TRANSPORTATION RESEARCH BOARD

1. Introduction

Study Motivation and Research Questions

In recent years, the real value of fuel tax revenues has declined significantly as a result of increasing vehicle fuel efficiency, failure to adjust tax rates to keep up with inflation, and fewer miles driven. This decline in the purchasing power of the revenues collected has led to ongoing funding challenges for transportation infrastructure and increased uncertainty about future funding options. The long term sustainability of motor fuel taxes has come into question, in view of increasing fuel efficiency and possible shifts to alternative fuel vehicles. Interest has grown in the potential of replacing the current fuel tax — assessed at the federal level and in many states as a flat fee per gallon — with new road usage charge assessed on all miles traveled. This method is often referred to as a mileage-based user fee (MBUF), road usage charge (RUC), vehicle miles traveled (VMT) fee, or per-mile tax.

As of 2015, many states are exploring MBUFs as a possible revenue source. Twenty-six states have taken some proactive measure along these lines, whether starting a small-scale program (Oregon), designing a pilot (California), conducting a study, and/or joining the Western RoadUsage Charge Consortium or Mileage-Based User Fee Alliance (Sloane 2015).

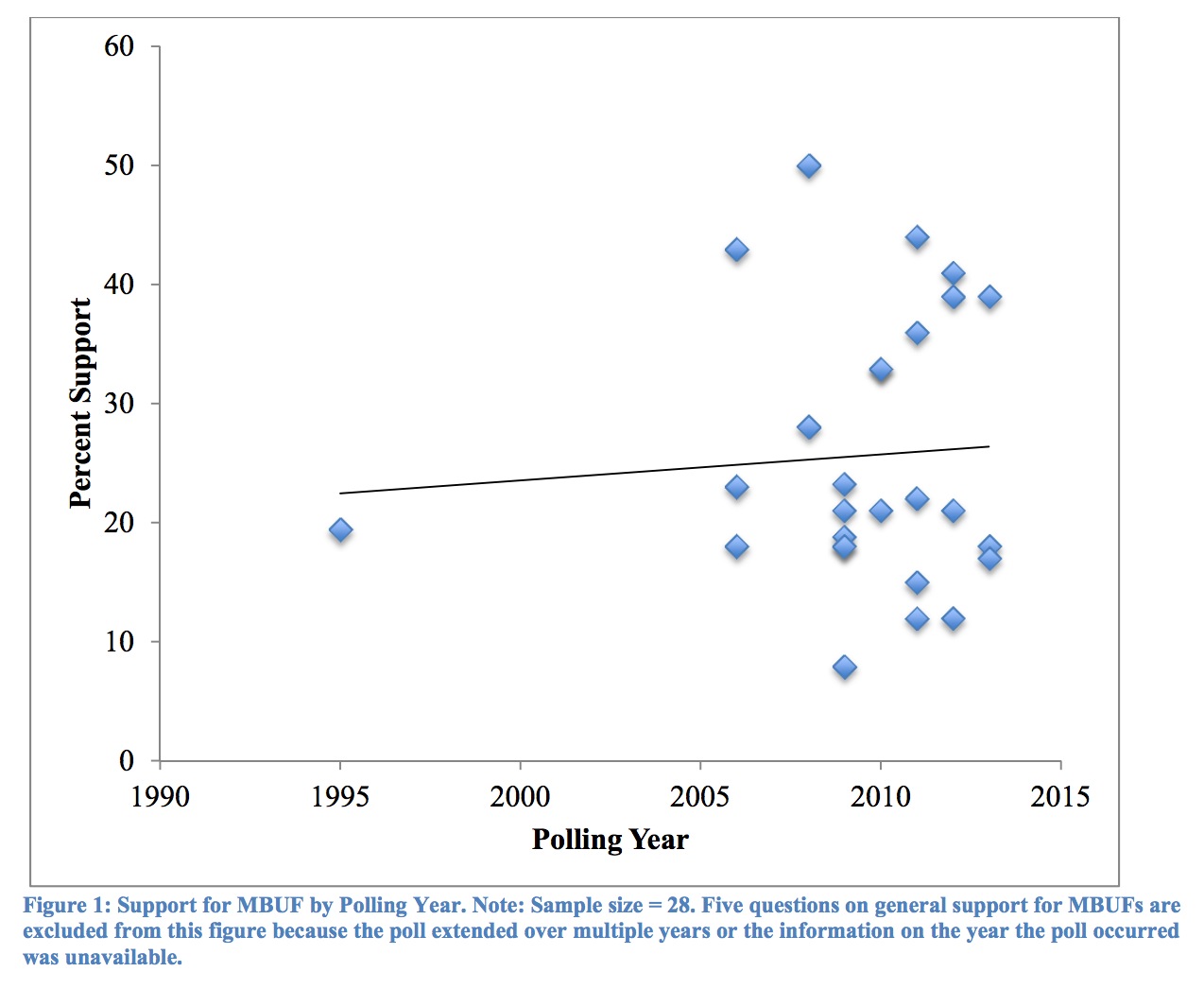

Public agencies and academic organizations have produced a small but growing body of public opinion research about MBUFs, reflecting the growing state interest in this promising new revenue source. Several pilot demonstrations at the state and local level of MBUF initiatives have included surveys or other assessments of public acceptability and concerns, including changing opinions by pilot participants. In addition, academic researchers and public interest groups have conducted public opinion research on the subject. However, a synthesis study was critically needed because the information on public opinion of MBUFs is scattered and time-consuming to find, and there was not yet any detailed and comprehensive assessment of the full body of research. In particular, understanding how opinions have varied or not according to demographic and other characteristics across multiple surveys was needed.

To help fill the gaps in knowledge about public opinion of MBUFs, this synthesis study was designed to address the following research questions:

- 1. What research has been conducted identifying U.S. public opinion research on MBUFs, including surveys and focus groups?

- 2. What is public opinion about mileage fees?

- 3. How does public opinion vary according to such factors as geography, respondent demographics, time, and common themes, trends, and factors that influence public acceptance or rejection?

- 4. What additional research is needed to address gaps in current understanding of public opinion of MBUF?

This report is intended to be useful for transportation policymakers and planners who are seriously considering the implications of potential future major changes in transportation user fees, given the need to establish sustainable transportation funding programs. This synthesis is also intended to be helpful in developing technological and institutional strategies to appropriately deal with public concerns about a future transition from fuel taxes to MBUFs.

Download full version (PDF): Public Perception of Mileage-Based User Fees

About the Transportation Research Board

www.trb.org

About the Transportation Research Board www.trb.org The mission of the Transportation Research Board is to provide leadership in transportation innovation and progress through research and information exchange, conducted within a setting that is objective, interdisciplinary, and multimodal.

Tags: Gas tax, MBUF, National Academies, Transportation Research Board, TRB, TRB of NA

RSS Feed

RSS Feed