INDIANA UNIVERSITY

SCHOOL OF PUBLIC AND ENVIRONMENTAL AFFAIRS

By Jerome Dumortier, Fengxiu Zhang, and John Marron

Abstract

Taxes on gasoline and diesel are the primary sources of transportation funding at the state and federal level. Due to inflation and improved fuel efficiency, these taxes are increasingly inadequate to maintain the transportation system. In most states and at the federal level, the real fuel tax rates decrease because they are fixed at a cents-per-gallon amount rather than indexed to inflation. In this paper, we provide a forecast on state and federal tax revenue based on different fuel taxation policies such as indexing to inflation, imposing a sales tax on gasoline and diesel, or using a mileage fee on vehicles. We compare how those taxation policies perform compared to the policies states use currently under different macroeconomic conditions relating to the price of oil, economic growth, and vehicle miles traveled. The baselines projections indicate that between 2015 and 2040, fuel tax revenue will decrease 52.2%-54.9% in states that do not index taxes to inflation and 22.6%-22.9% that do currently index to inflation. Switching to a mileage fee increases revenue between 15.6%-26.9% in 2040 compared to 2015. Indexing fuel taxes to inflation in addition to imposing a states’ sales tax increases revenue significantly but suffers from a continuous decline in the long-run due to increased fuel efficiency. Our results indicate that although a mileage fee is politically and technologically difficult to achieve, it avoids a declining tax revenue in the long-run.

1 Introduction

Each state as well as the federal government taxes gasoline, diesel, and other fuels to finance the construction and maintenance of road infrastructure. Fuel taxes reflect an adoption of the benefit principle in the sense that consumers of the service pay for its provision based on their willingness to pay (Duncan and Graham, 2013). The fuel tax has the advantage that the implementation is relatively easy and that it is approximately proportional to the distance traveled (Forkenbrock, 2005). Nevertheless, it is widely agreed that the motor fuel tax in the United States does not cover all direct and indirect costs (Goldman and Wachs, 2003; Parry and Small, 2005; TRB, 2006; Delucchi, 2007). Direct costs include the wear and tear to pavement done by motor vehicle travel and indirect costs include externalities such as congestion, accidents, and air pollution (CBO, 2011a). Besides not covering all cost of road travel, the revenue derived from fuel taxes in real terms has been stagnant and in some cases declining over the last decade, due mainly to an increase in fuel economy and fuel tax rates that are not adjusted to inflation. The economics and public finance literature covers well the equity and efficiency implications of various approaches of taxing and financing road travel, but it has not yet quantified the evolution of road funding availability in the future. The purpose of this article is to fill this gap and assess the future federal and state revenue associated with various taxing and revenue-generating schemes.

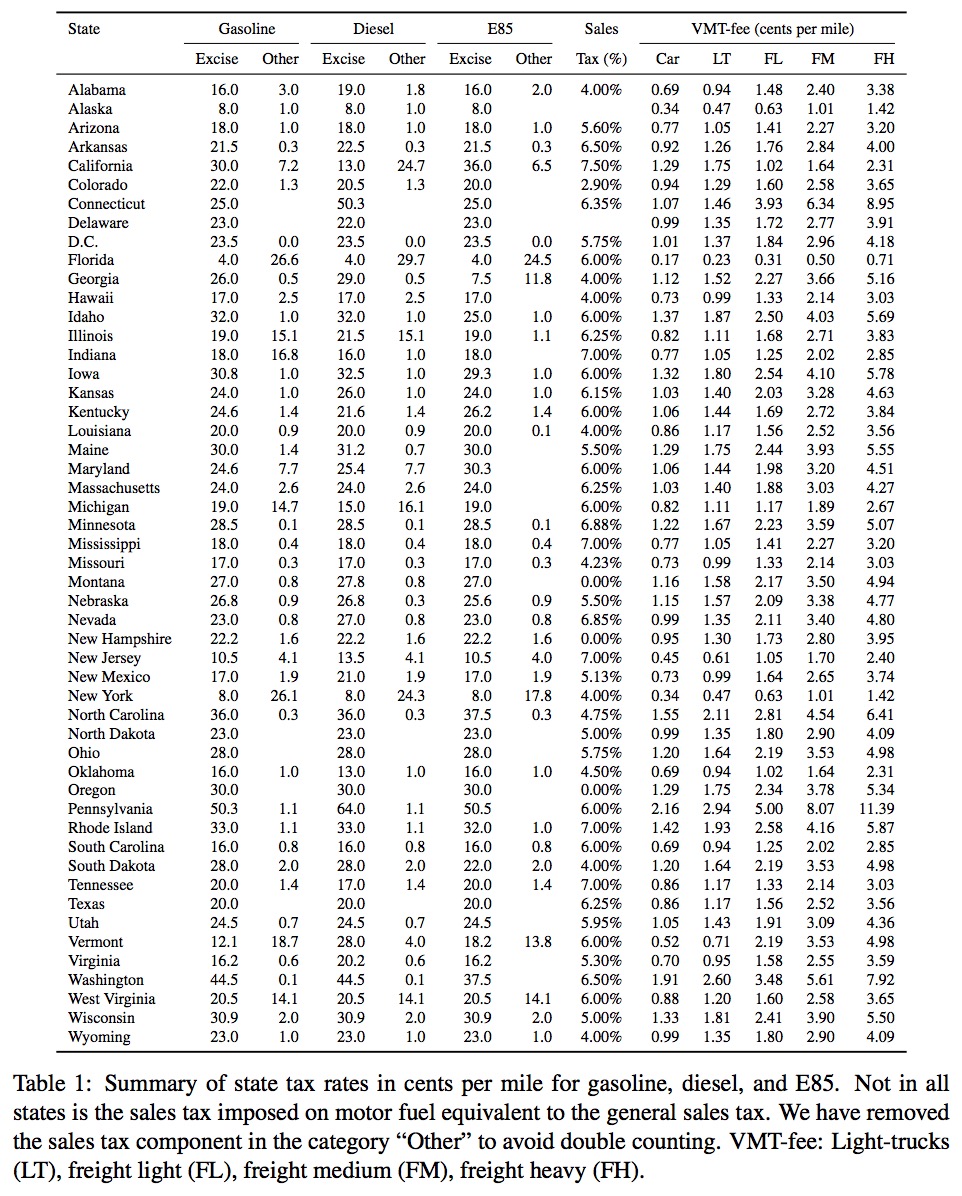

Fuel tax revenue is determined by the aggregate amount of gasoline and diesel purchased which in turn depends on multiple factors, including but not limited to fuel prices, tax rates, the number of vehicles, fuel economy, vehicle miles traveled per vehicle, and other factors. The current taxation structure and the fuel economy are the two main reasons for the stagnation of fuel tax rates in real terms (Greene, 2011; Gomez and Vassallo, 2013). First, the federal government as well as 35 states use a fixed cents-per-gallon tax. In 21 of those states, the last adjustment occurred before 2000 (FHWA, 2014). The non-adjustment of the cents-per-gallon tax leads to a decrease of the real fuel tax rate over time due to inflation. For example, the federal gasoline tax was set to $0.184 in 1997. As a result of the increase in the Consumer Price Index (CPI) since 1997, the purchasing power of the tax rate declined by 31% by 2012. In 15 states, revenue is supplemented by a sales tax imposed on motor fuel sales. For example, Indiana continues the collection of a fixed cents-per-gallon fuel taxes and supplements the tax by a sales taxes based on previous months’ fuel prices. Some states have chosen to use revenue from other taxes, mostly sales tax revenue, to cover shortfalls in transportation funding. This approach diminishes the resources available to support other stateprovided services and obligations. Other states have engaged in public-private partnerships and increased the use of tolling to generate more revenue. However, tolling systems are unlikely to be feasible as a funding approach; nor are toll fees likely to be equitable as this approach asks one segment of all transportation users (those using the toll roads) to finance a broader segment of the transportation system than from which they receive benefit.

Second, the increase in fuel efficiency is outpacing the increase in vehicle miles traveled (VMT). In 2012, the average fuel efficiency of the U.S. light-duty vehicle fleet was 23.3 and 17.1 miles per gallon (MPG) for short wheelbase and long wheelbase vehicles, respectively (U.S. DOT Bureau of Transportation Statistics, 2015). Newly sold passenger vehicles and light trucks have average fuel efficiencies of 36 and 25.3 MPG, respectively. Those values are expected to increase to 41.7 MPG by 2020 and to over 50 MPG by 2025 (EPA & NHTSA, 2012). In addition to increases in fuel efficiency and inflation-driven decreasing tax revenues, the stagnation of VMT has exacerbated the decline in fuel tax receipts. After a steady upward trajectory throughout most of the past decades, total VMT in the United States has remained relatively flat since 2007 (USPIRG, 2013; FHWA, 2014). This may reflect a temporary change in driving habits during the recent economic recession and rebound along with economic recovery in the future.

Projections by the U.S. Energy Information Administration (EIA) under various macroeconomic and driving scenarios indicate that, at least at the federal level, fuel tax revenue will continue to decline (EIA, 2014). Gasoline consumption will continue to decline in the future due to increasing fuel efficiency (Panel (a), Figure 2). Diesel consumption will increase due to an increasing number of freight trucks and stagnating fuel economy for heavy trucks (Panel (b), Figure 2). Despite the increase in diesel consumption and vehicle miles traveled (Panels (c), Figure 2), federal revenue from gasoline and diesel taxes will decline from $33.1 billion in 2012 to $16.5 billion in 2040 in the baseline case (Panels (d), Figure 2). This decline in federal revenue is based on the assumption of fuel tax rates not being adjusted to inflation. The revenue shortfall, in the absence of any policy adjustment, is expected to reach roughly $68 and $133 billion per year at the federal and state level, respectively (NSTIFC, 2009). In the very long-run, if the current vehicle fleet is replaced with an increasing number of highly fuel efficient or alternative fuel vehicles, e.g., plug-in hybrid or battery electric vehicles, the revenue from motor fuel taxes will decline further (Forkenbrock, 2005; McMullen et al., 2010). However, previous research has shown that this is not a significant issue in the time horizon considered in this analysis (Dumortier et al., 2015).

Through our analysis, we seek to project the state and federal revenue that is made available from vehicle travel under various tax policy, macroeconomic, and driving habit scenarios. The results can inform policy makers about the revenue that is potentially available for road and infrastructure funding. For this purpose, we develop a stylized simulation model based on projections from the 2014 EIA Annual Energy Outlook that covers the period from 2015 to 2040. The EIA cases vary by the macroeconomic framework, including projected economic growth and oil prices, as well as driving behavior in terms of vehicle miles traveled. Our model will impose different taxing schemes, such as a VMT fee, fuel tax indexation to inflation, on the EIA cases and compare those scenarios to the baseline. Using the EIA scenarios has the advantage that significant modeling has already been incorporated into the National Energy Modeling System (NEMS), thereby increasing the stability of the projections. We will look at three different tax policies for states and the federal government: (1) Indexing gasoline and diesel taxes to inflation, (2) applying state sales taxes to fuel prices in addition to the excise tax, and (3) implementing a VMT fee. We compare those tax policies with the current taxing schemes and assess under which circumstances a particular tax outperforms in terms of revenue generation. We find that the fuel tax revenue will decline by over 50% between 2015 and 2040 in states that do not adjust fuel taxes to inflation. The decrease will be smaller, i.e., around 22%, in states that currently adopt inflation-adjusted fuel taxes. This indicates that the fuel tax revenue shortfall is not solved by indexing taxes to inflation. Charging a VMT fee increases the tax revenue by 15.6%-26.9% by 2040 compared to the baseline. Imposing a sales tax in addition to the excise tax increases the revenue significantly at the beginning of the projection period but is reduces steadily over time due to improvements in the fuel efficiency. This paper contributes to the literature by informing policy makers, researchers, and other stakeholders about the future evolution of fuel tax revenue and the potential revenue impact under various taxing schemes and macroeconomic conditions.

About the Indiana University School of Public and Environmental Affairs

spea.indiana.edu

The School of Public and Environmental Affairs is a nationally ranked academic institution located on the campus of Indiana University and home to a Masters of Public Affairs program that’s ranked number one in the nation.

Tags: Fuel Tax, Gas tax, Indiana University, IU, School of Public and Environmental Affairs, SPEA, VMT Tax

RSS Feed

RSS Feed