ROCKY MOUNTAIN INSTITUTE

Distributed electricity generation, especially solar PV, is rapidly spreading and getting much cheaper. Distributed electricity storage is doing the same, thanks largely to mass production of batteries for electric vehicles. Solar power is already starting to erode some utilities’ sales and revenues. But what happens when solar and battery technologies are brought together? Together they can make the electric grid optional for many customers—without compromising reliability and increasingly at prices cheaper than utility retail electricity. Equipped with a solar-plus-battery system, customers can take or leave traditional utility service with what amounts to a “utility in a box.”

Distributed electricity generation, especially solar PV, is rapidly spreading and getting much cheaper. Distributed electricity storage is doing the same, thanks largely to mass production of batteries for electric vehicles. Solar power is already starting to erode some utilities’ sales and revenues. But what happens when solar and battery technologies are brought together? Together they can make the electric grid optional for many customers—without compromising reliability and increasingly at prices cheaper than utility retail electricity. Equipped with a solar-plus-battery system, customers can take or leave traditional utility service with what amounts to a “utility in a box.”

This “utility in a box” represents a fundamentally different challenge for utilities. Whereas other technologies, including solar PV and other distributed resources without storage, net metering, and energy efficiency still require some degree of grid dependence, solar-plus-batteries enable customers to cut the cord to their utility entirely.

Notably, the point at which solar-plus-battery systems reach grid parity—already here in some areas and imminent in many others for millions of U.S. customers—is well within the 30-year planned economic life of central power plants and transmission infrastructure. Such parity and the customer defections it could trigger would strand those costly utility assets. Even before mass defection, a growing number of early adopters could trigger a spiral of falling sales and rising electricity prices that make defection via solar-plus-battery systems even more attractive and undermine utilities’ traditional business models.

How soon could this happen? This analysis shows when and where U.S. customers could choose to bypass their utility without incurring higher costs or decreased reliability. It therefore maps how quickly different regions’ utilities must change how they do business or risk losing it. New market realities are creating a profoundly different competitive landscape as both utilities and their regulators are challenged to adapt. Utilities thus must be a part of helping to design new business, revenue, and regulatory models.

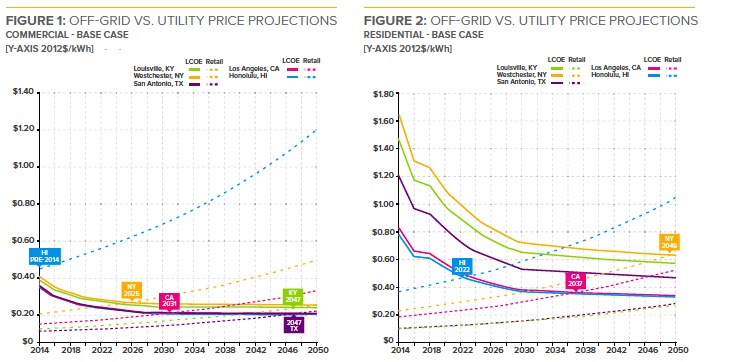

Our analysis focuses on five representative U.S. geographies (NY, KY, TX, CA, and HI). Those geographies cover a range of solar resource potential, retail utility electricity prices, and solar PV penetration rates, considered across both commercial and residential regionally-specific load profiles. After considering many distributed energy technologies, we focus on solar-plus-battery systems because the technologies are increasingly cost effective, relatively mature, commercially available today, and can operate fully independent of the grid, thus embodying the greatest potential threat.

We model four possible scenarios:

1. Base case—Uses an average of generally accepted cost forecasts for solar and battery systems that can meet 100% of a building’s load, in combination with occasional use of a diesel generator (for commercial systems only)

2. Accelerated technology improvement— Assumes that solar PV and battery technologies experience more aggressive cost declines, reaching or surpassing U.S. Department of Energy targets

3. Demand-side improvement—Includes investments in energy efficiency and user-controlled load flexibility

4. Combined improvement—Considers the combined effect of accelerated technology improvements and demand-side improvements

We compare our modeled scenarios against a reasonable range of retail electricity price forecasts bound by U.S. Energy Information Administration (EIA) forecasts on the low side and a 3%-real increase per year on the high side.

The analysis yields several important conclusions:

1. Solar-plus-battery grid parity is here already or coming soon for a rapidly growing minority of utility customers, raising the prospect of widespread grid defection. For certain customers, including many customer segments in Hawaii, grid parity is here today. It will likely be here before 2030 and potentially as early as 2020 for tens of millions of commercial and residential customers in additional geographies, including New York and California (see Figures 1 and 2). In general, grid parity arrives sooner for commercial than residential customers. Under more aggressive assumptions, such as accelerated technology improvements or investments in demand-side improvements, grid parity will arrive much sooner (see Figures 3 and 4).

2. Even before total grid defection becomes widely economic, utilities will see further kWh revenue decay from solar-plus-battery systems. Our analysis is based on average load profiles; in each geography there will be segments of the customer base for whom the economics improve much sooner. In addition, motivating factors such as customer desires for increased power reliability and low-carbon electricity generation are driving early adopters ahead of grid parity, including with smaller grid-dependent solar-plus- battery systems that can help reduce demand charges, provide backup power, and other benefits. Still others will look at investments in solar-plus-battery systems as part of an integrated package that includes efficiency and load flexibility. This early state could accelerate the infamous utility death spiral—self-reinforcing upward rate pressures, making further self-generation or total defection economic faster.

3. Because grid parity arrives within the 30-year economic life of typical utility power assets, it foretells the eventual demise of traditional utility business models. The “old” cost recovery model, based on kWh sales, by which utilities recover costs and an allowed market return on distribution networks, central power plants, and/or transmission lines will become obsolete. This is especially profound in certain regions of the country. In the Southwest across all MWh sold by utilities, for example, our conservative base case shows solar-plus-battery systems undercutting utility retail electricity prices for the most expensive one-fifth of load served in the year 2024; under more aggressive assumptions, off-grid systems prove cheaper than all utility-sold electricity in the region just a decade out from today (see Figure 5).

Though many utilities rightly see the impending arrival of solar-plus-battery grid parity as a threat, they could also see such systems as an opportunity to add value to the grid and their business models. The important next question is how utilities might adjust their existing business models or adopt new business models—either within existing regulatory frameworks or under an evolved regulatory landscape—to tap into and maximize new sources of value that build the best electricity system of the future at lowest cost to serve customers and society. These questions will be the subject of a forthcoming companion piece.

Download full version (PDF): The Economics of Grid Defection

About Rocky Mountain Institute

www.rmi.org

“Rocky Mountain Institute (RMI) is an independent, non-partisan nonprofit that drives the efficient and restorative use of resources. Co-founded in 1982 by Amory Lovins, its Chairman Emeritus and Chief Scientist, RMI now has approximately 75 full-time staff, an annual budget of $12 million, and a global reach and reputation.”

Tags: Batteries, Cohn Reznick, Homer Energy, Rocky Mountain Institute, Solar Energy

RSS Feed

RSS Feed