Port and inland distribution markets that invest CapEx in their transportation infrastructure will capture the economic opportunities from changing global trade patterns and evolving e-commerce. Those that don’t invest the needed CapEx risk capsizing their economies. America needs $3.6 trillion in funding for infrastructure by 2020 to remain competitive (ASCE 2013 Infrastructure Report Card).

Key Takeaways

- America’s infrastructure received a D+ grade from the American Society of Civil Engineers (ASCE). Although ports and rail earned a C, America’s infrastructure is only as healthy as its weakest link: inland waterways, roads and airports.

- The balance of influence in trade is shifting from Asia to Latin America, and from West Coast to Gulf/East Coast ports. Expanding U.S. trade with Latin America, Russia and India offset impact of Eurozone recession and China’s slowing GDP.

- Latin America is the next big growth opportunity, in the early stages of a growth economy. Demand for U.S. goods is growing: Walmart’s Q4 2012 net sales growth in LATAM was greater than in Asia—a first.

- Globally, foreign investors are recognizing the value to be unlocked in North American port cities. In the latest 2012 Association of Foreign Investment in Real Estate (AFIRE) report released January 2013, three of the top 5 global cities for investment were American port cities (NY, San Francisco and Houston).

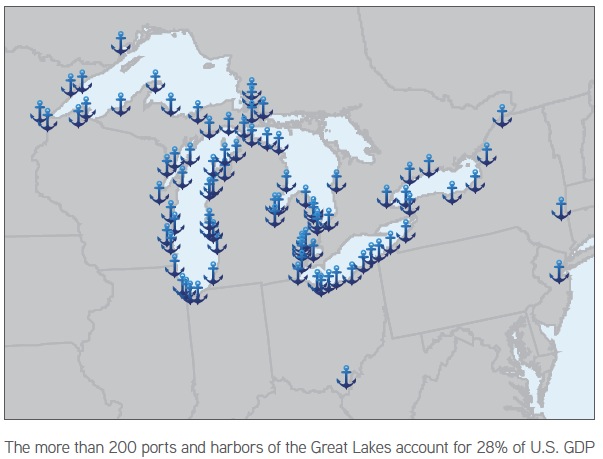

- The Great Lakes region is an overlooked “Fourth Coast” and the undisputed leader in bulk cargo trade. Great Lakes ports account for 28% of U.S. GDP, processing 240 million tons of cargo annually.

The Economy, GDP Growth, and Port Activity

Since the release of Colliers’ previous North American Ports Outlook report, port and intermodal activity have sprung forward despite a fall in GDP over the winter. Historically, when GDP decreases from, say 3.1% to 0.1% (as was the case in 2H 2012), we see contraction in port, intermodal and industrial activity. Why didn’t that happen in Spring 2013? Due to a combination of factors, including:

Since the release of Colliers’ previous North American Ports Outlook report, port and intermodal activity have sprung forward despite a fall in GDP over the winter. Historically, when GDP decreases from, say 3.1% to 0.1% (as was the case in 2H 2012), we see contraction in port, intermodal and industrial activity. Why didn’t that happen in Spring 2013? Due to a combination of factors, including:

- Retailers remaking supply chains: Distribution and manufacturing activity normally fueled by consumer spending is instead being driven by retailers investing capital in supply chain improvements: new distribution centers, logistics and IT to expand their consumer base globally via e-commerce—instead of opening new stores during a period of high unemployment and anemic job growth. Distribution and logistics center construction is up nearly 300% over a year ago; Georgia, Tennessee and Indiana are the leading states, with new construction for the likes of Amazon, FedEx, Home Depot, Lowes, Rubbermaid, Volkswagen and Whirlpool.

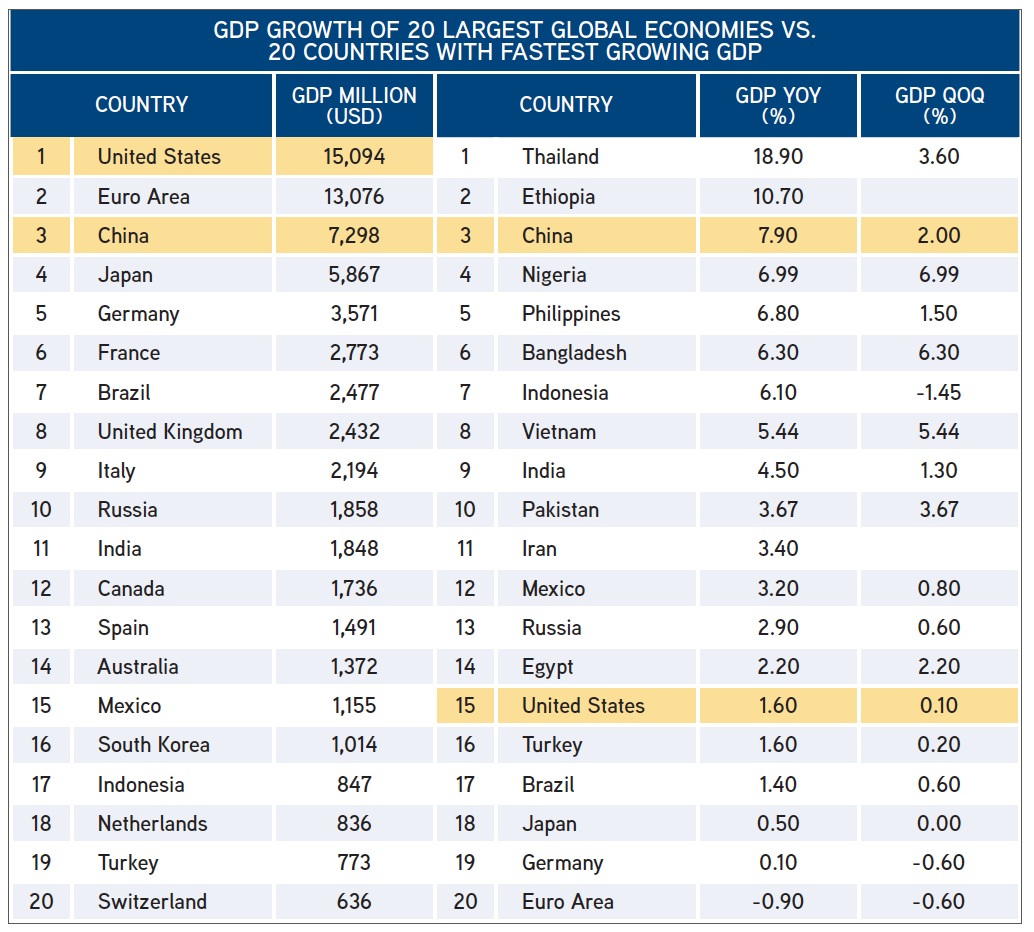

- Shift in global trade patterns: Although Europe is both the United States’ and China’s largest trading partner, with a GDP in excess of $13 trillion (second only to the U.S. and nearly double that of China’s $7.3 trillion economy), the U.S. has experienced net growth in global trade despite an ongoing European recession and a slowing GDP in China. The offset for the U.S. has come from expanded trade to Latin America, India and Russia.

- Latin America is the next big growth opportunity, and can be for the East and Gulf Coasts what Asia is for California. Much like the United States in the 1950s, Latin American countries are in the early stages of a growth economy with a newly developed middle class. They are looking for the American lifestyle and products ranging from apparel and autos to electronics and media. The demand for American goods is growing so rapidly that Walmart revealed in its Q4 2012 earnings that, for the first time, the net sales growth in Latin America surpassed that of Asia. With a full two years to go until completion of the Panama Canal locks expansion project, two Gulf Coast states (Texas and Louisiana) have already surpassed California in both import and export Foreign Trade Zone (FTZ) activity. And, California has fallen to tenth place in FTZ export activity, having been displaced by Texas and five Southeastern port states (LA, SC, FL, AL & MS).

- Energy and agriculture: The U.S. and North America in aggregate have become net exporters of carbon-based energy; and agriculture exports—especially wheat—are growing at near double-digit rates. This global demand is fueling capital spending to expand or upgrade coal transload facilities (Port of Norfolk), construct new intermodal container transfer facilities (Port of Mobile), and develop liquefied natural gas (LNG) distribution plants (Delaware River Port Authority, Florida and Texas ports).

- Rebirth of automobile manufacturing: Auto assembly in the U.S. has soared from less than 10 million units just a couple of years ago to more than 16 million units in 2012. Japan is struggling to repower its economy following the Sendai Earthquake, and Germany’s manufacturers face a currency disadvantage versus the U.S.. Further the U.S. offers a low cost of energy, and a highly skilled labor force. As a result, Volkswagen has expanded manufacturing to Chattanooga, TN, BMW and Mercedes have ramped up manufacturing in AL and SC, and all Japanese auto brands are accelerating assembly activity in states from TX to TN. Intermodal rail traffic from auto assembly is up double digits between the inland factories and ports, and auto exports to Latin America are at all-time highs. Auto manufacturing is the most visible part of an overall trend in onshoring of manufacturing operations, which includes aircraft and furniture, etc.

Download full report (Colliers.com): North American Port Analysis

About Colliers International

www.colliers.com

“Colliers International is a leading global commercial and residential real estate services organization defined by our spirit of enterprise. Our 12,300 professionals in over 520 offices worldwide are dedicated to creating strategic partnerships with our clients, providing customized services that transform real estate into a competitive advantage.”

Tags: American Society of Civil Engineers, ASCE, China, Colliers International, Euro Area, Great Lakes Region, Japan, North America, Report Card for America's Infrastructure, United States

RSS Feed

RSS Feed