US WATER ALLIANCE

UNC ENVIRONMENTAL FINANCE CENTER

Introduction

The water sector is at a crossroads. Most water systems in use today were built for communities that look different than the ones they now support. Population and demographic shifts, modern water quality threats, aging infrastructure, and related challenges are bearing down on water systems. Providing affordable, reliable, and high-quality water service is a difficult business. Consider a few salient facts:

- Water infrastructure is aging and failing. In 2017, the American Society of Civil Engineers gave the nation’s water infrastructure a “D” grade and the nation’s wastewater infrastructure a “D+.”

- Significant funding is needed. The American Water Works Association estimates drinking water systems need to invest $1.7 trillion in infrastructure over the next 40 years. The Environmental Protection Agency’s needs survey estimates the United States requires $271 billion for wastewater and stormwater needs over the next 20 years.

- Affordability is a growing concern. Water rates and fees are already rising and outpacing the Consumer Price Index. New investments contribute to growing concerns about water service affordability.

The water sector faces many barriers to addressing these challenges. One challenge is fragmentation. There are currently over 51,000 regulated community water systems owned and managed by thousands of entities ranging from large metropolitan cities to mobile home park owners. Furthermore, there are nearly 15,000 wastewater treatment plants, and over 1,000 stormwater utilities in America. By comparison, the United Kingdom only has 32 regulated water utilities and Australia only has 82 water suppliers. On average, each utility in Australia and the UK serves a much greater percent of the population than do systems in the United States.

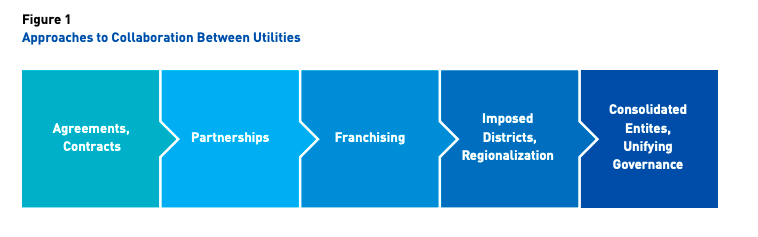

In this landscape, water utilities may struggle to maximize benefits from their investments, save costs by operating at scale, and tackle challenges efficiently. Luckily, there are many ways utilities can collaborate with one another to streamline and improve water service. Utility partnerships can take many forms—from informal collaboration agreements to merging the financial and governance functions of separate entities. For example, some utilities undertake joint contracting for services which can lower prices; others partner on projects like emergency planning; some may have franchise agreements in place to share water supply.

Consolidation is just one approach on this spectrum of options for how utilities can work together to provide high quality water service. Water utility consolidation occurs when two or more distinct legal entities become a single legal entity operating under the same governance, management, and financial functions. It may or may not include physically interconnecting assets. Consolidation also occurs at the regional level even when assets are spread out by merging the governance, management, and finance supporting geographically spread assets.

Consolidation is just one approach on this spectrum of options for how utilities can work together to provide high quality water service. Water utility consolidation occurs when two or more distinct legal entities become a single legal entity operating under the same governance, management, and financial functions. It may or may not include physically interconnecting assets. Consolidation also occurs at the regional level even when assets are spread out by merging the governance, management, and finance supporting geographically spread assets.

Current research and information on consolidation is less robust relative to other ways in which utilities engage in regional collaboration. Communities need access to facts, data, and information to support informed decision making. Towards that end, the US Water Alliance and the Environmental Finance Center at the University of North Carolina developed this report focused on the financial outcomes utilities have realized through consolidation. This report focuses on the impacts of different consolidation arrangements on customer rates, utility budgets, and debt. In some of the case studies, we also touch on economic implications, such as the broader costs and benefits to society beyond the utilities and customers involved.

Researchers at the UNC Environmental Finance Center identified and profiled a range of different consolidation models from across the country and studied the financial impacts resulting in each case. A team of graduate students from Duke University provided additional research including preparing a literature review that inventoried past research on consolidation.

With this report, the US Water Alliance and the Environmental Finance Center aspire to fill the gap in current research about the economic attributes associated with different consolidation models. We hope this research helps communities understand the opportunities, tradeoffs, and financial impacts of consolidation.

Part One: A Synthesis of Financial Impacts

Consolidation can be a tool to create fewer, more independent, high-capacity utilities—potentially benefiting ratepayers, local communities, and the broader water sector. However, communities need to weigh the benefits with the challenges of consolidating utilities. For example, consolidation can trigger a cascade of avoided future costs to a local utility, which can then be passed on to customers in the form of savings. But, in the near-term, some communities will face increased costs to address regulatory requirements and infrastructure investment backlogs. Communities need to look at financial factors over time and in local context. In some cases, utility consolidation may have more to do with improving service than reducing costs.

Financial Benefits

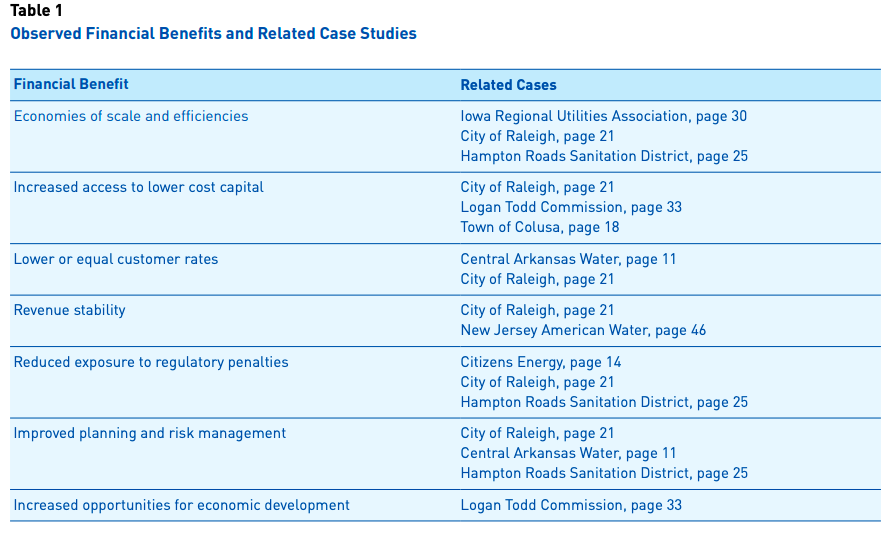

Communities contemplating whether to consolidate utilities need to consider a multitude of information. The most critical pieces are knowing what the value to the community would be and how long it could take to realize. Assessing, estimating, and quantifying benefits may be daunting, but doing so is essential to know whether benefits outweigh the costs and challenges. Benefits can be spread among customers, systems involved, and the broader economy. Potential financial benefits from water utility consolidation include:

- Economies of scale and operating efficiencies;

- Increased access to capital at a lower cost;

- Lower or equal customer rates for a specified level of service;

- Revenue stability;

- Reduced exposure to regulatory penalties;

- Improved planning and risk management; and

- Increased opportunities for economic development.

Economies of Scale and Operating Efficiencies

In rural and urban settings, consolidation often results in greater economies of scale. In other words, water, wastewater, and stormwater services involve dozens of separate business functions that can benefit from being spread over larger groups of customers.

Consider operating expenses. Reading 50 meters per month usually costs significantly more per meter than reading 50,000 meters. Maintaining a large network of assets rather than a smaller network of isolated assets can also be cost-effective. Similarly, the prices smaller systems pay for chemicals and services are often much higher than the price paid by their larger counterparts. Essential chemicals, such as chorine, are available in much lower unit costs when bought in bulk.

Staffing costs also benefit from economies of scale. Salaries for highly-trained managers have increased in tandem with the regulations and environmental challenges those managers are entrusted to handle. A skilled utility professional serving 500 customers may be equally able to serve a community with 5,000 customers. In this case, spreading the cost of a professional manager over more customers can reduce costs.

Increased Access to Capital at a Lower Cost

Water is a capital-intensive enterprise. There are high costs associated with investing in and maintaining the vast infrastructure that water utilities operate. Costs are climbing with the need to upgrade, retrofit, and make systems more resilient. Several case studies in this report show that consolidated utilities can access capital from investors at a lower cost. When utilities consolidate, they pool resources to serve larger customer bases. As a result, consolidated systems may receive better terms and interest rates on bonds and commercial loans from private capital markets to fund capital improvements.

Regional consolidation may also qualify systems for subsidized public funding options not available for non-regional efforts. These sources of funding vary by state but may include subsidized State Revolving Fund loans or state planning grants that can save communities money on principal costs and interest payments.

Lower or Equal Customer Rates for a Specified Level of Service

Once a water utility reduces or minimizes capital and operating costs, the level of funds needed from customers may change. In many situations, financial benefits from consolidating are tempered by rates needing to rise to address overdue issues and pay the near-term costs of consolidating. However, in less common situations, customers may see immediate or short-term rate reductions.

Rate parity across customer bases is typically a more common goal than rate reductions. Customers within a single geographic region served by multiple water service providers might pay different prices for the services they receive. Carefully structured consolidation can equalize rates among customers within a service area and slow future rate increases for all involved.

Revenue Stability

The water sector is experiencing major changes in its revenue business model.9 Utility consolidation can make systems less vulnerable to revenue shortfalls. Consolidated systems that tie together more diverse water users may be able to mitigate revenue fluctuations and spread the cost of filling shortfalls over a larger customer base when they do occur. Several case studies in this report demonstrate how systems can maintain revenue and fully optimize capacity through consolidation. This model works particularly well if systems consolidate when considering new investments. While consolidation may alleviate some revenue challenges, utilities should not view consolidation as a fail-safe way to protect communities from inherent risks like overoptimistic projections, large customer losses, or the cost of retrofitting and building systems resilient enough for future circumstances.

Reduced Exposure to Regulatory Penalties

Communities often consider consolidation because of regulatory pressure, placing more weight on avoiding unwanted penalties than on saving revenue. From treatment facilities to ailing collection systems, consolidation is increasingly becoming one of the main solutions for achieving cost effective regulatory compliance. Consolidating utilities can shift regulatory responsibility, streamline and reduce the cost of regulatory approvals, and, in some cases, provide immediate regulatory financial relief.

Improved Planning and Risk Management

Water service keeps local economies running, communities healthy, and the environment safe; that means the risks utilities plan for and manage carry significant costs. Consolidation has allowed many utilities to mitigate risk and benefit from integrated planning. A particular risk, like diminishing water supply, may even be the driver for why communities consider consolidation. The organizational and water resources planning processes under a consolidated utility can also lead to a more comprehensive, less piecemeal strategy than when spread across multiple systems or localities.

Increased Opportunities for Economic Development

Some financial savings are apparent on water utility budgets, rate sheets, and other financial documents. Other benefits may occur off the books in the broader community, despite being direct and visible outcomes from consolidating water utilities. For example, communities facing water shortages or lacking wastewater services can struggle to grow or develop their local economies. Businesses hesitate to locate in places where access to water supply or quality of water services are in question. Consolidation may give these communities the opportunity to address water supply or water infrastructure challenges that deter growth or lead to decline.

Key Considerations

Decision-makers weighing water utility consolidation can improve financial outcomes by anticipating roadblocks along the way. Some of the key financial considerations to consider include:

- Up-front costs;

- Real and perceived unequal distribution of benefits;

- Savings timeline;

- Different starting points; and

- Unequal or conflicting incentives.

Up-Front Costs

The initial financial consideration in utility consolidation is the high up-front investment needed to move through the consolidation process and establish the consolidated system. Planning, studies, and the staffing capacity to undertake this process can be expensive. In many cases, infrastructure improvements, new projects, or physical interconnections between infrastructure assets will also be needed.

Real and Perceived Unequal Distribution of Benefits

One challenge related to consolidating utilities is that the financial benefits cannot always be distributed equally. A region may experience aggregate benefits from a less fragmented approach to water management while individual communities or utilities may not experience any benefit. Some may even experience financial loss, and consolidation is especially difficult in these cases. Even though financial savings for the larger region can look promising, utility leaders typically make decisions with their individual utility or community in mind. Addressing inconsistencies among customers and systems can be challenging and may require compromise and commitment to solutions that ensure water services are affordable for all customers.

Savings Timeline

Communities and their utilities can find ways to smooth out or accelerate anticipated net savings or cost avoidance. Smoothing costs means reducing the burden of individual payments by spreading them out over a longer timeframe. Smoothing net savings means realizing savings in smaller increments over a longer timeframe, often with the goal of realizing some savings sooner. These can be important considerations when utility decisions are made by elected leaders whose term limits are shorter than the time it would take to realize savings. Often these officials hope to show ratepayers real savings or cost avoidance during their term in office. Models and financial instruments that can make savings accrue evenly over time or accelerate savings can encourage these leaders to support consolidation. Models with high upfront costs may be politically difficult for elected leaders to support, despite long-term savings. Restructuring existing debt to reduce costs can help in these cases.

Different Starting Points

Long-term thinking and analysis are also critical to improving the chances of consolidation taking place and realizing financial benefits for the community. Water utility and government leaders who come together to partner, regionalize, or consolidate often start the process from very different financial points. Partners that begin the process with very different rate schedules, asset values, savings, and liabilities need to put in effort, accounting prowess, and negotiating finesse to harmonize agreements.

Unequal or Conflicting Incentives

Communities are more likely to see a solution through if the incentives that need to be in place for consolidation to occur are present and clear. In some instances, a higher-capacity and financially-healthier utility may see few incentives to fully consolidate with a lower-capacity system and choose a less robust option as a result. When this happens, it can reduce incentives to consolidate in the future, leaving the additional benefits that opportunity could have provided unrealized. Identifying regional benefits from the outset can help communities with less incentive better understand why consolidation may be important for long-term sustainability.

Summary

Consolidation is an important tool for communities to consider but is not the right option in all cases. Water utilities and key stakeholders must assess their options carefully. Many positive financial and economic outcomes can accrue from utility consolidation, but communities must also consider and prepare for all the related challenges. Communities that have successfully consolidated utilities have several common characteristics: understanding the financial impacts; patience; long range planning; external incentives; and leadership.

Part Two: Financial Case Studies

Communities considering utility consolidation can learn from those who have already gone through the process. This section of the report provides eight case studies of communities that have consolidated or regionalized water service. Taken together, the case studies illustrate the diverse drivers, agreements, institutional arrangements, and outcomes associated with water utility consolidation.

These case studies are not comprehensive analyses of utility consolidation. Rather, they focus on the financial dynamics. There are many important and complex social, environmental, and political aspects involved in each case not addressed in this report. For example, while longterm rate savings for customers are discussed in the following case studies, the community response and experiences during the consolidation process are not covered. Though each case includes some information as background, the politics, governance decisions, and legal processes and agreements deserve further research and assessment. Nevertheless, these cases provide important information on key considerations and financial impacts. This is a necessary first step to build understanding about consolidation options and benefits.

Central Arkansas Water

Two municipal water departments consolidate to provide an affordable and reliable water source for the future.

Citizens Energy Group

Energy, water, and wastewater systems consolidate to streamline service and reduce rates.

City of Colusa

Small privately-owned water district consolidates with city to address contaminated drinking water supplies.

City of Raleigh Public Utilities Department

Seven local utilities merge into a full-service regional water and wastewater provider.

Hampton Roads Sanitation District

Regional wet weather program saves money, protects Chesapeake Bay.

Iowa Regional Utilities Association

Rural water systems consolidate to provide reliable, higher quality water supply.

Logan Todd Regional Water Commission

Twelve systems create treatment facility to provide a reliable regional water supply and drive economic development.

New Jersey American Water

Borough-owned water systems consolidate with statewide investor-owned utility to tackle needed, costly capital improvements.

Download full version (PDF): Strengthening Utilities Through Consolidation

About the US Water Alliance

uswateralliance.org/

The US Water Alliance advances policies and programs to secure a sustainable water future for all. Our membership includes water providers, public officials, business leaders, environmental organizations, community leaders, policy organizations, and more. A nationally recognized nonprofit organization, the US Water Alliance brings together diverse interests to identify and advance common ground, achievable solutions to our nation’s most pressing water challenges.

About the UNC Environmental Finance Center

efc.sog.unc.edu/

The Environmental Finance Center is dedicated to enhancing the ability of governments and other organizations to provide environmental programs and services in fair, effective, and financially sustainable ways. We reach local communities through the delivery of applied research, interactive training programs, and technical assistance.

Tags: consolidation, UNC Environmental Finance Center, US Water Alliance, Water utilities

RSS Feed

RSS Feed