PwC (PriceWaterhouseCoopers)

Executive summary

The auto industry stands on the brink of a revolution. By 2030, vehicle production will have split between mass-market, largely no-frills “cars on demand” that will be rented journey-by-journey and more customized vehicles for those who still want to drive, or be driven in, their own vehicle.

A high level of automation will be needed to produce both types of vehicles, and every process will be affected. The pressure on the workforce will be severe. The industry workforce will be cut by at least 50 percent by 2030, and employees who remain will need very different skills. Automakers must become data managers and mobility service providers as well as vehicle assemblers.

This shift has enormous implications not just for personal mobility, but also for automakers’ business models. Competition for profits started to intensify two decades ago when suppliers began doing more of the work that automakers — also known as original equipment manufacturers (OEMs) — had traditionally done, such as building interiors and dashboards. That competition will step up a gear in the new era, as suppliers take on even more of this work, leaving OEMs to figure out where they should best play.

Here are some of our key predictions for 2030:

- Standardized, shared vehicles — used simply to get from A to B — will account for at least 30 percent of the market in Europe, concentrated at the lower-price end. In the U.S. and Asia, an even greater proportion is expected.

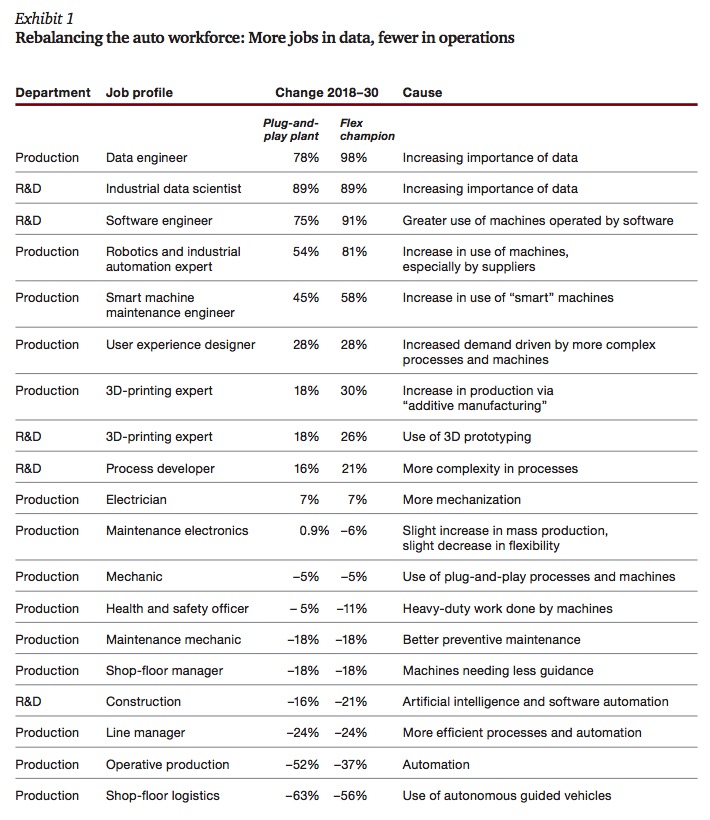

- The size of the workforce on assembly lines and in body and paint shops will be halved because of automation and the new types of vehicles being assembled.

- The number of shop-floor logistics roles will be reduced by around 60 percent, partially because humans will be replaced by autonomously guided vehicles.

- The number of data engineers required will almost double in some types of plants, and increase by 80 percent in others, while the number of software engineers needed will rise by as much as 90 percent.

- We expect the time required between R&D and the point of production to shrink from the current three to five years down to two years, to keep pace with technological changes.

Assembly plants — and workforce — of the future

To serve these two types of markets — mass-market “cars on demand” and customized vehicles for individual ownership — as efficiently as possible, two new types of factories are needed. One will be a highly automated “plug and play” plant producing large volumes with minimal variation between vehicle types, and with cost as the main distinguishing feature for ride-sharing companies buying these vehicles in bulk.

The second type of plant, which we call the “flex champion,” will produce customized vehicles to help build driver-owned cars. Today’s production lines, while allowing for some degree of product customization, are not flexible enough for this new scenario, where autonomous guided vehicles (AGVs) will take each car on its own unique route between assembly stations. OEMs might retrofit some of their existing factories, but they will need to decide on a case-by-case basis whether and how this makes economic sense.

In both cases, robots will do a far greater share of the work than they do today. This means that fewer employees will be needed. We estimate that only 40 percent of the workers with today’s skill sets will be needed in the plug-and-play plant, with around 50 percent fewer in the plant making the flex champion vehicles. Roles for remaining workers will change, and employees with new skills will be needed. In addition, there will be a greater degree of human–machine interaction as more intelligent machines work safely alongside humans. In R&D functions, for example, it will be possible to hand over lower-level routine decisions and paperwork to robots with artificial intelligence (AI) capabilities.

To enable automation, automakers and their suppliers must generate and share vast amounts of digital data about the design, dimensions, quality, and location of components, tracking their journey through the factory and beyond. Automakers must manage complex flows of physical materials and become data managers. Indeed, we expect the number of data engineers to double in the flexible plant between now and 2030.

Assembly will become simpler, particularly in the plug-and-play plant, with original equipment manufacturers (OEMs) asking suppliers to deliver more and more preassembled modules that can be fitted by robots into a range of vehicles. As mentioned above, this poses a risk to the profits of the OEMs, because as complexity passes to the supply chain, so does value.

The most significant threat to the OEMs from the new shared-vehicle market, however, is the risk of losing contact with their customers, who will deal directly with “mobility-as-a-service” companies instead. This new class of company will buy standard cars in bulk and rent them to the public for single journeys using online platforms and apps. One key question: Will OEMs that offer their own on-demand mobility services be able to compete with technology businesses that are set up for that express purpose? If not, they risk becoming a supplier to the mobility companies, no longer setting the rules of the game.

Below, we set out in detail our vision for how the two new types of vehicle factory mentioned above will operate, and the impact of these production changes on the size and role of the automotive workforce.

Plug and Play

Shared mobility will gain importance very rapidly. OEMs already offer mobility services, such as Daimler’s Car2go, which provides pay-per-ride Smart and Mercedes-Benz cars for hire in U.S. and European cities. However, as demand increases, particularly among young, urban drivers who don’t aspire to own a car, we believe OEMs will need to create new production facilities to produce high volumes of standardized vehicles as cost-effectively as possible.

In this new market, drivers won’t care about the color of the paint or the hardware inside. They will simply pick up the nearest car to get them where they need to go. Even in scenarios where a person will want to use a particular type of vehicle for a particular purpose — using a pickup truck to carry a heavy load, for instance — OEMs will produce standardized versions of these vehicles, for sale on a bulk order basis. Any individualization will happen when the car connects with the driver’s phone to offer access to that person’s music, contacts, and social networks. Whether the vehicle is autonomous or driver-controlled, powered by electricity or gasoline, the vehicle will still essentially be a standard model. This means that price will be the main differentiator for mobility-as-a-service companies that buy the cars and provide the client interface.

The employees left in the plant will be there to control and survey the system, and to fix problems. Assembly will be carried out by robots, and to make that simpler, more ready-built modules will come into play (see Exhibit 1, next page).

The use of preassembly is rising to another level with, for example, the engine, transmission, and axle combined on one platform and delivered to the OEM’s plant to be fitted into a common body using standardized connections. At the moment, final assembly is complicated by a variety of parts, screws, clips, and adhesives. The plug-and-play plant of the near future will require standardized parts that fit together like Lego bricks.

Download full version (PDF): How shared mobility and automation will revolutionize the auto industry

About PwC

www.pwc.com

PwC’s professional services, including audit and assurance, tax and consulting, cover such areas ascybersecurity and privacy, human resources, deals and forensics. We help resolve complex issues and identify opportunities across these industries.

Tags: Assembly Plants, Auto Industry, Automation, cars, PricewaterhouseCoopers, PwC, Shared Mobility

RSS Feed

RSS Feed