TRANSPORTATION INVESTMENT ADVOCACY CENTER

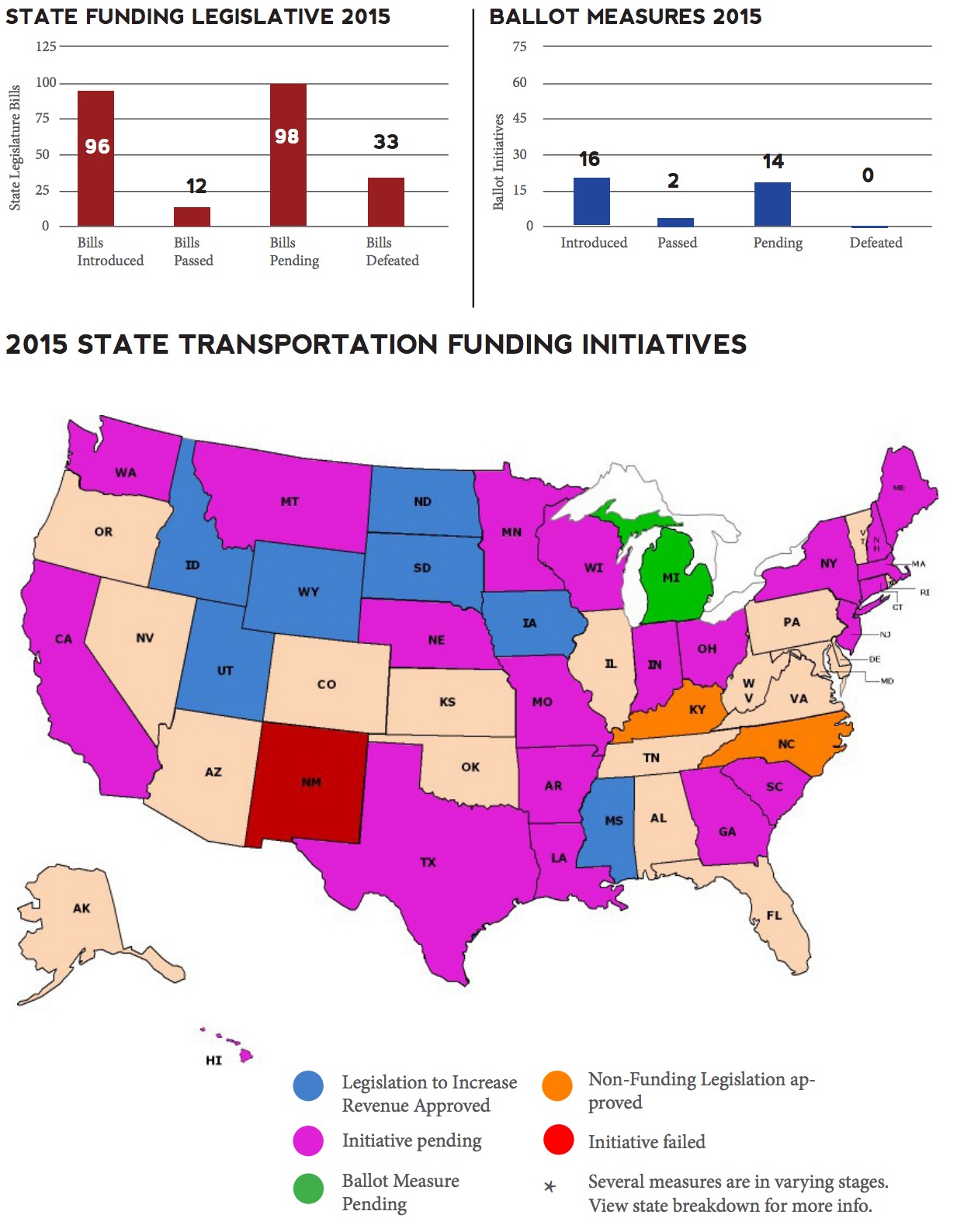

Nine states— La., Minn., Mo., Neb., N.H., N.J., S.C., Texas, Wash.— are currently considering legislation to increase their gas tax or sales tax on gasoline.

Three states— Conn., La., and Texas— are currently considering legislation to protect their transportation funds from diversions.

Three states— Ark., Mich., and Mo.— have pending legislation to convert the flat-rate excise tax on fuel entirely to a variable-rate tax. Additionally, a bill in Maine proposes indexing the flat gas tax to the Consumer Price Index.

View this complete post...

RSS Feed

RSS Feed