ECONOMIC POLICY INSTITUTE

Executive summary

The U.S. steel industry is facing its worst import crisis in more than a decade. In the aftermath of the Great Recession, steelmakers in other countries, backed by aggressive government support, continued to add production capacity as demand stagnated. The open and large U.S. market became the prime target for the massive excess supply stemming from this excess capacity, and, since 2011, U.S. steel imports have surged and import unit values have plummeted.

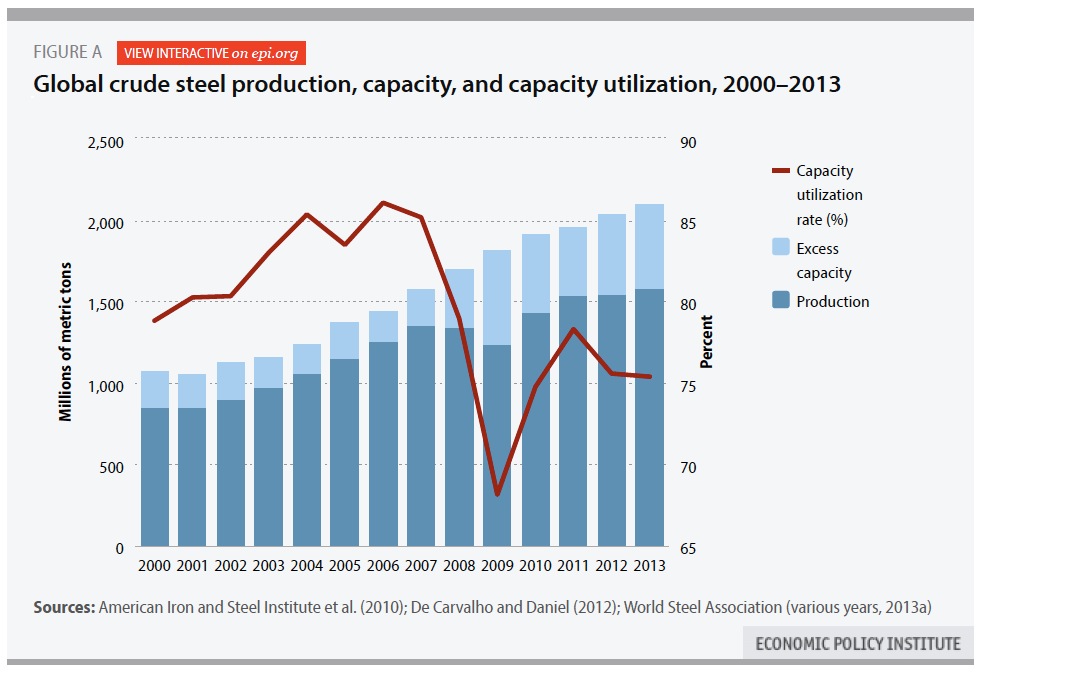

Global excess steel capacity is now over half a billion metric tons, more than twice the volume of excess capacity in the last steel import crisis that followed the Asian financial crisis more than a decade ago. While China accounts for more than a third of global excess capacity, there is also significant overcapacity in South Korea, India, and elsewhere. With more additions planned overseas and a continued slow recovery in demand, the excess capacity problem is not projected to be resolved any time soon.

- Excess capacity means that steel production facilities have the capacity to produce much more steel than the market demands. High fixed costs, capital intensity, and the large scale of steelmaking encourages state-backed producers with excess capacity to maintain production in excess of domestic demand, and export the surplus at below-market rates.

- The glut of exports from global excess steel supply is targeted in particular at the U.S. market. U.S. steel imports increased from 28.5 million net tons in 2011 to 32.0 million net tons in 2013, an increase of 12.3 percent. According to Austral Wright Metals, imports have increased not only in absolute terms, but also relative to domestic production and consumption, seizing more of the U.S. market and thwarting the domestic industry’s efforts to recover from the Great Recession.

- U.S. steel imports surged even more sharply in the first two months of 2014, hitting 6.4 million net tons, an increase of 24.5 percent over the same period in 2013. Domestic shipments declined 0.9 percent over the same period. Consequently, the import share of the domestic market increased 4.5 percentage points in January–February 2014 (an increase of 18.5 percent over the same period in 2013).

- Evidence that imported steel prices are falling, and falling unfairly, can be found in the declining sales price of imports (now underselling comparable domestic products) and the rapid growth in the number of unfair trade complaints filed in the past year. The average unit value of imported steel declined $259 per ton (23.1 percent) between 2011 and January–February 2014. U.S. steel producers filed 40 antidumping and countervailing duty petitions in 2013 and the first two months of 2014, the largest volume of trade cases in steel since 2001.

Surging imports of unfairly traded steel are threatening U.S. steel production, which supports more than a half million U.S. jobs across every state of the nation. The import surge has depressed domestic steel production and revenues, leading to sharp declines in net income in the U.S. steel industry over the past two years (2012–2013), layoffs for thousands of workers, and reduced wages for many more.

Download full version (PDF): Surging Steel Imports Put up to Half a Million U.S. Jobs at Risk

About the Economic Policy Institute

www.epi.org

“The Economic Policy Institute (EPI) is a nonprofit, nonpartisan think tank created in 1986 to include the needs of low- and middle-income workers in economic policy discussions. EPI believes every working person deserves a good job with fair pay, affordable health care, and retirement security. To achieve this goal, EPI conducts research and analysis on the economic status of working America. EPI proposes public policies that protect and improve the economic conditions of low- and middle-income workers and assesses policies with respect to how they affect those workers.”

Tags: Economic Policy Institute, EPI, Manufacturing, Steel

RSS Feed

RSS Feed