INSTITUTE ON TAXATION AND ECONOMIC POLICY

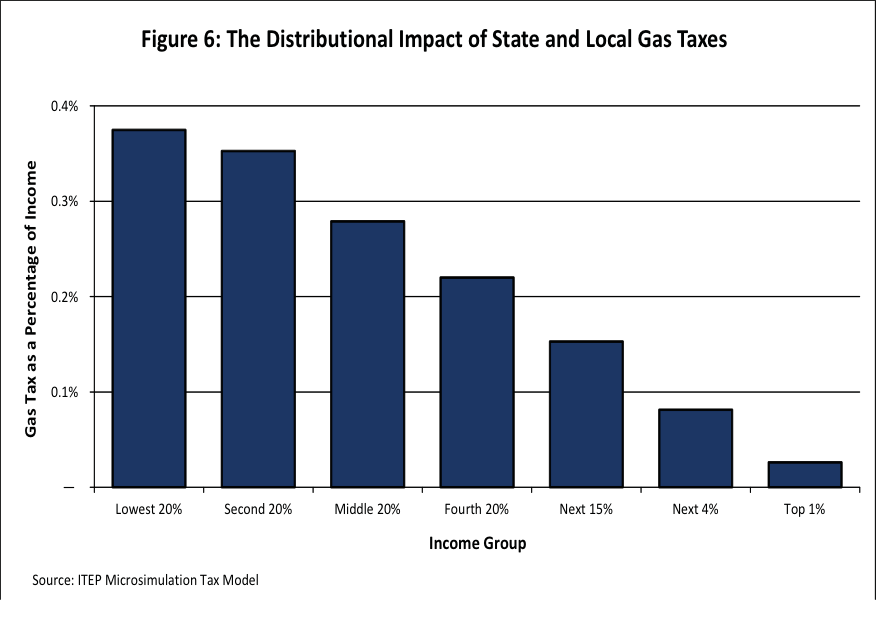

State gasoline and diesel taxes (often just called “gas taxes”) are the most important source of transportation funding under the control of state lawmakers. Every state levies both of these taxes.

Unfortunately, most state gas taxes are built to fail. Thirty six states levy only a fixed-rate tax that collects the same number of cents in tax, year aft er year, on every gallon of fuel purchased. But as this report shows, inflation has been eating away at these fixed rate taxes as the price of asphalt, concrete, and other transportation construction inputs continues to grow almost every year.

View this complete post...

RSS Feed

RSS Feed