RESEARCH AND INNOVATIVE TECHNOLOGY ADMINISTRATION

BUREAU OF TRANSPORTATION STATISTICS

INTRODUCTION

To move large quantities of goods across the country and around the world, Americans depend on the Nation’s freight transportation system—a vast network of roads, bridges, rail tracks, airports, seaports, navigable waterways, pipelines, and equipment. Today, U.S. households can buy fresh fruits and vegetables in mid-winter, expect fast and reliable next-day deliveries of Internet purchases, and use electronic appliances manufactured thousands of miles away, often in other countries. Because economic activities worldwide have become more integrated and globalized, more goods produced by U.S. factories and farms are bound for export, and imports originate from more than 200 countries. This pace of trade Americans have become accustomed to is made possible by the complex intermodal transportation network that blankets the country and links the United States with world markets.

The movement of international freight among nations relies on a complex array of long-distance transportation services. The process involves many participants, including shippers, commercial for-hire carriers, third-party logistics providers, and consignees. Moreover, global trade depends on seaport and airport services to move large volumes of merchandise over long distances via a variety of transportation modes. The interaction of these services and participants is vital to successful global trade.

In 2008, U.S. carriers received $22 billion for commercial freight services provided to businesses in other countries. U.S. seaports and airports received $36 billion for port services. U.S. firms paid $45 billion to foreign carriers for freight services and $27 billion to foreign ports for port services (USDOC BEA 2009).

ABOUT THIS REPORT

This report provides a snapshot of freight transportation activity from a global perspective, highlighting physical characteristics and industry output for the U.S. and other leading world economies. The report gives a broad overview of trends in the movement of international freight among the top 25 world economies, measured by 2008 gross domestic product (GDP). It presents recent statistics on freight activity by leading global ocean and air carriers, seaports, and airports engaged in international freight services.

The report also presents an overview of major trends in U.S. international goods trade, as well as trends in U.S. freight and port services. It further examines how U.S. international freight activities compare with those of the world’s top economies. The report concludes with a brief discussion of the key factors that are driving change in U.S. and global merchandise trade and freight activities.

OVERVIEW

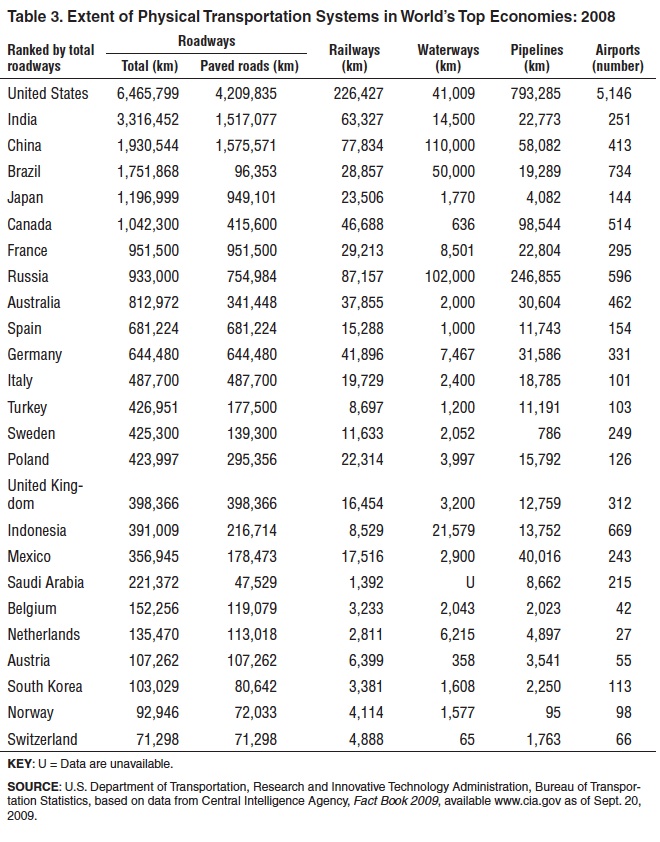

The United States has the largest freight transportation system in the world, an extensive physical network of infrastructure and entities that provide transportation services:

• 4 million miles of public roads,

• 140,000 miles of railroad tracks operated by freight carriers,

• 25,000 miles of navigable waterways,

• 9,800 coastal and inland waterway facilities, and

• 5,200 public-use airports (USDOT RITA BTS 2009a).

The U.S. transportation network serves more than 300 million people and 7.5 million business establishments across 3.8 million square miles of land. Moving raw materials and finished goods between production and consumption centers, this freight network is a vital component of commerce in the United States.

The United States is the world’s largest economy and leading importing nation, accounting for 23 percent of world GDP and 13 percent of the value of world merchandise imports in 2008. Before 2002, the United States was the world’s largest merchandise exporter. Germany became the leading exporting nation that year, and China moved to the top position in 2008.

Despite recent setbacks caused by the 2008 U.S. and global economic downturn, the movement of freight globally shows a long-term upward trend. From 1998 to 2008, world merchandise freight exports nearly tripled in value from $5.4 trillion to $16 trillion. During this period, U.S. freight exports doubled from $682 billion to $1.3 trillion (USDOC CB FTD 2009). The rising trend in world exports indicates the strong interconnectedness among countries and the increased globalization of economic activities that generate freight movements.

While virtually all countries export goods and the United States receives exports from more than 200 countries, the overwhelming majority of global exports are concentrated in only a few countries. In 2008, the concentration of world exports among the top trading nations was significant:

• more than half (51 percent) of the exports were from 10 countries,

• three-quarters (76 percent) were from 25 countries, and

• about 91 percent were from the top 50 countries.

OVERALL TRENDS

Freight is generated by economic activity and the freight industry tends to respond to fluctuations in this activity and the resultant level of trade among nations. The 2008 global economic downturn caused by the collapse of major financial markets resulted in declines in U.S. merchandise trade with partners around the world. From mid-2008 to early 2009, as the U.S. and global economies struggled, world trade sagged and the movement of international goods by service providers slowed. By the second quarter of 2009, demand for U.S. and global freight shipments had plummeted. Financial liquidity problems and fl uctuations in energy prices affected all modes of freight transportation and all sectors of the freight industry.

Before 2008, the global freight industry’s primary challenge was growth in merchandise trade and the freight flows that strained system capacity. In 2009, declines in freight flows transformed the major challenge into the management of excess capacity. Shippers, carriers, and facility operators in the United States and around the world were forced to contract their freight operations in response to reduced trade volumes. By the end of September 2009, an estimated 548 container vessels with a carrying capacity of 1.3 million 20-foot equivalent units (TEUs) were idled at seaports worldwide as a result of the decline in global demand for containership services (AXS-Alphaliner 2009a).

The slowdown in economic activity in the United States and globally in 2008 and the subsequent reduction in U.S. consumer demand also affected international air cargo traffic and capacity. Global international air cargo, measured in freight ton-kilometers, fell 23 percent from 2007 (IATA 2009a).3 During the second half of 2008, air carriers around the world struggled with excess capacity and lower revenues. In particular, carriers were negatively affected by global reductions in oil prices. In principle, declining oil prices should have resulted in lower fuel costs for the airlines, but fuel-hedging contracts taken out at the start of the year when prices were much higher resulted in unexpected fi nancial losses (IATA 2009a).4 By mid-2009, overall demand for air cargo and maritime freight had slowed because of weak economic activity and distressed financial markets.

Download full version (PDF): Freight Transportation

About the Bureau of Transportation Statistics

www.bts.gov

“The BTS mission is to create, manage, and share transportation statistical knowledge with public and private transportation communities and the Nation. The main purpose of BTS’ work is to help advance the DOT Strategic Plan (2006-2011). But we also aim to anticipate future needs and policy issues. Our challenge is to develop data and analyses that are relevant, high quality, timely, comparable, complete, and accessible-our strategic goals for transportation statistics.”

Tags: BTA, Bureau of Transportation Statistics, Department of Transportation, DOT, Freight, Research and Innovative Technology Administration, RITA, Schack Institute of Real Estate

RSS Feed

RSS Feed