Innovation NewsBriefs

Vol. 23, No. 31

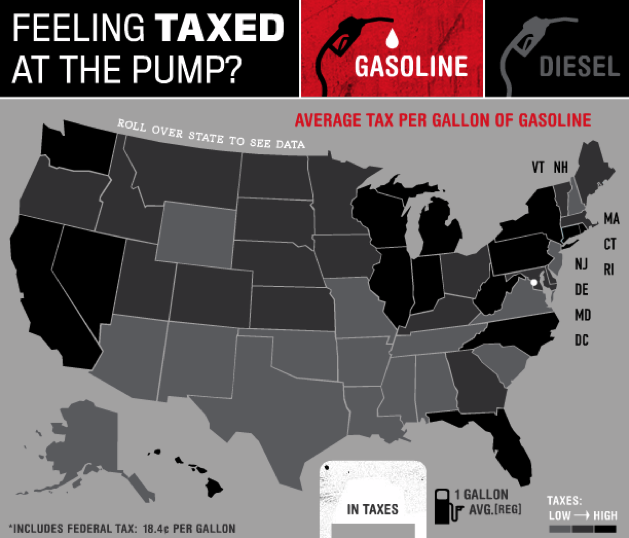

Although some infrastructure advocates are hoping to use the current budget negotiations to win support for an increase in the federal gasoline tax, the idea is unlikely to gain support in Congress or the Administration. While the 2010 Simpson-Bowles deficit-reduction commission proposed raising the federal gas tax by 15 cents/gallon as part of a broad deficit-reduction plan, neither House Speaker John Boehner (R-OH) nor Senate Majority Leader Harry Reid (D-NV) have endorsed the idea.

View this complete post...

Tags: C. Kenneth Orski, Gas tax, Harry Reid, John Boehner, NV, NY, OH, Ohio, TIFIA

Posted in

Accountability, Bipartisan, Democrat, Economic Stimulus, Guest Post, Highway, Innovation Newsbriefs, National, Policy, Public Transportation, Recovery, Republican, Roads, Tax, The Infra Blog, Transit

Comments Off on Higher Gas Tax Unlikely to Gain Support in U.S. Congress

RSS Feed

RSS Feed