NATIONAL LEAGUE OF CITIES

Executive Summary

Our nation’s infrastructure is in deplorable condition, with a growing backlog of projects made worse by a slow economic recovery

Declining funding, increasing mandates and misaligned priorities at the federal and state levels have placed responsibility squarely on local governments to maintain roads, upgrade water and wastewater systems and accommodate growing transit ridership. This represents a new federalism in which cities are taking the lead on issues historically driven by federal and state governments. Undermining this new dynamic, however, is insufficient funding authority at the local level. The ability of cities to meaningfully address growing infrastructure challenges is bound by levers authorized to them by states.

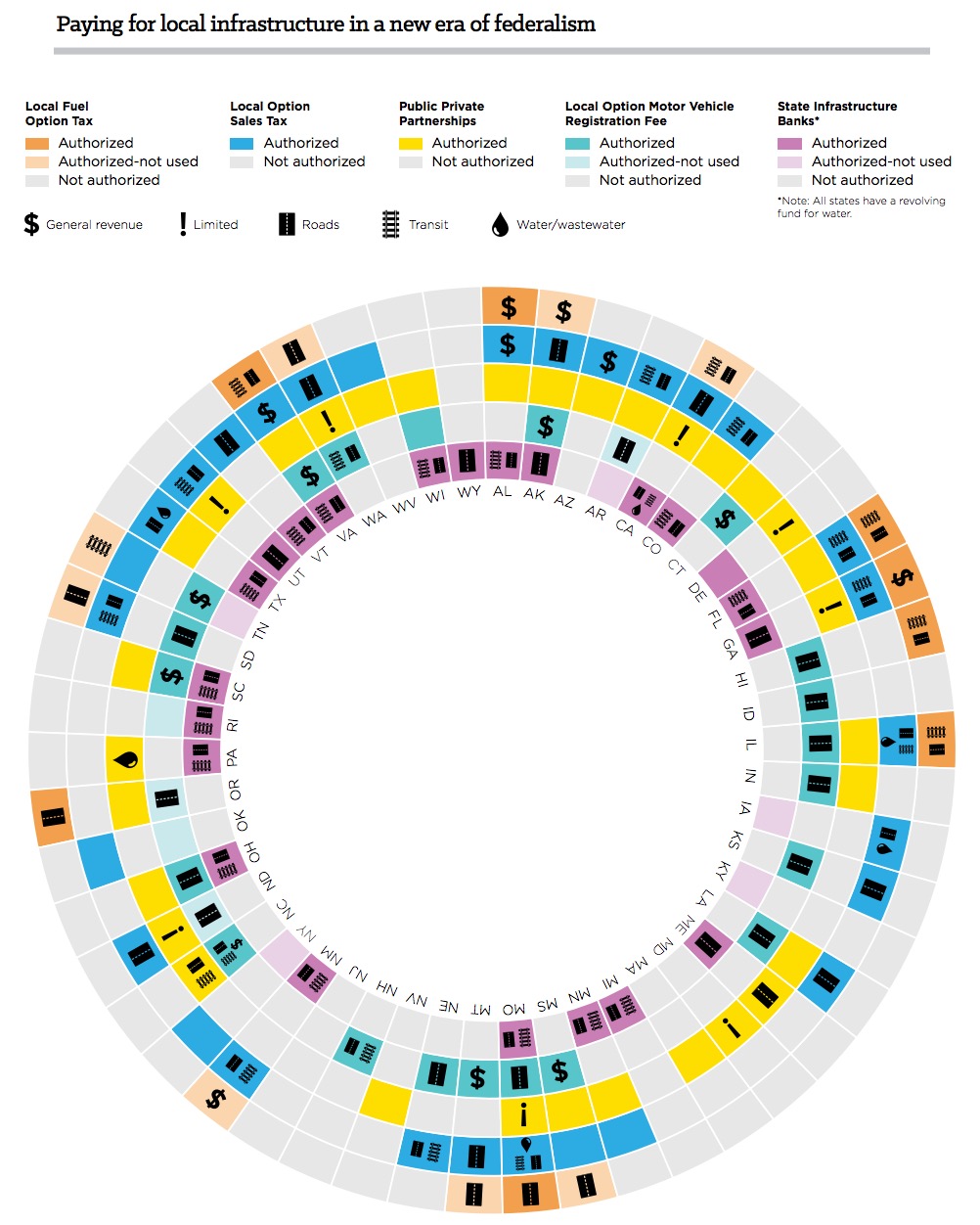

This report presents a state-by-state analysis and comparison of the local tools to fund infrastructure, including local option taxes and fees, such as sales taxes, fuel taxes and motor vehicle fees, as well as emerging mechanisms like state infrastructure banks and public-private partnerships.

Most cities are limited in terms of the number and scope of infrastructure funding tools. Cities also face additional implementation hurdles like county administration overlays and voter approval requirements. Of course, cities are marrying the tools explored here with others, but a patchwork of tactics will only take them so far. Cities need a more deliberate approach that recognizes the central role of infrastructure in the success of our nation’s economic engines.

The report is based on state, federal and local government data as well as a survey and interviews with our state municipal league partners. We find that:

Introduction

A new federalism – one in which cities lead the nation’s most critical challenges – is emerging and can be seen prominently in the funding and managing of our infrastructure systems.

States and local governments own the vast majority of the nation’s roads, highways, transit systems, drinking water and wastewater systems. With significant decline in federal investment, and less predictable funding from states, local governments have assumed an even greater proportion of fiscal responsibility. Unfortunately, this devolution has not been sufficiently matched with funding or decision making authority at the local level. As a result, spending on infrastructure maintenance and new investments are the most widespread fiscal stressors for city governments.

At the federal level, the primary funding source for infrastructure is imperiled. The federal fuel tax, which supports the Highway Trust Fund, has not been raised since 1993. Meanwhile, reductions in per capita vehicle miles traveled, coupled with increased fuel efficiency standards, have resulted in net revenue losses for the Fund. If current spending and revenue projections are accurate, the Fund will amass a deficit of $180 billion over the next decade. The outlook is not much brighter for water infrastructure, where federal grants and loans to cities are dwindling in the face of growing need.

At the state level, declining gas tax revenues have made state programs and funding to cities increasingly unreliable. In Michigan, the state has moved away from user fees as the sole dedicated source of revenue for infrastructure, placing a $600 million dollar burden on the General Fund to fund infrastructure. This will very likely lead to cuts in other areas of the budget that could negatively affect cities. Other states are diverting dedicated gas tax revenue to balancing the state budget instead of addressing critical infrastructure needs. And where the gas tax is not sufficient, some states are raiding local revenues to help fill the maintenance funding gap. In rare instances where states have budget surpluses, like Minnesota, lawmakers are favoring one-time spending increases on transportation over permanent tax increases.

Additionally, state spending priorities, both for capital projects and infrastructure grants, are often not aligned with city needs or priorities. For example, state departments of transportation tend to favor highway and road projects over other types of infrastructures investments. The state of New Hampshire currently has a moratorium on state aid grants for water and sewer projects. Cities had already completed some of the projects with the intention of using these state grants to help pay down bond payments. In Georgia, cities have some input into state level transportation priorities. Yet, they are increasingly required to pay for the maintenance of state routes, thus limiting revenues for other local priorities.

Matching requirements also pose significant barriers, particularly for smaller cities. For instance, localities in Wyoming are finding it extremely difficult to identify matching funds. Many smaller cities also face design and build specification hurdles, which are often tied to state funding. In West Virginia, state water and sewer funding requires new projects to meet specifications that are often “one size fits all” and very complex. Complex and inflexible funding requirements discourage cities from applying for more funding. It can also result in cities being left with huge operation and maintenance costs as well as with the difficult job of finding certified staff to operate the systems.

Of course, the relationship that cities have with their states extends well beyond intergovernmental transfers and grants. Local governments are nested within state structures, and states decide whether cities can raise revenues for infrastructure. Due to funding challenges at the state and federal levels, the authority of local governments to raise revenue – and the ability to freely spend those funds – is vital to maintaining roads, upgrading water and wastewater systems, accommodating increasing transit ridership, and strengthening the overall competitive position of cities.

This report examines the tools available to cities to fund infrastructure, including water and wastewater, transit and roads. This state-by-state analysis explores local option taxes and fees, such as motor vehicle fees, sales and fuel taxes, as well as emerging mechanisms like state infrastructure banks and public-private partnerships.

Download full version (PDF): Paying for Local Infrastructure in a New Era of Federalism

About the National League of Cities

www.nlc.org

The National League of Cities (NLC) is dedicated to helping city leaders build better communities. Working in partnership with the 49 state municipal leagues, NLC serves as a resource to and an advocate for the more than 19,000 cities, villages and towns it represents.

Tags: National League of Cities, NLC, PPPs, Public-Private Partnerships

RSS Feed

RSS Feed