SOLAR ENERGY INDUSTRIES ASSOCIATION

INTRODUCTION

In 2010, the U.S. installed 887 megawatts (MW) of grid-connected photovoltaics (PV), representing 104% growth over the 435 MW installed in 2009. Despite this, U.S. market share of global installations fell to 5.1%, down from 6% in 2009 due to even faster growth abroad. Over the past six years, the U.S. has been growing at a relatively even pace with the global market; as a result, U.S. market share of global installations has consistently hovered between 5% and 7% since 2005. In 2011, however, this pattern is likely to end. A slowdown in major European markets (most notably Italy and Germany), combined with the continued strength of the U.S. market, has already led most PV manufacturers and developers to seek opportunities in the U.S. We anticipate an exciting, if volatile, year in the U.S. PV market. This report catalogues the beginning of this period.

For concentrating solar, which includes both concentrating solar power (CSP) and concentrating photovoltaics (CPV), the U.S. is poised to become the global market leader in installations. After 20 years of near-dormancy in the industry, many large-scale concentrating solar projects are set to continue their expected ramp-up over the next few years including the expected completion of the world’s largest CPV facility (at 30 MW) expected before December.

KEY FINDINGS:

Photovoltaics (PV):

- Grid-connected PV installations in Q1 2011 grew 66% over Q1 2010 to reach 252 MW.

- Cumulative grid-connected PV in the U.S. has now reached over 2.3 GW.

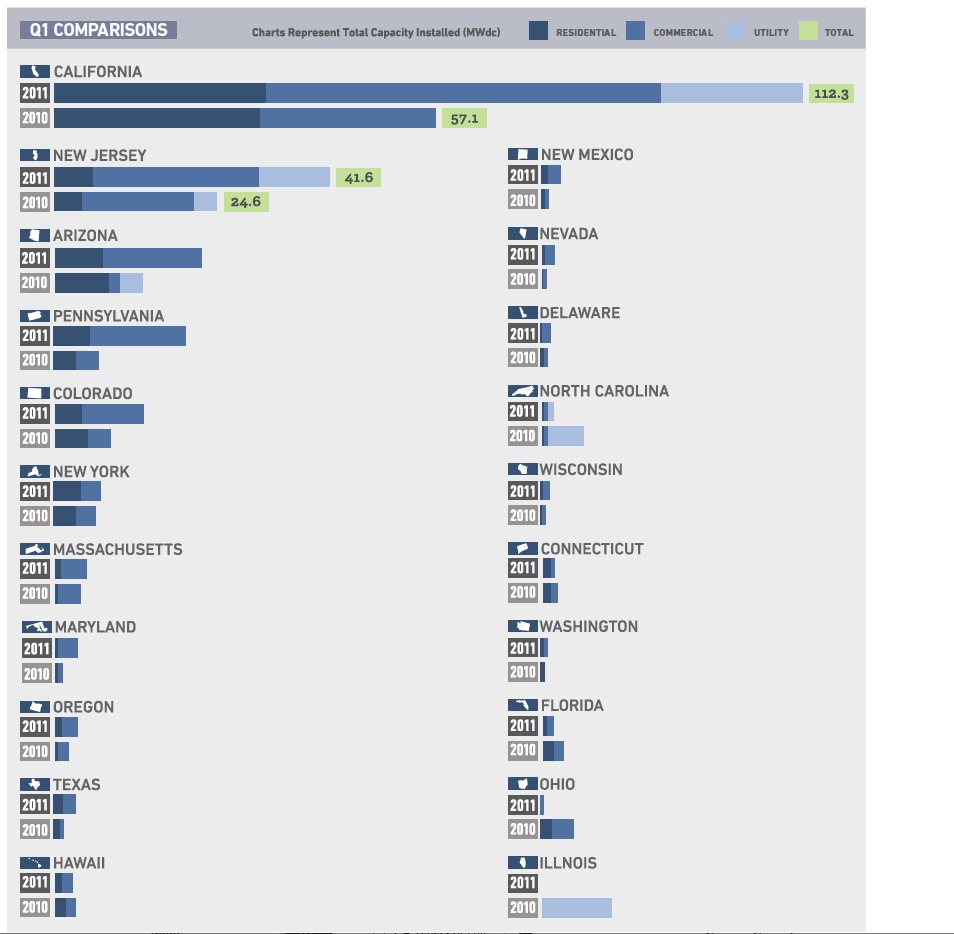

- The top seven states installed 88% of all PV in Q1 2011, up from 82% in 2010.

- Non-residential installations in Q1 2011 more than doubled over Q1 2010 in 10 of the top 21 states.

- U.S. module production increased by 17% relative to Q4 2010, from 297 MW to 348 MW. While production from export-oriented firms and facilities dipped materially on account of soft demand conditions in the key feed-in tariff markets of Germany and Italy, plants that serve the domestic market enjoyed far healthier utilization of manufacturing capacity.

- After a year of fl at-to-increasing pricing for some PV components in 2010, annual beginning-of-year feed-in tariff cuts and depressed global demand in Q1 2011 resulted in substantial price declines. Wafer and cell prices dropped by around 15% each, while module prices fell around 7%.

Concentrating Solar Power (CSP and CPV):

- The 500-MW Blythe CSP plant obtained a $2.1 billion DOE loan guarantee.

- Construction is underway on the 30 MW Alamosa CPV plant, with expected completion in 2011.

- There is a Concentrating Solar (combined CSP and CPV) pipeline of over 9 GW in the U.S.; more than 2.4 GW have signed PPAs.

- In total, 1,100 MW of CSP and CPV are now under construction in the U.S.

Download Executive Summary (PDF): U.S. Solar Market Insight, 1st Quarter 2011

About Solar Energy Industries Association

www.seia.org

“Established in 1974, the Solar Energy Industries Association is the national trade association of the U.S. solar energy industry. As the voice of the industry, SEIA works with its 1,000 member companies to make solar a mainstream and significant energy source by expanding markets, removing market barriers, strengthening the industry and educating the public on the benefits of solar energy.”

Tags: Photovoltaics, PV, SEIA, Solar Energy, Solar Energy Industries Association

RSS Feed

RSS Feed