CONGRESSIONAL BUDGET OFFICE

The Highway Trust Fund

The federal government’s surface transportation programs are financed mostly through the Highway Trust Fund, an accounting mechanism in the federal budget that comprises two separate accounts, one for highways and one for mass transit. Revenues credited to those accounts are derived mostly from excise taxes on gasoline and certain other motor fuels. The fund also is credited with interest on its accumulated balances.

Spending from the Highway Trust Fund is partly determined by authorization acts that provide budget authority for highway programs, mostly in the form of contract authority. How much of that contract authority can be used in a given year is governed by obligation limitations that are customarily set in annual appropriation acts. The Moving Ahead for Progress in the 21st Century (MAP-21, Public Law 112-141) is the most recent authorization for highway and transit programs. (It expires on September 30, 2014.) A total of about $51 billion in contract authority has been provided for fiscal year 2013, and the obligation limitations for this year amount to about $50 billion.

Most obligations for the highway and transit accounts involve capital projects that take several years to complete. (The Federal-Aid Highway program, for example, typically spends about 25 percent of its budgetary resources in the year funds are first made available for spending; the rest is spent over the next several years.) Most of the Highway Trust Fund’s current obligations will therefore be met using tax revenues that have not yet been collected because the existing obligations of the fund far exceed the amounts currently in the fund. For example, at the end of 2012, the total obligated amounts of contract authority in the highway account were equal to about two years of collections of excise taxes. That amount totaled about $67 billion at the end of 2012, and tax receipts dedicated to the highway account are projected to be about $33 billion a year over the next two years.

Projections of Outlays and Revenues

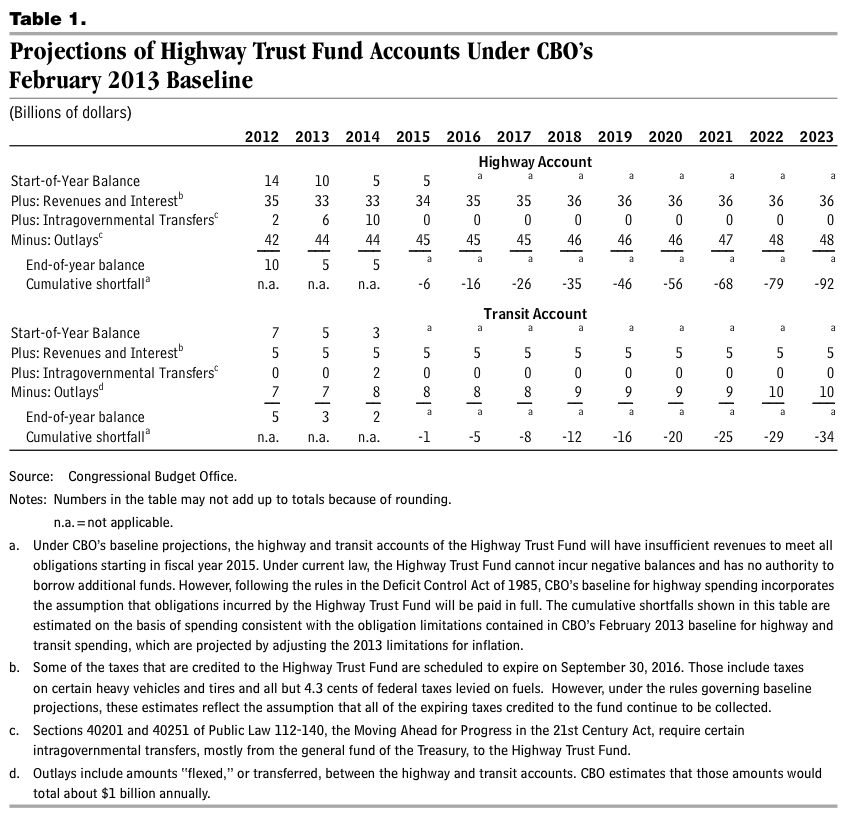

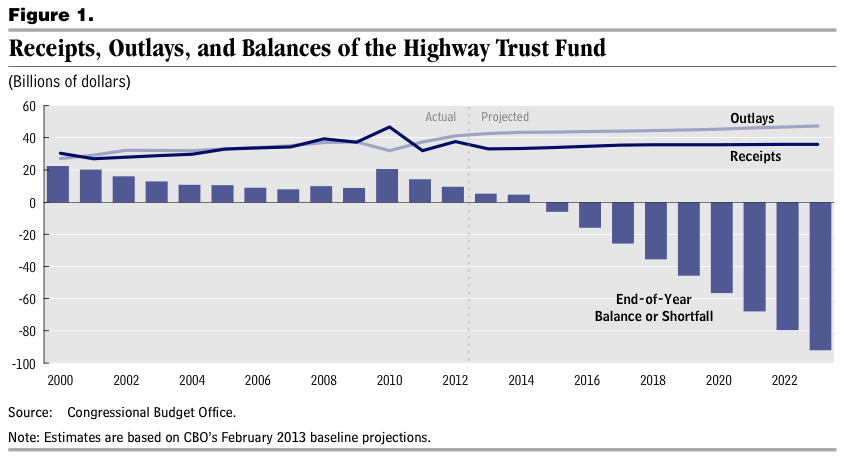

CBO estimates that the highway account will end fiscal year 2013 with a balance of $5 billion, compared with a $10 billion balance at the end of fiscal year 2012 (see Table 1 and Figure 1). By CBO’s estimates, outlays from the highway account will total $44 billion in 2013, while revenues and interest earnings will amount to only $33 billion for the year. To partly bridge that gap, MAP-21 transferred $6 billion of general funds to the highway account in 2013.

The transit account will end fiscal year 2013 with a balance of $3 billion, CBO estimates, down from $5 billion a year earlier (see Figure 2). Revenues and interest earnings are projected to amount to $5 billion in 2013, but outlays are expected to total $7 billion.

Assuming that obligations from the fund increase from year to year at the rate of inflation, CBO projects that both the highway account and the transit account will have insufficient revenues in 2015 to meet all obligations. Under that assumption, as well as an assumption (incorporated in CBO’s baseline projections) that taxes dedicated to the Highway Trust Fund are extended beyond their 2016 expiration date, the shortfall will grow steadily larger, as revenues from the excise taxes are expected to grow very little in coming years. Under those conditions, the cumulative shortfalls will total about $92 billion for the highway account and about $34 billion for the transit account by the end of 2023, CBO projects.

Read full report (PDF) here: Status of the Highway Trust Fund

About the Congressional Budget Office (CBO)

www.cbo.gov

“Since its founding in 1974, the Congressional Budget Office (CBO) has produced independent analyses of budgetary and economic issues to support the Congressional budget process. The agency is strictly nonpartisan and conducts objective, impartial analysis, which is evident in each of the dozens of reports and hundreds of cost estimates that its economists and policy analysts produce each year. All CBO employees are appointed solely on the basis of professional competence, without regard to political affiliation. CBO does not make policy recommendations, and each report and cost estimate discloses the agency’s assumptions and methodologies. All of CBO’s products apart from informal cost estimates for legislation being developed privately by Members of Congress or their staffs are available to the Congress and the public on CBO’s website.”

Tags: CBO, Congressional Budget Office

RSS Feed

RSS Feed