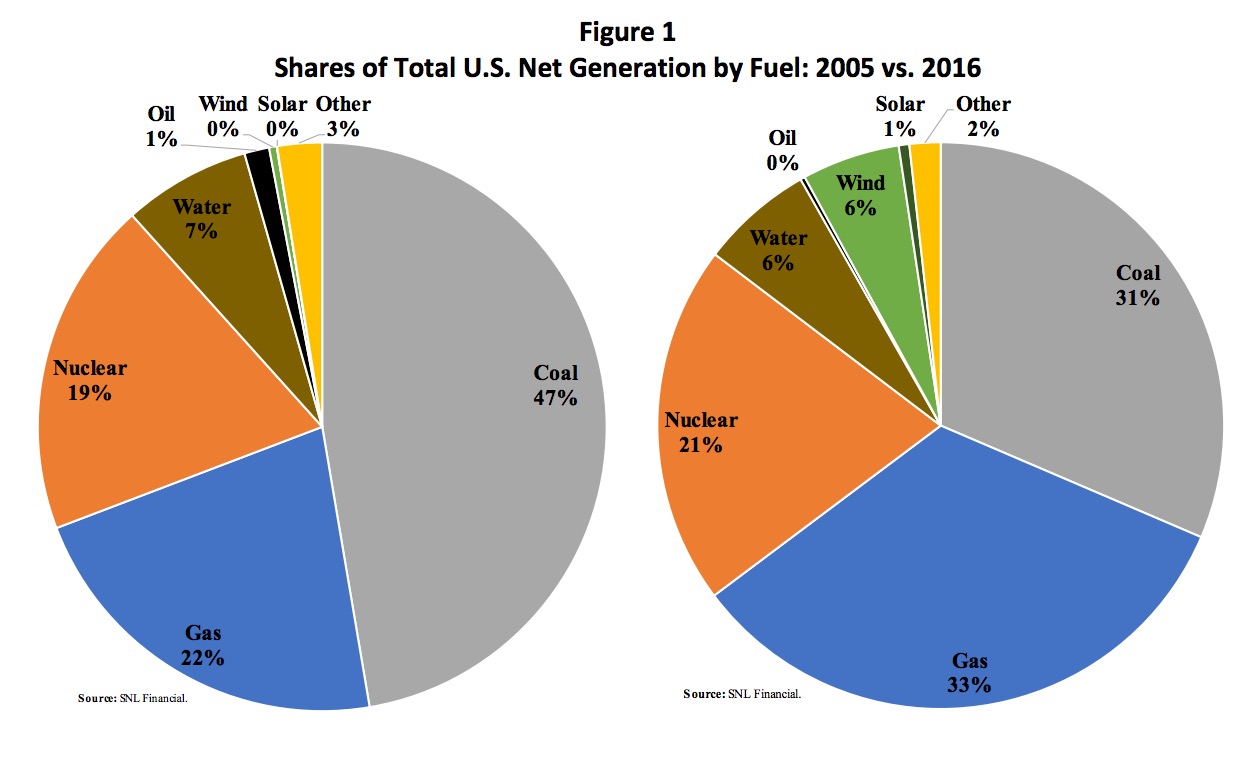

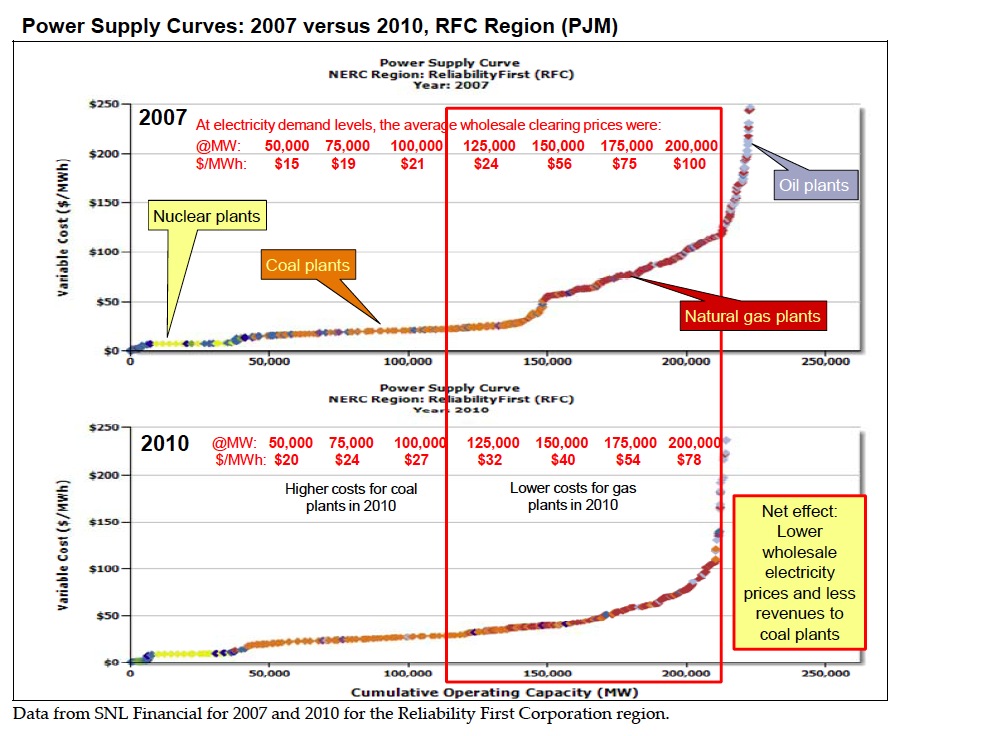

Fundamental market forces — the addition of highly efficient new gas-fired resources, low natural gas prices, and flat demand for electricity — are primarily responsible for altering the profitability of many older merchant generating assets in the parts of the country with wholesale competitive markets administered by Regional Transmission Organizations (RTOs). As a result, some of these resources (mostly coal- and natural gas-fired generating units, but also many oil-fired power plants and a handful of nuclear power plants) have retired from the system or announced that they will do so at a future date.

View this complete post...

RSS Feed

RSS Feed