CERES

Executive Summary

In April 2012, Ceres published Practicing Risk-Aware Electricity Regulation: What Every State Regulator Needs to Know. That paper examines wide-ranging challenges facing the U.S. electric utility industry—such as aging power plant fleets, evolving energy technologies and environmental regulatory pressures. It also includes recommended steps that utility regulators can take to minimize risks and costs for utilities, customers, shareholders and society as future investments are being considered. Two years later, this 2014 Update looks at key trends that continue to reshape the U.S. electricity industry, analyzes changing costs and risk profiles of energy resources (especially renewable energy), and offers further insights and recommendations for smart, “risk-aware” decision-making by utility regulators.

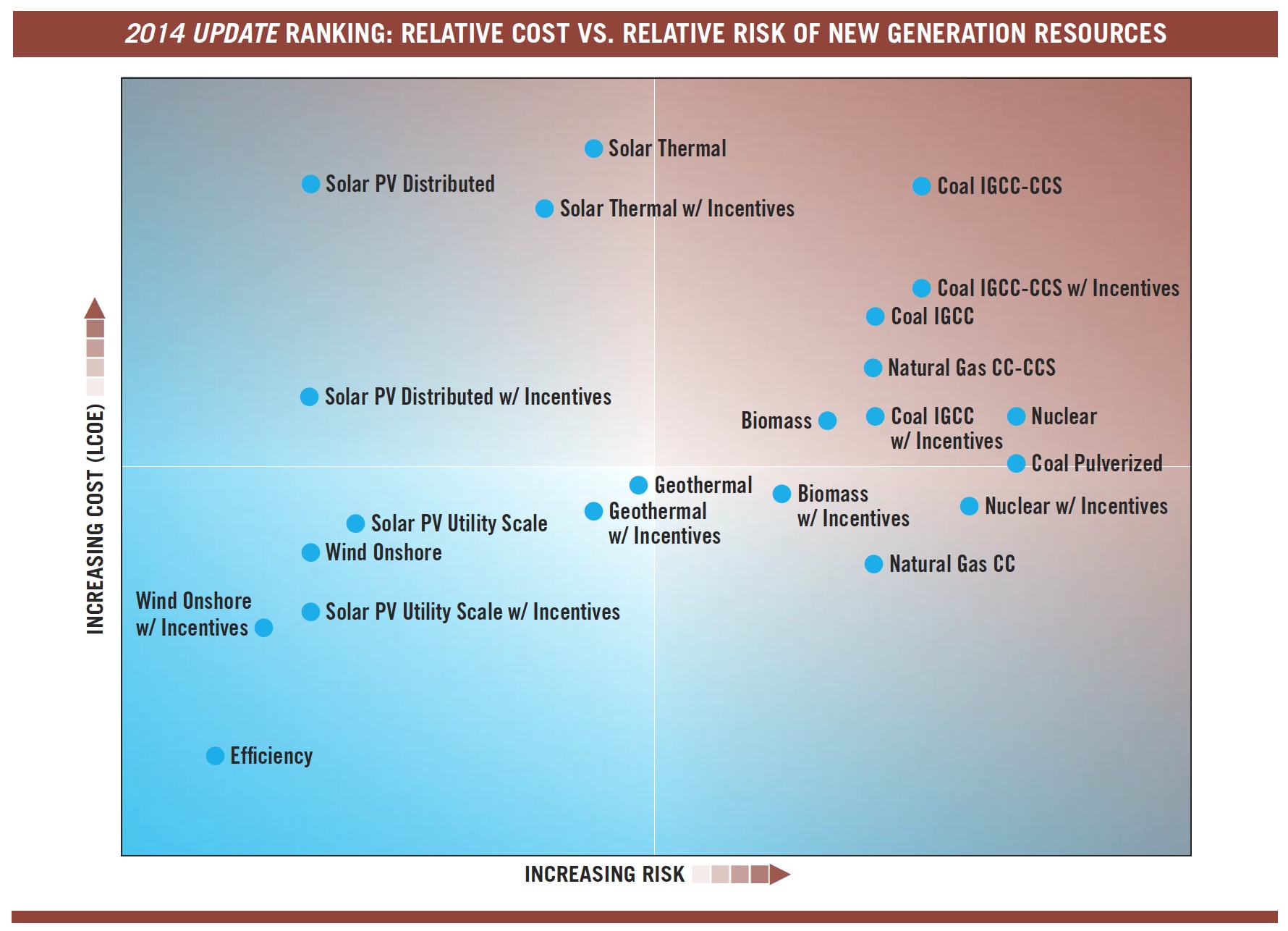

This report, authored by utility industry and finance experts, concludes that almost without exception the riskiest investments for utilities—the ones that could cause the most financial harm for utilities, ratepayers and investors—are large base load fossil fuel and nuclear plants. In contrast, energy efficiency, distributed energy and renewable energy (whose costs, in some cases, have come down dramatically since 2012) are seen as more attractive investments that have lower risks and costs. Among the paper’s findings:

Key Developments in the U.S. Electricity Sector Since 2012

1. The EPA has begun regulating carbon dioxide emissions from electricity generation as a pollutant. Assuming the EPA’s regulations for new and existing power plants survive judicial review, utilities will place a much higher emphasis on low-carbon or no-carbon resources.

2. Hurricane sandy and an armed attack on the power grid near san Jose, CA highlighted the need for greater grid resilience and security. These events in 2012 and 2013 make clear that the landscape for “risk-aware” regulators extends far beyond considering risks in energy supply portfolios to include safeguarding the entire electric grid.

3. Renewable energy technology costs have fallen sharply, closing the cost gap between renewable resources and traditional fossil fuel resources. Solar photovoltaic (PV) energy costs, in particular, have declined precipitously in recent years (Figure ES-1). Wind and solar costs are expected to continue to fall through at least 2020, a characteristic not shared by other generation technologies.

4. Potential “disruptive challenges” to utilities are now more evident than ever. Cheaper renewable energy options and projections for anemic electricity demand growth are just two of the trends that are intensifying pressure on electric utilities and catalyzing an industry-wide conversation about the changing role of utilities in the 21st century. Put simply, utility business models are shifting from a simple “cost of service” approach to one that expands utility service offerings and capabilities in light of carbon reduction, grid resilience and customer engagement imperatives. This transformation is already happening to a degree and in a timeframe that seemed unthinkable just a few years ago.

5. Cheap natural gas and increasing renewables penetration are changing the topology of the electricity grid, accentuating the need for more flexible energy resources. In some areas, high penetration of solar and wind resources may soon replace the afternoon demand peak with an afternoon demand trough, challenging system grid operators to adopt new grid management techniques, increase demand response and boost energy storage. Kauai, Hawaii expects to wrestle with this phenomenon as early as 2015, five years sooner than California (Figure ES-2).

6. the pace of innovation in utility regulation is accelerating. Massachusetts, New York and Hawaii, most notably, have instituted proceedings to pursue the market and regulatory structures needed to build a cleaner, smarter, more decentralized 21st century electric grid.

Download full version (PDF): Practicing Risk-Aware Electricity Generation, 2014 Update

About Ceres

www.ceres.org

“Ceres (pronounced “series”) is a national network of investors, environmental organizations and other public interest groups working with companies and investors to address sustainability challenges such as global climate change.”

Tags: Ceres, Energy efficiency

RSS Feed

RSS Feed