GEORGE WASHINGTON UNIVERSITY SCHOOL OF BUSINESS

Written by Christopher B. Leinberger

1. Executive Summary

During the second half of the 20th century, the dominant development model has been the familiar drivable sub-urban approach. Most real estate developers and investors, government regulators and financiers have come to understand this model extremely well, turning it into a successful development formula and economic driver. There are few metro areas of which this has been more true than metropolitan Atlanta. However, starting in the mid- 1990s, the pendulum has begun to move back toward building the opposite—walkable urbanism.

During the second half of the 20th century, the dominant development model has been the familiar drivable sub-urban approach. Most real estate developers and investors, government regulators and financiers have come to understand this model extremely well, turning it into a successful development formula and economic driver. There are few metro areas of which this has been more true than metropolitan Atlanta. However, starting in the mid- 1990s, the pendulum has begun to move back toward building the opposite—walkable urbanism.

This research has found the surprising and overwhelming recent emergence of walkable urban development and places in metropolitan Atlanta. Walkable urban development represents not only a growing share of new development in the Atlanta region, but recently the majority of most real estate development. Walkable urban real estate projects now command an impressive rent premium over their drivable sub-urban competition. The amount of walkable urban square feet built in each of the last three real estate cycles in metropolitan Atlanta has mushroomed, growing from a small fraction in the 1990s to a majority in the current real estate cycle.

The market has spoken—it is now time for public policy to reflect this new market demand by putting in the necessary infrastructure and zoning as well as encouraging place management entities, such as the Community Improvement Districts (CIDs), which will be the location of most future economic growth and development.

Metropolitan Atlanta, “the poster child of sprawl,” is now experiencing the end of sprawl.

BACKGROUND

In metropolitan areas, land use is categorized as playing one of two economic functions: either regionally significant or local-serving. Regionally significant places have concentrations of employment, civic centers, institutions of higher education, major medical centers and regional retail, as well as one-of-a-kind cultural, entertainment, and sports assets. Local-serving places are bedroom communities dominated by residential development that is supported by local- serving commercial (e.g., grocery stores) and civic uses, such as primary and secondary schools, police and fire stations, and so on.

Both drivable sub-urban and walkable urban forms of development have market support and appeal; it is not as if one is “better” than the other, it is only a matter of current and future supply and demand. It is important to note that each form can be found in both center cities and suburbs, there is drivable sub-urban development in the city of Atlanta as well as the suburbs. There are walkable urban places in the suburbs of Atlanta as well as the city.

This research report focuses on regionally significant walkable urban places, referred to as WalkUPs. It suggests that these places will be the loci of both the growth of real estate and wealth-creating employ

KEY FINDINGS

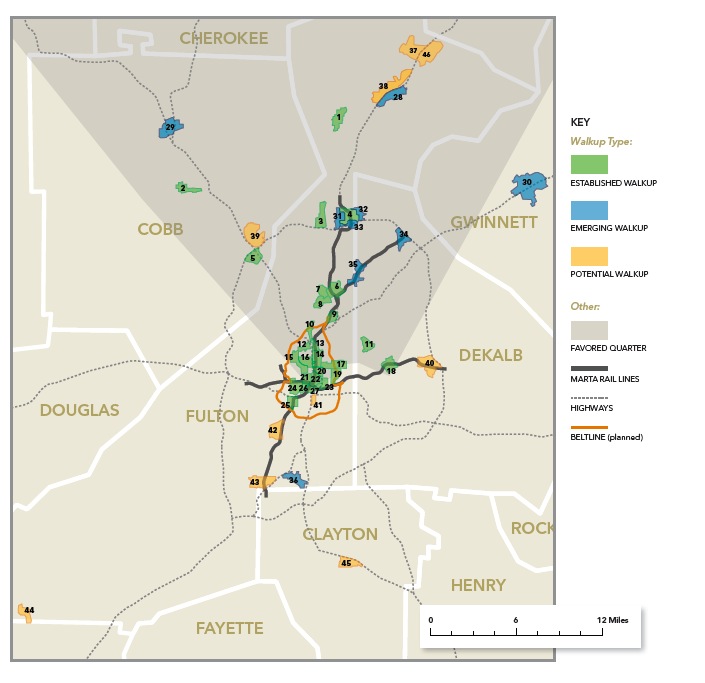

- There are 27 Established WalkUPs in metro Atlanta in 2013. Combined, these WalkUPs account for only 0.55 percent of the total land in the metro area.1 In addition, we have identified nine Emerging WalkUPs totaling 0.33 percent of the regions land mass. These established and emerging WalkUPs total 0.88 percent of the region.

- The densities of the 27 Established WalkUPs average 0.60 gross floor-area ratio (FAR). 2 The gross FAR for the region, excluding WalkUPs, is only 0.04. In other words, WalkUPs are over 16 times denser than the rest of the region.

- Nearly 19 percent of total metropolitan jobs are located in Established WalkUPs, with another three percent located in Emerging WalkUPs. Overall, Established WalkUPs have an employment density of 36.5 jobs per acre; the region as a whole, not including Established and Emerging WalkUPs, has an employment density of only 0.8 jobs/acre.

- Seventy-four percent of Established WalkUPs in the region are within the city of Atlanta. However, all nine Emerging WalkUPs are in the suburbs and eight of the ten Potential WalkUPs identified in the study are outside of the city. The city of Atlanta has 83 percent of the total real estate square footage in the Established WalkUPs.

- Sixteen of the 27 regionally significant WalkUPs, or 59 percent, have rail transit. The remaining 11 WalkUPs have no rail service and none have rail transit funding.

- Average rent in all real estate products in Established WalkUPs is 112 percent higher on a rentper- square-foot basis than drivable sub-urban real estate.

- The market share of the region’s development within Established WalkUPs over the past three real estate cycles (1992 to 2000, 2001 to 2008, and 2009 to the present) has steadily and rapidly increased; 10 percent share in the 1990s cycle doubling to 22 percent in the 2000s cycle and more than doubling again to 50 percent in the current cycle.

- In the current real estate cycle, more than 60 percent of income-producing property in the region was developed in Established or Emerging WalkUPs taking place in less than one percent of the region’s land mass.

- Within both Established and Emerging WalkUPs, the vast majority of recent development has gone to those areas that are served by MARTA rail. In the current 2009-2013 real estate cycle, 73 percent of development in Established WalkUPs went to the MARTA-served places. Even more dramatic, 85 percent of development in Emerging WalkUPs went to places with rail transit.

- Multifamily rental housing was the most significant driver of real estate growth in regionally significant WalkUPs, which is consistent with national trends. In the 1990s, less than nine percent of income-producing real estate captured by Established WalkUPs was multifamily rental housing. In the early 2000s, this rose to 28 percent and has skyrocketed to 88 percent in this real estate cycle.

- Following rental housing, office space was the second most important factor in the trend toward walkable urbanism. Only 19 percent of the office space delivered in the 1990s cycle was built in then-Established WalkUPs. This increased to 31 percent in the 2000s and to 50 percent in the current cycle that started in 2009.

- Despite higher rents, development of new retail space in WalkUPs lags. Only six percent of new retail space developed in the region in the 1990s was located in WalkUPs. For the early 2000s, it rose slightly to seven percent but has fallen to only two percent for the cycle starting in 2009.

Download full version (PDF): The WalkUP Wake-Up Call

About George Washington University School of Business

business.gwu.edu

“Mission Statement: To deliver an outstanding education, advance knowledge, and provide practical experience in diverse organizational settings, leveraging the unique advantages of our location in the Washington, D.C., area, in order to enhance the capacities of students, faculty, staff, alumni, and the business community to be productive and principled members of society.”

About Christopher B. Leinberger

chrisleinberger.com

“Christopher B. Leinberger is a land use strategist, teacher, developer, researcher and author, balancing business realities with social and environmental concerns. Mr. Leinberger is:

- President of Locus; Responsible Real Estate Developers and Investors

- The Charles Bendit Distinguished Scholar and Research Professor, George Washington University School of Business

- Nonresident Senior Fellow at Brookings Institution in Washington DC

- Founding Partner of Arcadia Land Company, a New Urbanism and transit-oriented development firm”

Tags: Atlanta, Christopher B. Leinberger, GA, George Washington University School of Business, Georgia, GWU

RSS Feed

RSS Feed