GREENBIZ GROUP

TRUCOST

Foreword

The global economy needs deep and liquid markets of all types of capital to run effectively. Natural capital, long overlooked in traditional financial accounting, is now recognized as a material economic input as businesses increasingly seek to manage volatile commodity prices linked to resource scarcity and extreme weather events. Important steps are now being taken to account for the natural resources that fuel economic growth, as well as the pollution that undermines it. We are pleased to partner with GreenBiz Group to bring natural capital metrics to the “State of Green Business” report.

The global economy needs deep and liquid markets of all types of capital to run effectively. Natural capital, long overlooked in traditional financial accounting, is now recognized as a material economic input as businesses increasingly seek to manage volatile commodity prices linked to resource scarcity and extreme weather events. Important steps are now being taken to account for the natural resources that fuel economic growth, as well as the pollution that undermines it. We are pleased to partner with GreenBiz Group to bring natural capital metrics to the “State of Green Business” report.

Trucost has been valuing natural capital and putting a price on resource use and pollution for more than a decade to help companies and investors address sustainability issues in board room business decisions. Trucost’s Environmental Register, the world’s most comprehensive database of natural capital metrics, provided the data insights for this year’s report, showing that companies became more environmentally efficient over the past five years. Simply put, businesses used fewer resources and polluted less to generate revenue. Notably, though, U.S. companies were found to lag their global peers, suggesting that without improved corporate efforts in North America to measure and manage the natural capital in their operations and supply chains, their global competitiveness may stall.

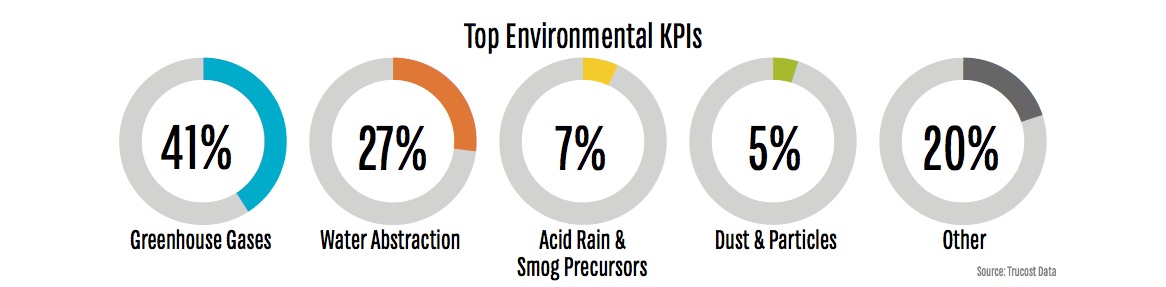

Although companies are developing ways to deliver goods and services more efficiently, their overall reliance on natural capital grew, with environmental costs rising by 8 percent to almost $352 million between 2007 and 2011. Companies have yet to decouple growth from environmental damage. This is mainly because of our global economy’s continued reliance on carbon-intensive fossil fuels, which meant that 42 percent of costs came from greenhouse gas emissions.

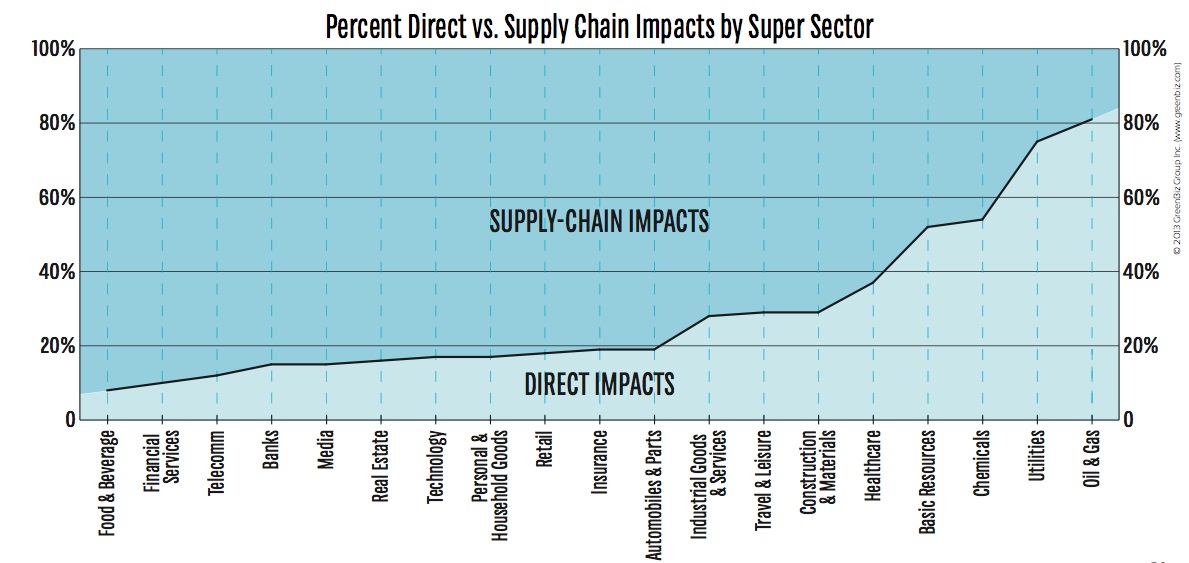

It’s clearly not just about greenhouse gases, though. Water is also material, as the repercussions of drought in the U.S. and elsewhere have shown, from shipping disruptions to rising crop prices. The majority of the S&P 500’s $84 million in water costs are embedded within global supplier webs, so any business aiming to be more resilient and avoid commodity price shocks will need to scrutinize supply chains and engage with strategic suppliers.

Most companies now disclose at least some environmental impacts, and a growing number are having third-party assurance completed on their quantified performance data to make their reporting more credible. Despite improvements by U.S. companies, their global peers are ahead on most Trucost indicators captured in this report, including disclosure. Investors now need to rout out the most material risks and opportunities, allocate financial capital effectively and start rewarding companies taking the initiative to measure and disclose natural capital.

Where there are risks, lie opportunities. The cost of protecting natural capital creates strategic opportunities for businesses that can optimize resource use, and deliver innovative products and services to help companies better align business success with environmental megatrends.

Many of the companies analyzed are already reaping the rewards of strengthening supply-chain resource management, from cost savings to innovation that leads to new revenue streams. The number of S&P 500 companies reporting on profits from environmental activities rocketed by 61 percent over five years. Their environmental R&D more than doubled, despite economic gloom. The best is yet to come.

The opportunity is ripe for forward-thinking leaders of multinational companies to take the lead in remaining competitive in a resource- constrained, volatile economy that has become the “new normal.” That journey begins by measuring and understanding reliance on natural capital and using that insight to cut costs, extract value, and unleash opportunity.

Download full report (PDF): State of Green Business 2013

About the GreenBiz Group

www.greenbiz.com

“GreenBiz Group provides clear, concise, accurate, and balanced information, resources, and learning opportunities to help companies of all sizes and sectors integrate environmental responsibility into their operations in a manner that supports profitable business practices.”

About Trucost

www.trucost.com

“Trucost has been helping companies, investors, governments, academics and thought leaders to understand the economic consequences of natural capital dependency for over 12 years.”

RSS Feed

RSS Feed