CERES

Executive Summary

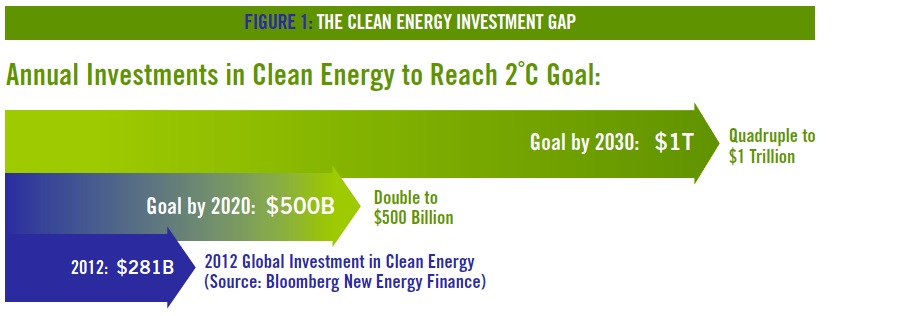

this Ceres report provides 10 recommendations for investors, companies and policymakers to increase annual global investment in clean energy to at least $1 trillion by 2030—roughly a four-fold jump from current investment levels.

Mobilize Investor Action to Scale Up Clean Energy Investment

1. develop capacity to boost clean energy investments and consider setting a goal such as 5 percent portfolio-wide clean energy investments

2. elevate scrutiny of fossil fuel companies’ potential carbon asset risk exposure

3. engage portfolio companies on the business case for energy efficiency and renewable energy sourcing, as well as on financing vehicles to support such efforts

4. support efforts to standardize and quantify clean energy investment data and products to improve market transparency

Promote Green Banking and Debt Capital Markets

5. encourage “green banking” to maximize private capital flows into clean energy

6. support issuances of asset-backed securities to expand debt financing for clean energy projects

7. support development bank finance and technical assistance for emerging economies

Reform Climate, Energy and Financial Policies

8. support regulatory reforms to electric utility business models to accelerate deployment of clean energy sources and technologies

9. support government policies that result in a strong price on carbon pollution from fossil fuels and phase out fossil fuel subsidies

10. support policies to de-risk deployment of clean energy sources and technologies

In 2010 world governments agreed to limit the increase in global temperature to two degrees Celsius (2 °C) above pre-industrial levels to avoid the worst impacts of climate change. To have an 80 percent chance of maintaining this 2 °C limit, the IEA estimates an additional $36 trillion in clean energy investment is needed through 2050—or an average of $1 trillion more per year compared to a “business as usual” scenario over the next 36 years.

These new investments in clean energy—including renewable energy such as solar, wind and geothermal, energy efficiency and energy smart technologies such as power storage, fuel cells and carbon capture and storage—will provide multiple benefits. In addition to cutting greenhouse gas emissions in half by 2050, such investment will yield significant returns in the form of reduced fuel costs. Total fuel savings are an estimated $100 trillion between 2010 and 2050. Moreover, the greater job-creation potential of energy efficiency and renewable energy relative to fossil fuels makes clear that quadrupling annual global investment in clean energy will create millions of new jobs worldwide.

This paper refers to the necessary additional investment in clean energy as the “Clean Trillion.” Current annual investment in clean energy falls far short of this goal. In 2012, global investment in clean energy (as defined by Bloomberg New Energy Finance) was $281 billion—and in 2013 this figure is expected to be even lower. Simply put, there is a clean energy investment gap.

Download full version (PDF): Investing in the Clean Trillion

About Ceres

www.ceres.org

Ceres is a nonprofit organization mobilizing business and investor leadership on climate change, water scarcity and other sustainability challenges. Ceres directs the Investor Network on Climate Risk (INCR), a network of over 100 institutional investors with collective assets totaling more than $12 trillion. Ceres also directs Business for Innovative Climate & Energy Policy (BICEP), an advocacy coalition of nearly 30 businesses committed to working with policy makers to pass meaningful energy and climate legislation.

Tags: Ceres, Clean Energy

RSS Feed

RSS Feed