SOLAR ENERGY INDUSTRIES ASSOCIATION & GTM RESEARCH

Introduction

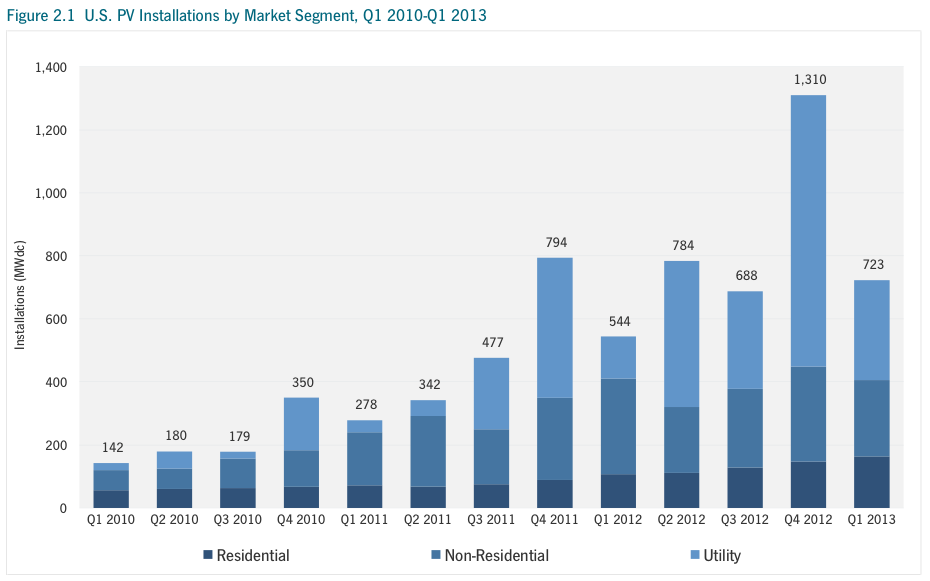

This is the 12th edition of the quarterly GTM Research/SEIA® U.S. Solar Market InsightTM series. From the first report published in 2010 through the end of 2012, the most dramatic transformation in the U.S. solar market was the growth of utility-scale solar. Utility PV installations in the U.S. grew 670% over the course of just two years from 2010 to 2012. In 2012 alone, 1,769 MW of utility PV was connected to the grid – 59% more than the cumulative total in all prior years. While residential and non-residential solar grew substantially during that period, the growth rate paled in comparison to that of the utility market.

We expect that the next four years will be marked by a new solar revolution in the U.S., this time driven by the distributed generation (DG) market. Whereas residential and commercial solar markets have historically been effectively capped by the availability of state- and utility-level incentives, solar has now become cost-effective in some markets with only the federal investment tax credit (ITC), accelerated depreciation and net metering. This report highlights this shift in California, where a meaningful number of installations have been completed without California Solar Initiative incentives, which have been that market’s main driver since 2007.

With the ITC currently in place through the end of 2016 and PV system prices continuing to fall each quarter, the DG market’s prospects have never been better. However, with this opportunity comes a new set of risks:

1. Net metering and the debate over how to value distributed generation: As the penetration of DG has grown, a number of utilities have sought to revise, cap, or remove net metering. This issue will play out differently across geographies but will have major implications everywhere.

2. Changing rate structures: Utility tariff structures can similarly impact the cost-effectiveness of solar. Changes in the details of these structures (such as how to incorporate time-of-use pricing and fixed vs. volumetric charges) can easily push solar into, or out of, economic viability. While net metering is currently a more public battleground, we anticipate that rate structures will soon follow behind.

3. The availability and cost of project finance: We estimate that the distributed generation market will require $48.5 billion of investment during the 2013-2017 period, which far exceeds all project finance provided to date. Market participants and advocates are working to secure new sources of capital, adapting financing models from other industries (REITs, master limited partnerships), retail capital sources (crowdfunding, community solar), and new investors in existing structures (corporate and utility tax equity). Still, project finance could serve as a significant bottleneck to growth over the next four years.

In the absence of these limiting factors, residential and commercial PV could grow exponentially through 2016.

Download full report (PDF): U.S. Solar Market Insight Report Q1 2013

About Solar Energy Industries Association

www.seia.org

“Established in 1974, the Solar Energy Industries Association is the national trade association of the U.S. solar energy industry. As the voice of the industry, SEIA works with its 1,000 member companies to make solar a mainstream and significant energy source by expanding markets, removing market barriers, strengthening the industry and educating the public on the benefits of solar energy.”

About GTM Research

www.greentechmedia.com/research/

“GTM Research, a Greentech Media company, provides critical and timely market analysis in the form of concise and long-form market research reports, monthly newsletters and strategic consulting services. We specialize in solar, smart grid and enterprise markets. GTM Research’s analysis also underpins our webinars and live events. Our analyst team combines diverse backgrounds in the solar, smart grid, energy, environmental, emerging technology, investment banking, information technology and strategic consulting sectors.”

Tags: GTM Research, Q1 2013, SEIA, U.S. Solar Market Insight Report

RSS Feed

RSS Feed