SOLAR ENERGY INDUSTRIES ASSOCIATION & GTM RESEARCH

Introduction

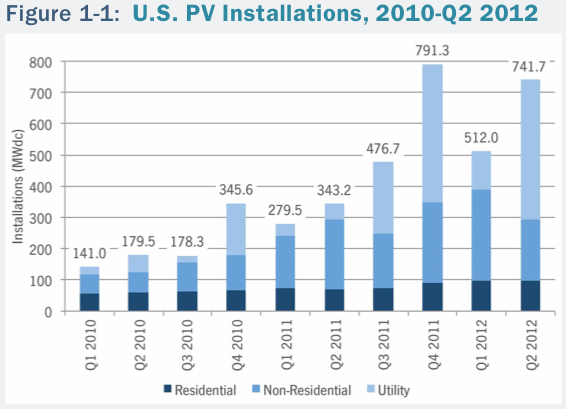

The U.S. market remains a rare bright spot in a difficult global solar environment this year. Although global installations should grow overall (GTM Research forecasts 18% global growth in 2012), manufacturer margins remain severely compressed as a result of persistent overcapacity. Major markets such as Germany and Italy show few signs of recovery, leading suppliers to turn with increasing fervency to growth markets – primarily China and the U.S. Fortunately, both of these markets have borne fruit in 2012. China has been a particularly dramatic growth story, with installations expected to more than double in 2012 and exceed 5 gigawatts (GW) by year’s end. Meanwhile, the U.S. continues its recent trend of posting strong, albeit more moderate and consistent, growth figures each quarter – with the exception of individual quarterly booms driven by utility installations.

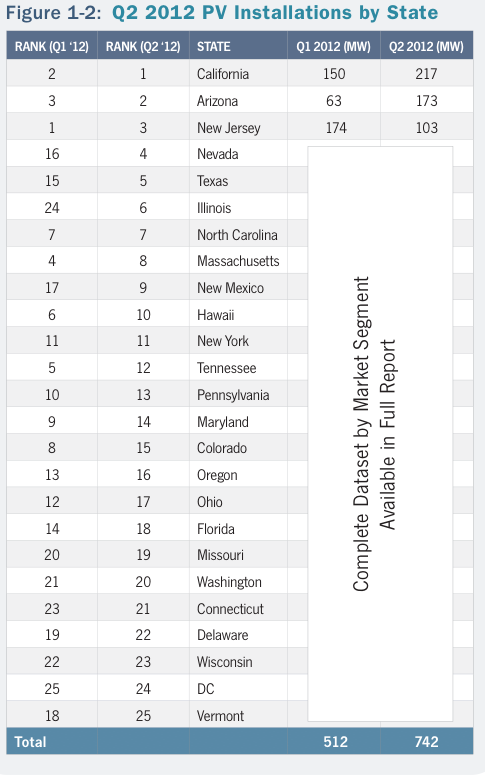

As usual, the second quarter was a tale of many markets for solar in the U.S. Growth rates varied greatly across states and across market segments. New Jersey began to experience a long-expected correction, while Massachusetts boomed. Overall commercial installations fell nationally, but utility installations more than doubled on a quarterly basis.

This report series tracks 24 states individually, as well as Washington, D.C., and while most market dynamics remain state-specific, a few trends were consistent throughout the country:

1. System prices continue to fall, bringing the market ever closer to the point where residential and non-residential demand is driven more by solar radiation and retail electricity prices than state-level incentives

2.The residential third-party financing model continues to gain steam in every market where it has been introduced

3.The non-residential market has struggled where incentive levels or SREC prices decline (particularly in California and New Jersey), implying system costs must fall further before state incentives become unnecessary

4.The volume of utility installations is booming, but new utility procurement has slowed down, leaving some earlier-stage projects in limbo as developers turn their attention to more promising prospects

GTM Research forecasts that 3.2 GW of PV will be installed in the U.S. this year, representing 71% growth over 2011. Given this forecast, U.S. market share of global installations will rise to over 10% from 7% in 2011 and less than 5% in 2010.

Download full report (PDF): U.S. Solar Market Insight Report Q2 2012

About Solar Energy Industries Association

www.seia.org

“Established in 1974, the Solar Energy Industries Association is the national trade association of the U.S. solar energy industry. As the voice of the industry, SEIA works with its 1,000 member companies to make solar a mainstream and significant energy source by expanding markets, removing market barriers, strengthening the industry and educating the public on the benefits of solar energy.”

About GTM Research

www.greentechmedia.com/research/

“GTM Research, a Greentech Media company, provides critical and timely market analysis in the form of concise and long-form market research reports, monthly newsletters and strategic consulting services. We specialize in solar, smart grid and enterprise markets. GTM Research’s analysis also underpins our webinars and live events. Our analyst team combines diverse backgrounds in the solar, smart grid, energy, environmental, emerging technology, investment banking, information technology and strategic consulting sectors.”

Tags: Greentech Research Media, GTM, SEIA, Solar Energy, Solar Energy Industries Association

RSS Feed

RSS Feed