AMERICAN PETROLEUM INSTITUTE

Executive Summary

Over the past five years, unconventional oil and gas activity has thrust the nation into an unexpected position. The U.S. is now the global growth leader in crude oil production capacity growth, adding nearly 1.2 million barrels per day (mbd) of capacity over the 2008 – 2012 time period. In addition, the U.S. is now the largest natural gas producer, at 65 billion cubic feet (Bcf) per day. At the same time, unconventional activity is spurring the growth of natural gas liquids (NGLs) production, adding over 500,000 barrels of oil equivalent (boe) per day since 2008. This has brought the total increase in liquids production capacity to some 1.7 mbd since 2008.

As this period of high infrastructure investment, which began after the 2008-2009 financial recession, continues to progress it will largely reverse a macro energy infrastructure trend that began taking shape in the early 1970’s. Many of the major oil and gas infrastructure investments made for the past 30 years have been premised under the assumption of decreasing domestic production, increasing energy imports, and the need to move imported energy from coastal receiving ports to inland demand centers. A large portion of the projects being developed during this sustained infrastructure investment period will shift the U.S. towards being energy trade balanced and add key infrastructure segments that enable growing energy production in the Midcontinent region to reach demand centers on the US Gulf Coast and Eastern seaboard.

The purpose of this study is two-fold: (1) to provide a comprehensive assessment of required investment in oil and gas transportation and storage infrastructure through 2025; and (2) to assess the economic impacts associated with this investment, in terms of employment, contribution to GDP (Value Added), labor income, and tax revenues. The analysis of infrastructure investments examines significant trends both during an historical period – 2010 through 2013 – and on a forecast basis, 2014 – 2025. It focuses on energy types supported by investment, including Natural Gas, NGLs and LPG, Oil and Condensate, Refineries and Refined Products, and Common Infrastructure. The economic impact assessment is developed on the basis of average annual investments from 2014 through 2025. Both the analysis of infrastructure spending and the resultant economic impact assessment are developed under two scenarios – a base case, reflecting the IHS view of the most likely path of oil and gas production over the 2014-2025 time frame, and a high production case, reflecting a 20 percent increase in natural gas, natural gas liquids, and crude oil production above the base case that could be associated with expanded access to current off limit areas in Atlantic, Eastern GOM, Pacific and Alaska.

Capital Investment in Oil and Gas Transportation & Storage Infrastructure

There are several themes and forward looking changes that are major factors affecting both the level and composition of oil and gas infrastructure spending. These can be summarized as follows:

- An incisive example of the structural shift from import to export oriented infrastructure assets is provided with liquefied natural gas (LNG) facilities. By the late 1990s, it appeared that the U.S. would need to supplement domestic natural gas production with imported LNG, and starting in 2000, LNG regasification (import) facilities were re-commissioned, expanded, or constructed. As the last of these import facilities were placed into service, the full potential of the shale gas resource was just being understood by the marketplace, largely making billions of dollars in import investment unnecessary. Fortunately, these import facilities can be repurposed with additional investment as dual purpose import and export LNG facilities.

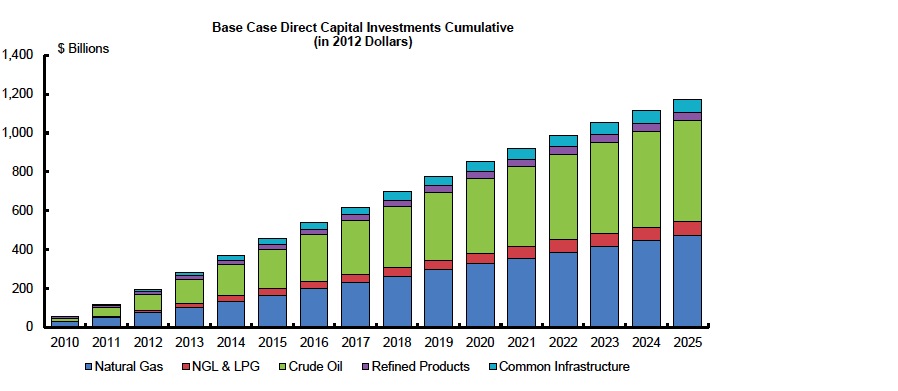

- The results of the IHS analysis determine that this recent surge in oil and gas transportation and storage infrastructure investment is not a short lived phenomenon. Rather, we find that a sustained period of high levels of oil and gas infrastructure investment will continue through the end of the decade. The IHS analysis estimates that between $85 – $90 billion of direct capital will be allocated toward oil and gas infrastructure in 2014. Between 2014 and 2020, IHS projects that an average of greater than $80 billion will be invested annually in U.S. midstream and downstream petroleum infrastructure. After 2020, IHS expects that pace of investment to curtail moderately from this sustained period of high investment, declining gradually to an infrastructure direct capital investment of just under $60 billion by 2025.

Download full version (PDF): Oil & Natural Gas Transportation & Storage Infrastructure

About the American Petroleum Institute

www.api.org

“The American Petroleum Institute (API) is the only national trade association that represents all aspects of America’s oil and natural gas industry. Our more than 500 corporate members, from the largest major oil company to the smallest of independents, come from all segments of the industry. They are producers, refiners, suppliers, pipeline operators and marine transporters, as well as service and supply companies that support all segments of the industry.”

Tags: American Petroleum Institute, API, Natural Gas, Oil, Petroleum

RSS Feed

RSS Feed