GREENTECH MEDIA RESEARCH

Introduction

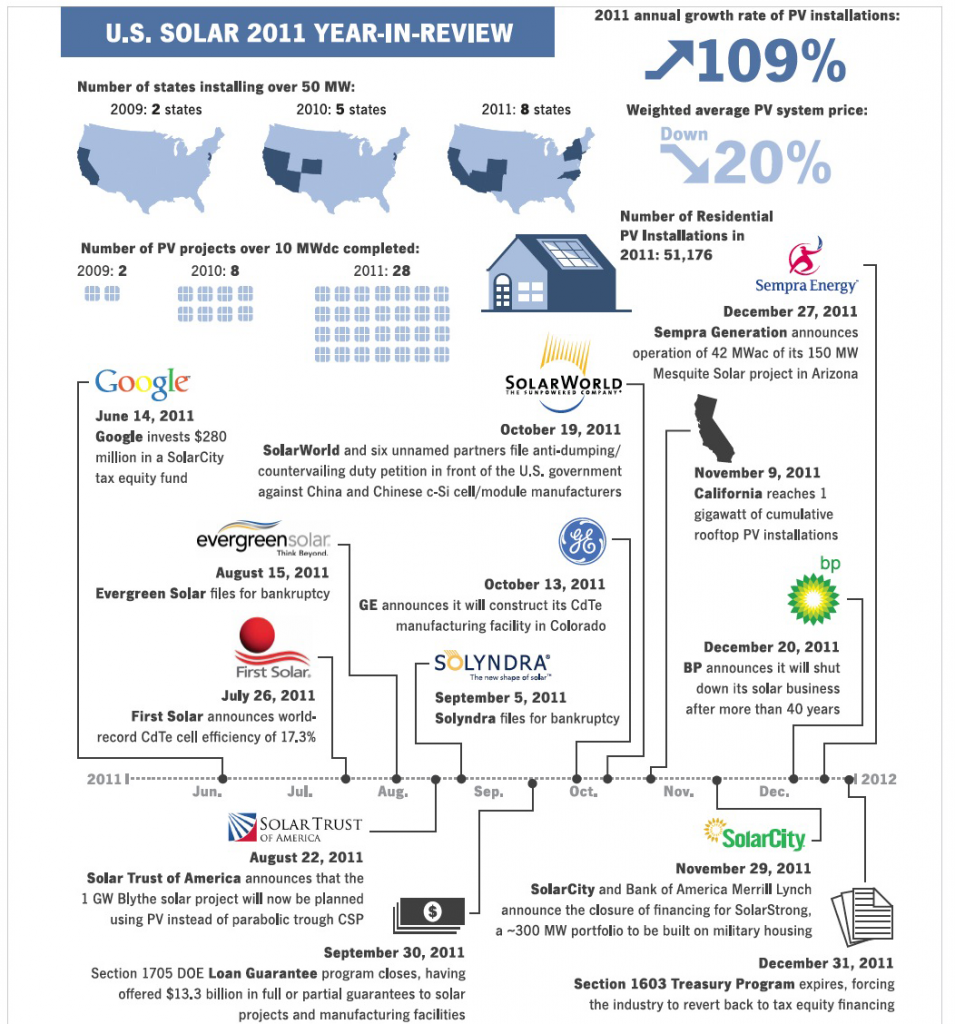

For the U.S. solar energy industry, 2011 was a historic year. On the positive side, the market for solar installations continued to boom, as the U.S. installed 1,855 megawatts (MW) of photovoltaic (PV) solar systems, representing 109% growth over 2010. The fourth quarter of 2011 saw 776 MW of PV installed, by far the most of any quarter in U.S. market history (473 MW was the previous record, set in the third quarter of 2011). Growth occurred in every market segment—residential, non-residential and utility—and in 18 of the 23 states that are tracked individually. The dollar amount of project fi nance investments reached an all-time high and traditional energy companies such as MidAmerican Energy Holdings, Exelon and NRG Energy became equity investors in the largest planned solar projects in the country.

Not all developments in 2011 were positive. With regard to installations, the highly valued 1603 Treasury Program expired at the end of the year, subsequently complicating the financing of many new solar projects. As for manufacturing, though global PV module capacity grew more than 50% in 2011, throughout most of the year global demand remained slow as a result of regulatory changes in Italy and tepid growth in Germany. Solar panel prices went into free-fall in the second quarter and refused to stabilize until the last weeks of 2011, ultimately falling more than 50% during the year. This squeezed profi t margins for every manufacturer, but it was particularly damaging for two types of companies: those that were less cost-competitive and those that were in the process of commercializing new technologies. As a result, multiple U.S. module manufacturing plants closed over the course of 2011. Despite these closures, U.S. module manufacturing capacity expanded 28% and production remained fl at for the year when compared to 2010.

In the wake of precipitously falling module prices, SolarWorld, along with six unnamed partners, filed an anti-dumping/countervailing duty petition against Chinese crystalline silicon cell and module manufacturers with the Department of Commerce and the International Trade Commission in October 2011. The petition alleges that Chinese suppliers benefitted from illegal subsidies and dumped product into the U.S. market. The outcome of the petition remains to be seen. However, it has already begun to impact procurement patterns and complicate the overall supply picture in the U.S.

In September 2011, Solyndra, a CIGS module manufacturer, filed for bankruptcy and brought with it a storm of negative attention to the solar industry. While Solyndra was never a signifi cant player in the global solar industry, its default on a federal loan guarantee brought a high-profi le political element that was absent for the other two U.S. solar bankruptcies in 2011 (Spectrawatt and Evergreen Solar). As a result, an industry blessed with overwhelming public support suddenly became a target for those who sought to admonish the loan guarantee program or clean energy policy in general.

While it is easy to brush aside the more outlandish claims made in response to Solyndra’s failure regarding solar technology in general, the Solyndra story has brought a number of valuable questions to the forefront. First, has the support that has been given to the solar industry, both at the state and federal level, been successful? The market’s impressive recent growth points to yes. Installations are booming, jobs are being added, and solar has proven itself as a reliable technology to meet growing energy demand. Second, is there a role for U.S. solar manufacturing? Here, there is reasonable debate on both sides. We continue to believe that the U.S. can maintain a presence in manufacturing innovative, proprietary technologies, particularly those in their early stages of commercialization. Apart from this, the U.S. can remain home to the bulk of innovations that drive down the cost of solar power for years to come. That being said, it would be unreasonable to expect all (or even most) solar manufacturing to come from the U.S. The solar industry is global, and consequently subject to the same economic forces as manufacturing in other sectors. Undoubtedly, some portions of the value chain will fi nd domestic manufacturing attractive while others will not. The U.S. certainly has a role to play, but it will be over the next decade that the nature of that role will be determined. As the industry continues to mature, successful and sustainable companies will be separated from hopeful but ultimately unsuccessful ventures.

Download full report (PDF): US Solar Market Insight: 2011 In Review Executive Summary

About Greentech Media Research

www.greentechmedia.com/research/

“GTM Research, a Greentech Media company, provides critical and timely market analysis in the form of concise and long-form market research reports, monthly newsletters and strategic consulting services.”

Tags: Greentech Media, GTM Research, SEIA, Solar Energy Industries Association, U.S. Solar Market Insight

RSS Feed

RSS Feed