DOUBLE BOTTOM LINE VENTURE CAPITAL (DBL INVESTORS)

Executive Summary

Has increased reliance on renewable energy in the United States meant expensive electricity in the United States? This question has pervaded debates on renewables and fossil fuels, and this paper sheds light on this critical issue, including a look at the top and bottom 10 renewable states. Determination of the top 10 and bottom 10 states here is based on share of total electricity generated from all renewable sources. The top 10, therefore, includes states like South Dakota, which has significant wind generation, as well as states like California, which has significant solar generation. It reveals that states with the greatest share of electricity generation from renewable sources have often experienced average retail electricity prices that are cheaper than both the national average and also states with the smallest share of electricity generation from renewable sources.

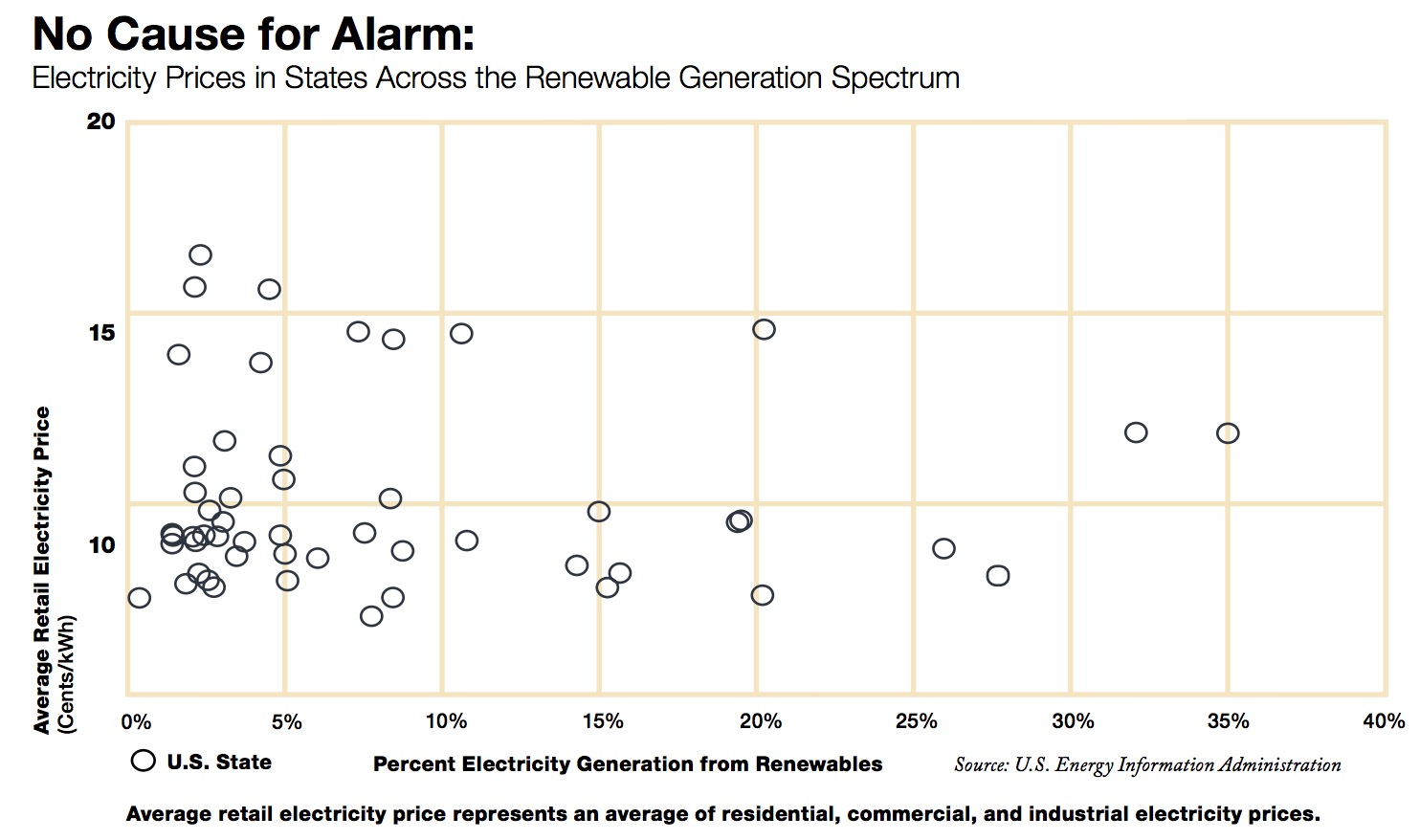

In 2013, U.S. states generated electricity from renewable sources at a variety of different levels. And yet, as the graph below demonstrates, greater generation from renewables did not mean skyrocketing electricity prices. In fact, states generating more electricity from renewables often experienced average retail electricity prices well below states producing less electricity from renewables.

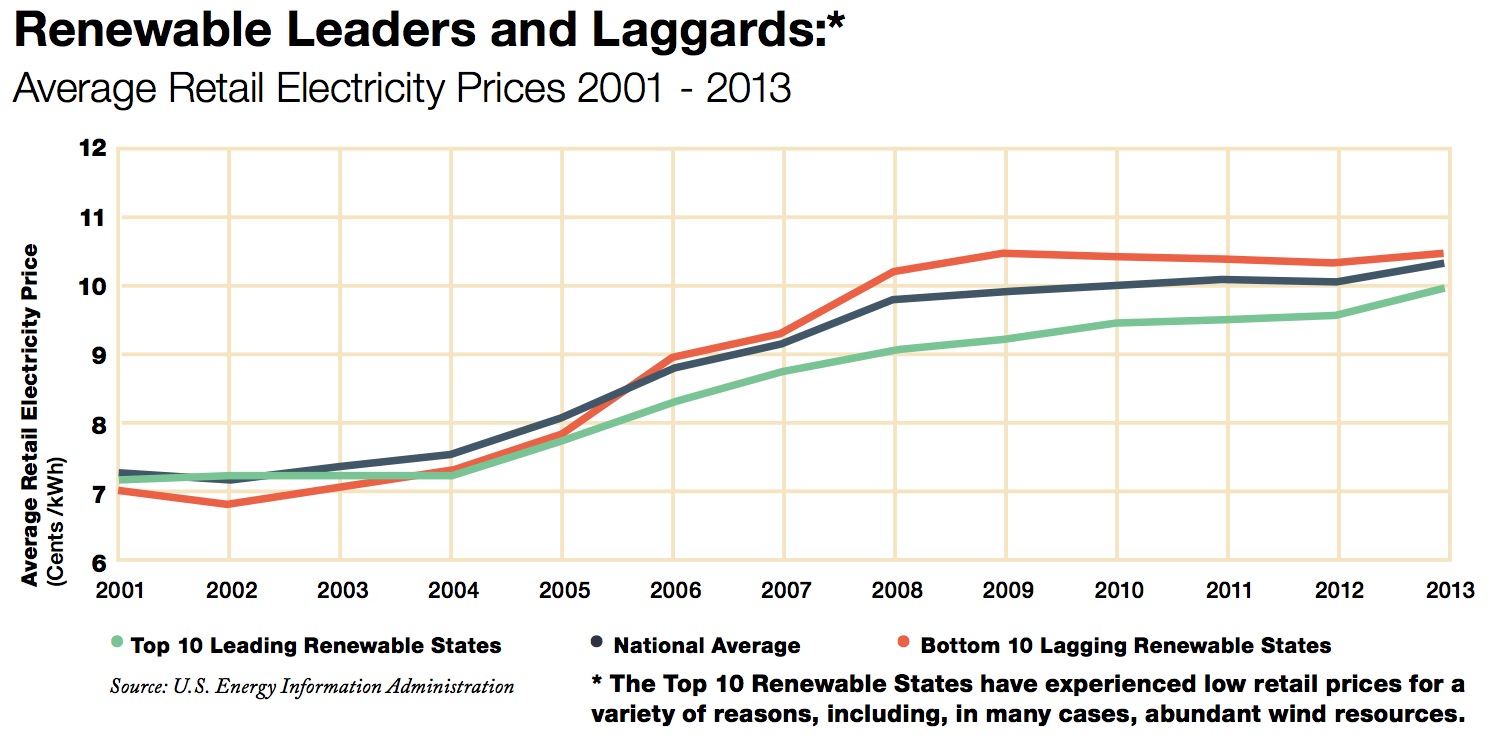

A similar trend has emerged over time. In 2001, in the ten states with the greatest share of electricity from renewable sources, retail electricity prices, on average, were slightly more expensive than in the ten states with the smallest share of electricity from renewable sources. However, by 2013, these states had switched places: the ten states relying most on renewables experienced average retail electricity prices slightly cheaper than the ten states relying least on renewables. The graph on the following page depicts this trend. In addition, electricity prices in leading renewable states also fared better in terms of rates of change. Between 2002 and 2013, the average annual rate of change in retail electricity prices was less in states that led on renewables, as depicted in the second chart below.

This analysis draws no direct correlation or causation between renewable generation and average retail electricity prices, yet it indicates that states leading on renewables have not experienced disproportionate electricity price growth, as some critics have implied.

Looking forward, the electricity market remains ripe for fundamental change. Key economic drivers of this change include the falling cost of renewables, mounting economic benefits from clean energy, and growing uncertainty for carbon-based fuels.

Download full version (PDF): Renewables Are Driving Up Energy Prices–Wait, What?

About Double Bottom Line Venture Capital

www.dblinvestors.com

DBL Investors uses venture capital to accelerate innovation in a way that positively affects an organization’s social impact as well as its financial success. In fact, we believe the two–positive social change and a healthy financial performance–are inherently connected. DBL invests in and helps nurture outstanding entrepreneurs and companies in Cleantech, Information Technology, Health Care, and Sustainable Products and Services.

Tags: DBL, DBL Investors, DOUBLE BOTTOM LINE VENTURE CAPITAL, Renewables, Solar Energy, Wind Energy

RSS Feed

RSS Feed