NATIONAL ACADEMY OF SCIENCES

Chapter 1: Overview and Scope of the Study

Legislative Background to the Study

In 2008, Congress directed the U.S. Department of the Treasury to work with the National Academies to undertake “a comprehensive review of the Internal Revenue Code of 1986 to identify the types of and specific tax provisions that have the largest effects on carbon and other greenhouse gas emissions and to estimate the magnitude of those effects.” Congress later appropriated funds so the study could commence in early 2011.

In considering its task, the committee held discussions with staff of the Department of the Treasury, had an open meeting with the legislative sponsor of the study mandate, Representative Earl Blumenauer (D-OR), and held two public meetings to hear from interested parties. The committee also considered a suggestion from the staff of the Joint Committee on Taxation (JCT) that the study should “provide scientifically-based information to aid decision makers in the formulation of tax policies aimed at reducing emissions and mitigating climate change … [and] …identify the provisions of the Code that are most likely to have significant effects on carbon emissions” (JCT, 2009).

Those discussions led the committee to interpret Congress’s request as including both provisions intended to affect energy-intensive activities in a narrow, specific way as well as provisions affecting major sectors of the economy, activities, or large segments of the population. We label the latter set “broad-based provisions” in this report. Moreover, we interpreted the charge to include any tax code provisions that might significantly affect emissions, whether by increasing or decreasing them, that is, whether they increase revenue (as in the case of excise taxes) or reduce revenues (as in the case of special deductions, exemptions, and credits that the Office of Management Budget [OMB] and the JCT call tax expenditures).

Limitations of the Study

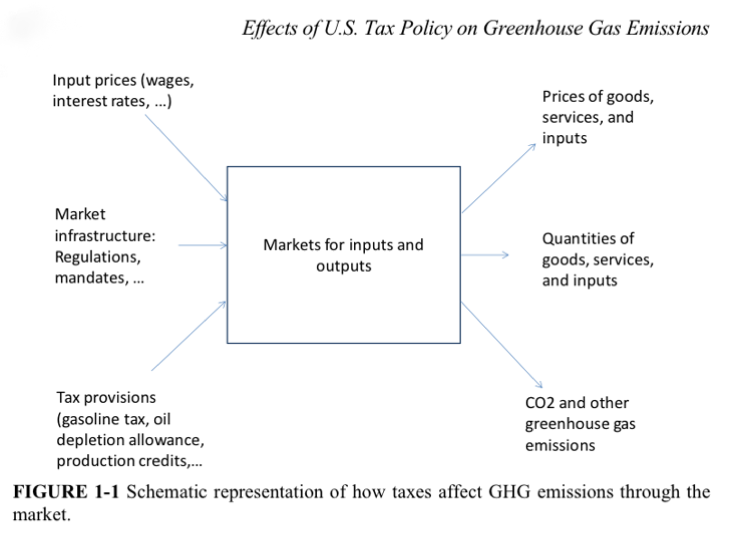

The potential scope of the study is enormous because of the size and complexity of the Internal Revenue Code (IRC). Difficulties arise as well because it is difficult to gauge the full scope and depth of the mechanisms by which the tax code affects economic activity and greenhouse gas (GHG) emissions.

At the same time, there were clear boundaries on Congress’s request. It did not ask the committee to assess the contribution of greenhouse gases to climate change, nor to examine the consequences of global warming, nor to recommend changes in specific provisions of the tax code.

Statement of Task

The National Academies’ first task in carrying out its congressional mandate was to work with the Treasury Department to draft a statement of work reflecting an understanding of congressional expectations. The committee reviewed and accepted the following charge:

The committee will undertake a consensus study to identify the types of and specific tax provisions that have substantial effects on the emission rates of carbon dioxide and other greenhouse gases, and to the extent possible rank the magnitudes of those effects.

The committee will first determine the most appropriate analytical framework and methodology to use in examining the effects of the tax code on greenhouse gas emissions. It will consider both provisions that may increase emission rates as well as those having the effect of lowering them over specific periods, and both direct (e.g., fuel-related provisions) and indirect measures (e.g., the home mortgage deduction and the investment tax credit). Studying the tax code’s impact on GHG emissions, the committee will necessarily focus heavily on energy, both the life cycles of different energy sources and their uses in different sectors such as electricity generation, transportation, industrial processes, and consumer uses (including in households). The study may extend to areas beyond energy, such as agriculture, forestry, urban development, and other land uses which can have significant effects on GHG emissions.

The study will not recommend particular new taxes or tax incentives or changes in existing provisions of the tax code but may outline principles and criteria for formulating climate-sensitive tax policy in the future. It may evaluate the efficiency and effectiveness of different tax measures in reducing GHG emissions relative to other policy instruments.

Read full report (PDF) here: Effects of U.S. Tax Policy on Greenhouse Gas Emissions

About The National Academy of Sciences (NAS)

http://www.nasonline.org/

“The National Academy of Sciences (NAS) is a private, non-profit society of distinguished scholars. Established by an Act of Congress, signed by President Abraham Lincoln in 1863, the NAS is charged with providing independent, objective advice to the nation on matters related to science and technology. Scientists are elected by their peers to membership in the NAS for outstanding contributions to research. The NAS is committed to furthering science in America, and its members are active contributors to the international scientific community. Nearly 500 members of the NAS have won Nobel Prizes, and the Proceedings of the National Academy of Sciences, founded in 1914, is today one of the premier international journals publishing the results of original research.”

Tags: greenhouse gas emissions, The National Academy of Sciences, U.S. Tax Policy

RSS Feed

RSS Feed