CAMBRIDGE ECONOMETRICS

THE INTERNATIONAL COUNCIL FOR CLEAN TRANSPORTATION

Key Findings

Policies to tackle climate change are likely to lead to lower oil prices, according to the results of this analysis. As governments start implementing the Paris Agreement, they will increasingly need to cut carbon emissions from transport by curbing the combustion of petroleum fuels. Lower oil prices will prevail in this lower-demand scenario, compared to a business-as-usual scenario where oil demand would rise unchecked and in line with economic growth and expanding mobility trends.

Amid today’s low oil prices, it is easy to forget the long-term fundamentals. The sharp fall in oil prices since mid-2014 has created considerable uncertainty in global energy markets. Although initial reductions in the oil price were due to low-cost US shale oil production and OPEC’s response, more recently the volatility in prices has been due to short-term market uncertainty in light of unprecedented levels of oil stocks in rich countries, slowing economic growth in China, new supplies from Iran, among other factors. This follows a period in which geopolitical factors, such as conflict in Ukraine and the rise of the Islamic State in Iraq, helped push oil prices to $100-$120 per barrel over the period 2011-2014.

While short-term factors, such as geopolitics, speculation and sentiment, play a role in setting spot prices for oil, in the long-term the most important factors are those that affect the marginal cost of development. One such factor is the imperative to tackle climate change.

Governments are meeting this challenge by setting policies that signal a longterm direction of travel for investment in low-carbon solutions. For example, the European Union is currently setting its energy policy goals for 2030, which themselves are influenced by scientific guidance that developed economies must be radically decarbonised by mid-century. In the time horizon of 2030-2050, it is most relevant to consider oil markets in terms of the long-term fundamentals.

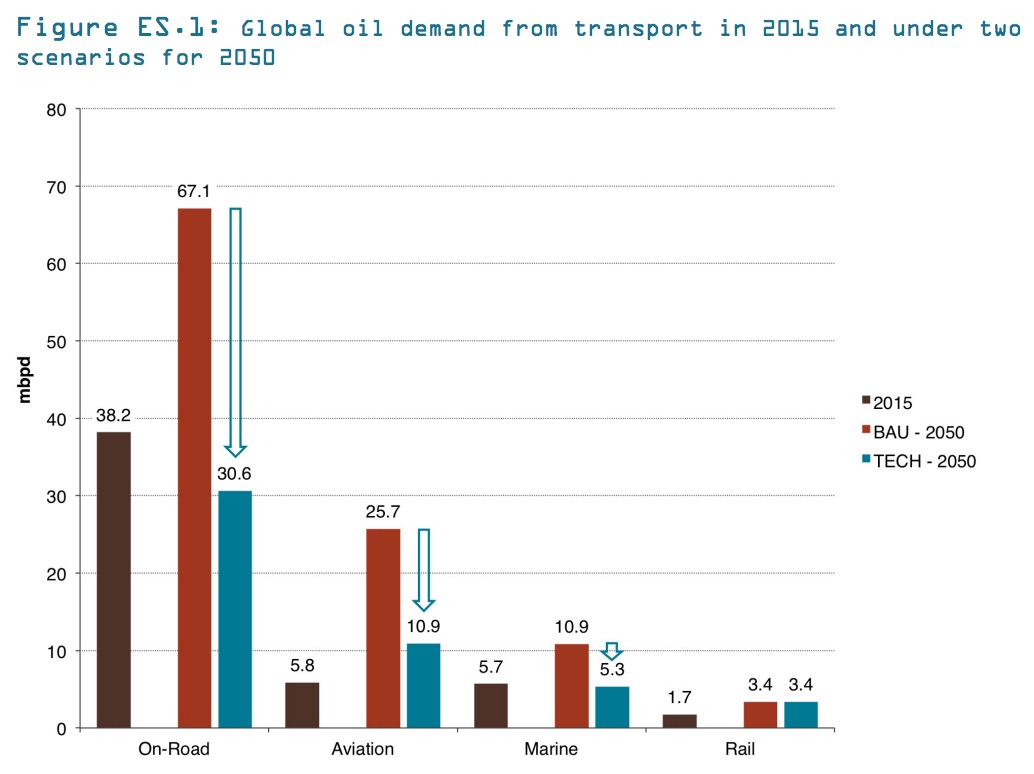

In a world without climate policies to drive investment in low-carbon technologies, this study finds that global demand for oil would grow from 94 million barrels per day (mbpd) in 2015 to 112 mbpd in 2030, an increase of 19%. By 2050, demand would grow by a further 35% to 151 mbpd, primarily driven by economic growth in Asia and higher demand for aviation.

The global crude oil market in 2015 had an excess of 2 mbpd of supply over demand due to rapid increases in US production and OPEC’s strategic response to maintain market share. However, anticipated growth in oil demand out to 2020 should absorb this over-supply, and existing production will continue to decline, aggravated by under-investment amid current low oil prices. This would lead to a situation in the 2020s where significant investment in new non-OPEC production capacity is needed, and oil prices will need to rise to around $80 per barrel to stimulate that production. Ultimately, without major new finds or step changes in production techniques, increasing demand would push world prices above $90 per barrel by 2030 and over $130 per barrel by 2050 (in 2014 prices).

By contrast, in a world where climate policies are being implemented to drive investment in low-carbon technologies, demand for oil will be significantly lower than in a business-as-usual case: by around 11 mbpd in 2030 and by 60 mbpd in 2050. This analysis found that vehicle efficiency standards implemented globally between 2000-2015 have already prevented the consumption of around 5 billion barrels of oil. In our Technology Potential scenario, policies that further push vehicle efficiency and electric-drive technologies into the market and reduce fuel consumption by aircraft and ships could lead to an inflexion point in 2025, after which oil consumption would steadily decline. Cumulatively, these policies could cut oil demand by 260 billion barrels between 2015 and 2050.

This reduction in demand delays the need to invest in extracting increasingly expensive oil from non-conventional sources, and the long-term market price of oil would settle around a stable band between $83 and $87 per barrel from 2030 to 2050. In other words, the global deployment of technologies to mitigate CO2 emissions would cause oil prices to be lower than they would otherwise be in a business-as-usual scenario: Around 8.5% lower in 2030; 24% lower in 2040; and 33% lower in 2050, according to the results of this analysis.

The central findings of this study reinforce the findings of the International Energy Agency (IEA). In the World Energy Outlook (2015), the IEA projects that if mankind constrains atmospheric greenhouse gas emissions below 450 parts per million – a level generally seen as consistent with meeting the 2°C climate target – the global demand for oil in 2030 would be around 86 mbpd, compared to 104 mbpd in a scenario based on current policies.

While the IEA study uses slightly different assumptions, it finds a comparable impact on oil prices: Prices would settle around $90 per barrel after 2030, rather than increasing to around $150 per barrel by 2040 in the current policies scenario.

The European economy will be better off in the long run as a result of lower oil prices, despite the lost revenue for European oil producers. The EU, which is 88% dependent on imports to meet its oil needs, would benefit overall from lower oil prices. Reduction in the volume of EU oil imports would lower the EU’s oil bill by €29 billion in 2030 in our Technology Potential scenario, and the consequent reduction in oil prices would shave a further €12 billion from the bill.

Lower oil prices reduce inflationary pressure on consumers, increasing real incomes and allowing for more expenditure on other goods and services that provide larger domestic value-added for the European economy. As a result of the lower oil prices modeled in this analysis, EU average incomes would be 0.3% higher by 2030 and 0.9% higher by 2050, relative to business-as-usual. EU GDP would be 0.2% higher by 2030 and 0.5% higher by 2050. This would drive a 0.2% increase in employment by 2050, equivalent to more than 400,000 extra jobs, which would mostly be created in the service sectors, reflecting typical household consumption patterns.

It is important to note that the economic benefits described above are the result of oil price impacts in isolation. The transition modeled here would also lead to other important shifts in spending in the EU economy. Economic benefits can be derived from the increased investment in low-carbon technologies and energy sources, as well as from more efficient mobility, which allows a shift in spending away from mobility and towards other areas of the economy. The study “Fuelling Europe’s Future” shows that such a transition for cars and vans alone could deliver an additional 1% to EU GDP by 2050.

This study also delivers important insights into the long-term viability of exploration for unconventional oil sources. At the level of demand projected in the Technology Potential scenario, it would not be profitable to extract oil from the Arctic; from many deep-water oil reserves; as well as from in-situ tar sands.

In summary, if implemented globally, policies to tackle carbon emissions from transport will lower global oil prices, with a positive impact on many oil-importing economies and important implications for the profitability, or not, of unconventional oil extraction.

Download summary report (PDF): Oil Market Futures

About Cambridge Econometrics

www.camecon.com

“Cambridge Econometrics is a leading independent consultancy specialising in applied economic modelling and data analysis techniques. We aim to provide rigorous, accessible and relevant independent economic analysis to support strategic planners and policy-makers in business and government, doing work that we are interested in and can be proud of.”

About the International Council for Clean Transportation

www.theicct.org

The International Council on Clean Transportation is an independent nonprofit organization founded to provide first-rate, unbiased research and technical and scientific analysis to environmental regulators. Our mission is to improve the environmental performance and energy efficiency of road, marine, and air transportation, in order to benefit public health and mitigate climate change.

Tags: Cambridge Econometrics, CamEcon, Fossil Fuels, ICCT, International Council for Clean Transportation, Oil, Oil Market, Oil Prices, Petroleum

RSS Feed

RSS Feed

While a transition to ZEVs from ICE is desirable, if we move to a fleet of vehicles that use only electricity, what do we do if their is a cyber attack that takes portions of grid down for weeks or months or years (as illustrated in the book entitled “lights out” by Ted Kopple? Some people think this event is not “if but when” and would produce a double catastrophe.