SMART GROWTH AMERICA

Note: this post represents one section of Smart Growth America’s publication, The Innovative DOT: A handbook of policy and practice

Appropriate pricing strategies can raise revenues and manage demand, keeping costs down. On the other hand, when transportation system users do not see appropriate price signals, demand is artificially high, increasing congestion and pressure for new capacity. State departments of transportation generally cannot impose price signals on their own, but they can work with a variety of stakeholders and decision-makers, from legislators to insurance companies, to accomplish these goals.

Appropriate pricing strategies can raise revenues and manage demand, keeping costs down. On the other hand, when transportation system users do not see appropriate price signals, demand is artificially high, increasing congestion and pressure for new capacity. State departments of transportation generally cannot impose price signals on their own, but they can work with a variety of stakeholders and decision-makers, from legislators to insurance companies, to accomplish these goals.

In this section:

- Use Variable Tolling to Manage Demand

- Implement Pay-As-You-Drive Insurance

Use Variable Tolling to Manage Demand The Opportunity

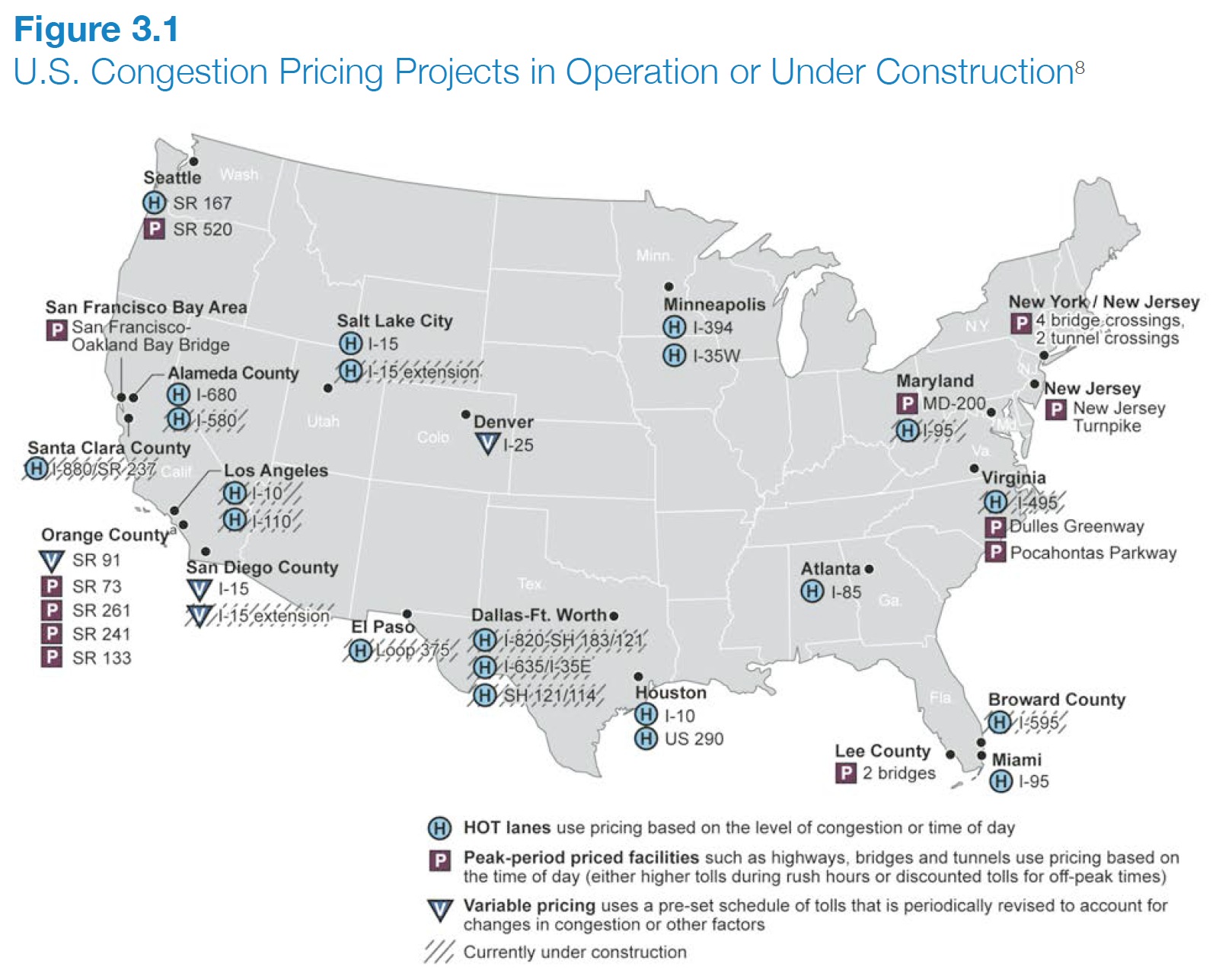

It is well known that transportation funding in the U.S. has not kept pace with the cost of system maintenance and modernization. Tolling can help solve this problem by creating a user-generated revenue source for transportation. Just as important, tolls can help to manage finite roadway capacity, moderating demand through the use of pricing based on location, time of day, and traffic conditions. Variable tolls that are higher at peak times can reduce traffic congestion by shifting transportation away from single-occupancy vehicles, out of peak travel periods, and to less-congested roads or modes of transportation. Tolling can also be a more popular alternative to fuel tax increases, especially if the revenues are earmarked for maintaining transportation infrastructure and the toll variability can be shown to reduce congestion.

State and local governments, travelers, and businesses can all benefit from demand-sensitive tolling. Transportation agencies receive additional dollars without having to borrow or implement a tax increase. For drivers, traffic in tolled lanes can be priced to move at a faster pace than non-tolled lanes, saving time on commutes and guaranteeing reliable speeds and travel times. Express bus riders experience a similar speed and travel time benefit, because express buses are typically given free access to managed lanes. Variable tolling also sends a price signal that leads some drivers to use public transportation, carpool, or shift trips to off-peak hours. In fact, using tolls for demand management may be cheaper than building new roadway capacity. According to estimates by the Federal Highway Administration (FHWA), widespread use of value pricing methods such as variable tolling would reduce the amount of capital investment needed to sustain the performance and condition of the highway system by nearly one-third—from $127 billion per year to about $85 billion per year.

Unsurprisingly, variable tolling raises fairness and equity considerations related to the distribution of the benefits and burdens of the toll. Broadly, there are three types of equity concerns for tolling projects: income equity (does the project negatively impact low-income people?), geographic equity (does the project negatively impact particular areas?), and modal equity (does the project negatively impact people who are taking transit?). These concerns have derailed tolling projects in many states and cities, and the extent of variable tolling’s equity impact is still being examined. Nevertheless, attempts can be made to address fairness concerns through the design of the tolling program, for instance, by putting toll revenues back into the tolled corridor to finance transit service as well as the highway.

What Is It?

Flat-price tolls have long been employed to cover the costs of construction and sometimes operations and maintenance of highways. Variable tolling, the modern version of this long-standing practice, also raises revenues, but at the same time manages demand to reduce congestion and the need for costly expansions. Variable tolling is a type of value pricing where prices are set to align with the value delivered from quicker and more reliable travel times. Variable tolling has the added benefit of generating revenue to cover some portion of the costs of providing the service.

…

Implement Pay-As-You-Drive Insurance The Opportunity

State transportation agencies may not play a direct role in the provision of auto insurance to drivers, but they stand to benefit if insurance programs are structured to maximize the life of the infrastructure they maintain. Pay-As-You-Drive (PAYD) auto insurance can help manage transportation demand by giving motorists an option for auto insurance that effectively rewards them for driving less. Even small reductions during peak demand can lead to significant decreases in roadway congestion, eliminating delays and improving flow.41 A Brookings Institute report calculated that PAYD insurance implemented in all 50 states could reduce vehicle miles traveled (VMT) by eight percent and save $50- $60 billion a year by decreasing the number of crashes and other driving-related externalities. With PAYD insurance, nearly two-thirds of households would save an average of $270 per car per year. In turn, insurance would become more affordable and the number of uninsured drivers would decrease. One study found that PAYD insurance has the same impact on managing demand as a $1-per-gallon gas tax increase.42 Decreased congestion through VMT reductions would also result in decreased pressure for highway capacity expansions.

What Is It?

Most automobile insurance rates make only minor distinctions between drivers who log thousands of miles every year (and are thus exposed to significantly greater risks) and those who only travel a few hundred. PAYD insurance supports the actuarial nature of insurance (higher exposure means higher risk), allowing those at lower risk due to less driving to reduce their financial obligation.

PAYD auto insurance premiums are priced per miles driven. While program structures can vary, insurance companies generally divide current premiums by the category of miles reported to the insurer. For example, a $250 premium for 10,000 miles reported becomes 2.5 cents per mile; an $1,800 premium for 15,000 miles equals 12 cents per mile. For the typical driver, premiums would average 6.5 cents per mile. Potential payment methods include:

- Pay the premium based on the expected mileage category; a driver will pay the difference or receive a refund at the end of the policy term, depending on actual miles driven.

- Purchase a lump sum of miles at the start of the policy term and buy more miles if needed or receive credit for unused miles.

- Be billed for usage on a monthly basis, similar to a utility

Download full version (PDF): Focus Area 3 – Pricing

About Smart Growth America

www.smartgrowthamerica.org

Smart Growth America advocates for people who want to live and work in great neighborhoods. We believe smart growth solutions support thriving businesses and jobs, provide more options for how people get around and make it more affordable to live near work and the grocery store. Our coalition works with communities to fight sprawl and save money. We are making America’s neighborhoods great together.

Tags: Department of Transportation, Innovative DOT, Smart Growth America, Tolls, USDOT

RSS Feed

RSS Feed