AMERICAN ASSOCIATION OF STATE HIGHWAY AND TRANSPORTATION OFFICIALS (AASHTO)

Brief Description of Existing and Potential Revenue Options

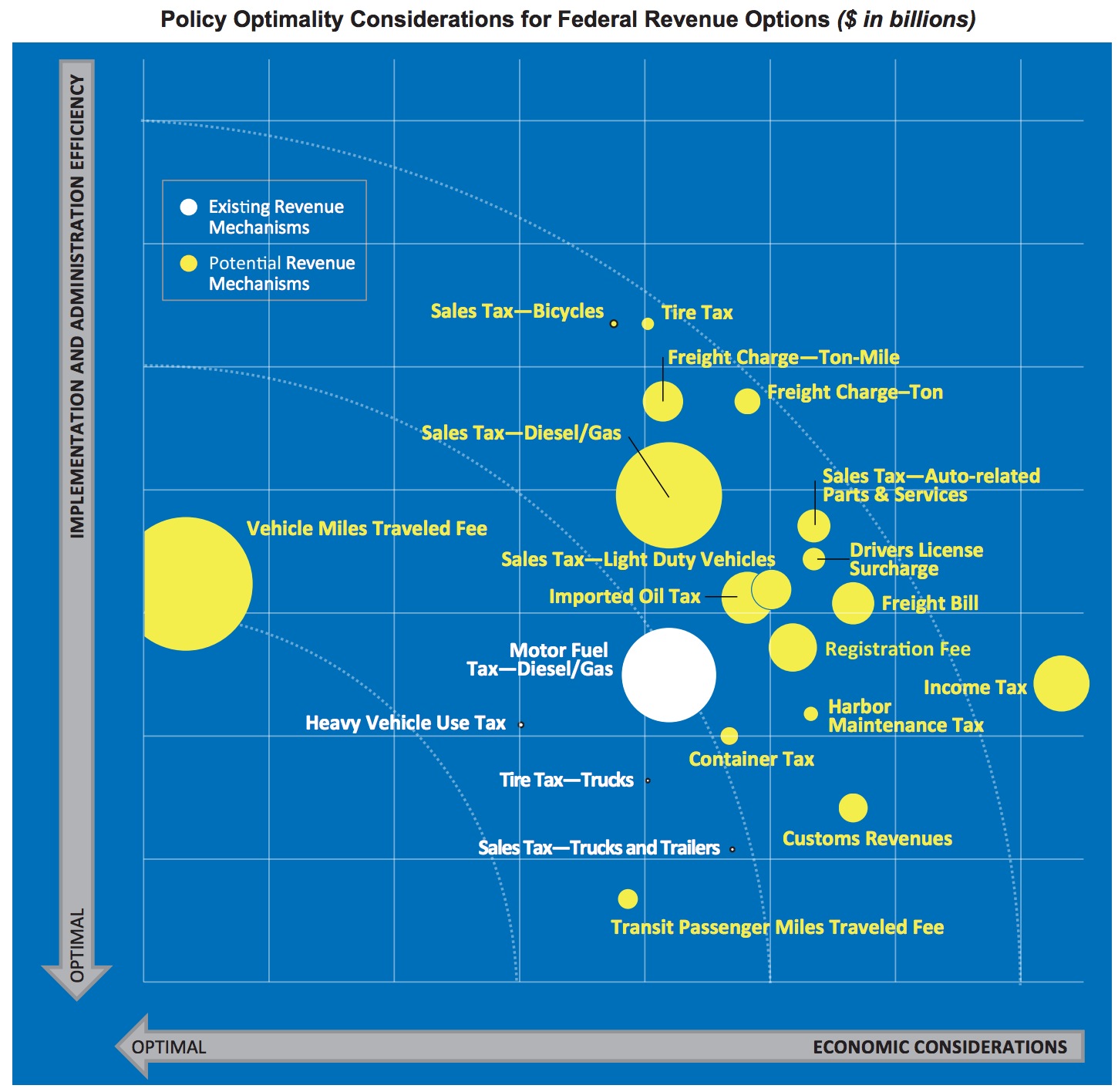

Container Tax—A national fee imposed on some or all containers moving through the United States. If the charge is only assessed on imports, it can be expected to raise approximately one-third less revenues. Revenues from such a fee would be strictly dedicated to fund freight investment activities.

- Pros—Raises a decent level of funding relative to freight needs; moderate implementation, administration, and compliance costs; strong sustainability

- Cons—Does little to promote efficient system use; potential international trade laws conflicts; could have regional equity issues

Customs Revenues—Customs duties are imposed at varying rates on various imported goods passing through U.S. international gateways and currently go to the General Fund of the U.S. Treasury. A number of interest groups, as well as the Policy Commission, have suggested that given the role transportation infrastructure plays in facilitating the import of goods, a portion of current customs duties should be allocated to support transportation investment.

- Pros—Small percentage of current revenues provides significant revenues; highly sustainable

- Cons—Diverts or expands a mechanism that is currently used and viewed as an important U.S. General Fund revenue source

Drivers License Surcharge—States charge a fee for issuing drivers’ licenses. In some cases, the fee simply recovers the cost of administering the licensing programs. In many states, however, license fees also are used as a source of funding for transportation or other purposes.

- Pros—Significant revenue yield; well-established in each state with minimal additional administrative cost

- Cons—Strong public and political opposition; different licensing practices in each state; infringes on states’ reliance on this fee; poor social equity

Freight Bill—A freight waybill tax would serve as a sales tax on the shipping costs for freight. Such a tax could be modeled on the aviation system tax, in which passenger and freight users who rely on the same infrastructure and carriers all contribute to fund the system. The air-freight waybill tax currently provides 5 percent of contributions to the federal Airport and Airway Trust Fund

- Pros—Large revenue yield potential; reasonably equitable

- Cons—Expensive to administer and enforce; more of an indirect user fee, as not directly related to system use

…

Imported Oil Tax—A tax on imported oil charged as either a fixed amount per barrel of oil or as a percentage on the value of imported oil.

- Pros—Small fee could raise significant revenue; can help to promote U.S. energy independence

- Cons—Broad nature of tax creates limited user pay/benefit relationship (e.g., home heating oil would be taxed for transportation); raises geographical equity issues; could raise broader free trade issues

Income Tax: Business and/or Personal—A national income tax for transportation could be created fairly easily and inexpensively by dedicating a portion of the existing tax or by adding an across-the-board increase to current personal and/ or corporate income tax rates.

- Pros—Small percentage tax yields significant revenue; strong sustainability; inflation-neutral; easy to administer and enforce; relatively progressive

- Cons—Support for dedicating revenues to transportation needed though good transportation aids income growth; strong political opposition; weak link to economic efficiency and equity; negative impacts on the federal budget

Motor Fuel Tax—Federal motor fuel tax rates are currently 18.4 cents per gallon for gasoline, gasohol and special fuels (rates on special fuels vary, but average about 18.4 cents), and 24.4 cents per gallon for diesel. Federal motor fuels taxes were last increased for transportation purposes by 5 cents per gallon in 1982. Additional revenues were added to the Highway Trust Fund (HTF) by recapturing 2.5 cents per gallon in 1996 and another 4.3 cents per gallon in 1998 that were previously allocated to the General Fund for deficit reduction purposes.

- Pros—Large revenue yield with small rate change; a tried-and-true user fee; ease of administration

- Cons—Long-term sustainability issues; strong public opposition; somewhat regressive

Motor Fuel Tax Indexing—Establishes an annual adjustment to motor fuel tax rates to sustain purchasing power based on a gauge of inflation such as CPI-U (Consumer Price Index–Urban) or GDP (Gross Domestic Product) Price Index.

- Pros—Maintains purchasing power

- Cons—Likely unpopular during high inflation periods; perpetuates dependence on motor fuels as the primary HTF funding source

Oil, Gas, and Minerals Receipts—The federal government receives various income comprised of royalties, rent, bonus bids, and other payments from the extraction of oil, natural gas, and minerals from federal lands and offshore mining activities. Aside from a portion designated for the states, the remaining amount of these revenues currently goes to the federal General Fund which could be redirected for transportation purposes.

- Pros—Sustainable; can help to promote U.S. energy independence

- Cons—Diverts funds from U.S. General Fund; link to transportation is not as strong as user fees; revenues could be volatile

…

Vehicle Miles Traveled Fee—Drivers can be charged for the total number of miles traveled, regardless of the road used or the time of day. The fee can be charged in a number of ways. With the recent passage of a bill by the Oregon Legislature, Oregon will be implementing the nation’s first VMT fee. Oregon DOT will build a system that will allow up to 5,000 voluntary participants to choose from a number of methods of collecting data on miles driven and paying fees, including means that do not require GPS systems to address privacy concerns. Germany has a system of charging trucks tolls for miles traveled, exhaust emissions, and number of axles. The charges are calculated using on-board GPS equipment and wireless communication devices. A related method is pay-as-you-drive insurance.

- Pros—Large revenue yield potential; highly sustainable; appropriate user fee; leads to more efficient use of system

- Cons—Public and political opposition is high, especially on privacy grounds; considerable costs and challenges (institutional, administrative, and cultural); not enough real-world experience with implementation; not a viable short-term option

Download full version (PDF): Matrix of Illustrative Surface Transportation Revenue Options

About the American Association of State Highway and Transportation Officials

www.transportation.org

AASHTO is a nonprofit, nonpartisan association representing highway and transportation departments in the 50 states, the District of Columbia, and Puerto Rico. It represents all five transportation modes: air, highways, public transportation, rail, and water. Its primary goal is to foster the development, operation, and maintenance of an integrated national transportation system.

Tags: AASHTO, American Association of State Highway and Transportation Officials, VMT Tax

RSS Feed

RSS Feed