads

RSS Feed

RSS Feed