ENVIRONMENTAL DEFENSE FUND

EDF + BUSINESS

Executive Summary

Communities throughout the United States are facing unprecedented infrastructure challenges including compromised energy, water, and transportation systems. This is more than just a matter of inconvenience. Unless addressed, decades of neglect and lack of investment will result in loss of business sales, reduced jobs and wages, and negative impacts to the country’s GDP. This crisis cannot be solved by reallocating existing funds – there is an estimated $1.4 trillion gap in funding3 required to meet infrastructure needs.

Communities throughout the United States are facing unprecedented infrastructure challenges including compromised energy, water, and transportation systems. This is more than just a matter of inconvenience. Unless addressed, decades of neglect and lack of investment will result in loss of business sales, reduced jobs and wages, and negative impacts to the country’s GDP. This crisis cannot be solved by reallocating existing funds – there is an estimated $1.4 trillion gap in funding3 required to meet infrastructure needs.

How will governments responsible for maintaining infrastructure navigate this monumental challenge and continue to revitalize and promote the sustainable development of America’s communities?

This report was developed to help public sector officials navigate infrastructure challenges by providing resources and guidance to resource-constrained local, state and federal government agencies. This report employs a two-pronged approach to discuss the issue by examining demand-side strategies to increase overall demand in sustainable infrastructure projects and supply-side approaches to bolster available capital. For demand-side approaches, the report lays out options for innovative, cost-effective approaches to sustainable infrastructure development that can be used as an alternative to or in combination with traditional gray infrastructure – thereby reducing the overall costs for delivery. On the supply side, the report identifies key barriers that inhibit private capital from playing a larger role in infrastructure development. Taken together, these two strategies may help the public sector deliver on its obligations to serve its constituents.

What is sustainable infrastructure?

It is infrastructure built and managed in a way that helps meet economic, environmental and social goals.4 In addition to providing critical infrastructure services, sustainable infrastructure enables government to meet multiple goals with limited resources by integrating environmental and social co-benefits.5 These co-benefits have real monetary value. Co-benefits help create more cost-effective infrastructure solutions. Measuring and monetizing co-benefits can be used to develop an economic case for sustainable infrastructure investment that is attractive to a wider pool of investors.

Private Capital to Finance Infrastructure

What does the path forward look like for addressing the barriers inhibiting private investment in sustainable infrastructure?

The research and interviews used to develop this report identify four key elements that support the path forward through the creation of projects that are ready for investment, including private capital. Those responsible for planning and financing sustainable infrastructure must:

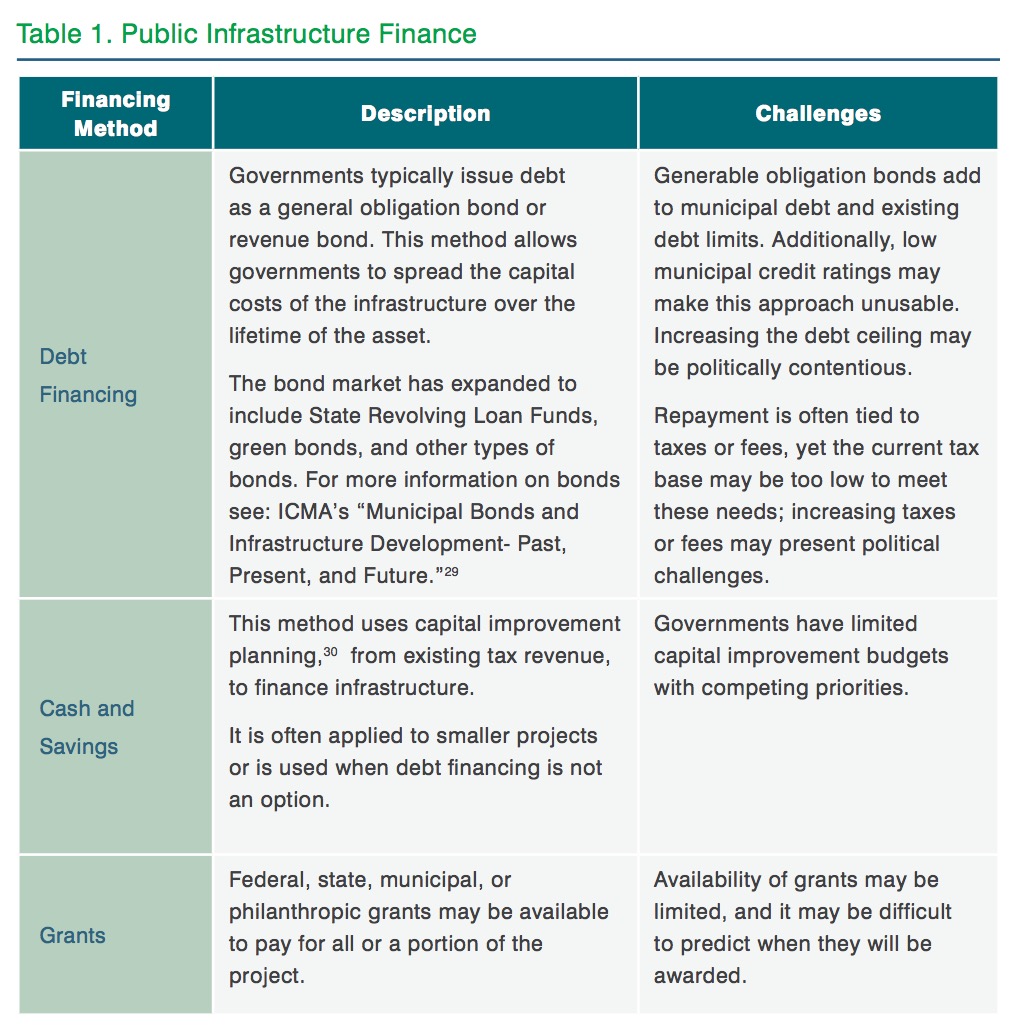

- Identify suitable funding models: Robust funding models will require stable revenue streams. In addition to traditional revenue streams, such as fees and taxes, the economic, social and environmental values produced by sustainable infrastructure should be monetized where possible.

- Standardize performance measurement: The measurement of key performance metrics and outcomes produced by sustainable infrastructure are important for determining a project’s value. However, consistent and comparable performance metrics across the sector do not yet exist.

- Manage risks appropriately: Limited long-term performance data and standardization procedures for sustainable infrastructure may increase risks to both government and private investors. Therefore, identifying, quantifying, mitigating and distributing risk is critical to attracting private investors.

- Facilitate effective stakeholder engagement: Convening the right stakeholders and expertise during the planning and developing of a sustainable infrastructure project can significantly increase the likelihood of success. Sustainable infrastructure investment requires changing status quo operating models by employing new technologies and finance methods.

Governments, working in partnership with private investors, can lead the way in addressing barriers to financing sustainable infrastructure projects in ways that work towards increasing the scale of the market. In fact, communities are already taking the steps needed to utilize innovative partnerships and new financing models to build sustainable infrastructure. For example, the U.S. municipal green bond market is growing rapidly and in 2016, DC Water released the first ever Environmental Impact Bond.

The path forward requires active partnership and collaboration between the public and private sectors, as well as support from non-profits and the philanthropic community. A multi-sectoral approach, as the case studies in the report demonstrate, effectively addresses these key barriers, right sizes demand and unlocks the flow of private capital needed to put into place the infrastructure of the future – sustainable infrastructure.

About EDF+Business

business.edf.org

Founded in 1967, EDF drives environmental breakthroughs in climate and energy, ecosystems, oceans and health through a unique approach that draws heavily on science, economics and bipartisan outreach. The other element that makes EDF unique is its ability to form unlikely partnerships around common goals. When looking specifically at EDF+Business, the common goal is finding the opportunities where both business and the planet can thrive.

Tags: EDF, EDF Business, EDF+Business, Environmental Defense Fund, Meister Consultants Group, PPPs, Public-Private Partnerships

RSS Feed

RSS Feed