THE NORTHBRIDGE GROUP

by Frank Huntowski, Aaron Patterson, and Michael Schnitzer

Executive Summary

As a matter of both economics and public policy, no government production tax subsidy should ever be so large that it creates an incentive for a business to actually pay customers to take its product. Yet, the federal Production Tax Credit (“PTC”) for wind generation is doing just that with increasing frequency in electricity markets across the United States. In some “wind-rich” regions of the country, wind producers are paying grid operators to take their generation during periods of surplus supply. But wind producers more than make up the cost of the “negative price” payment, because they receive a $22/MWH federal production tax credit for every MWH generated.

The federal wind Production Tax Credit (“PTC”) was originally enacted in 1992 to jumpstart the wind energy industry. The PTC has since been extended on six occasions and is now due to expire on December 31, 2012. Today, policymakers on both sides of the issue are debating the merits of yet another extension of the subsidy on a variety of grounds. This paper focuses on one harmful, but often overlooked, aspect of the PTC – specifically how the PTC interacts with wholesale electricity markets to create the phenomenon of distortionary “negative prices.” While the concept of negative prices might at first glance seem to be a money-saver for electricity users, or at best a harmless phenomenon, in fact these negative prices are: (a) funded by taxpayers; (b) distorting wholesale electricity markets; and (c) harming conventional generation and imperiling reliability. As recently as September 6, 2012 the Public Utilities Commission of Texas Chairman Donna Nelson cautioned policymakers against further subsidies noting that the PTC had undermined Texas reliability:

“Federal incentives for renewable energy… have distorted the competitive wholesale market in ERCOT. Wind has been supported by a federal production tax credit that provides $22 per MWH of energy generated by a wind resource. With this substantial incentive, wind resources can actually bid negative prices into the market and still make a profit. We’ve seen a number of days with a negative clearing price in the west zone of ERCOT where most of the wind resources are installed….The market distortions caused by renewable energy incentives are one of the primary causes I believe of our current resource adequacy issue… [T]his distortion makes it difficult for other generation types to recover their cost and discourages investment in new generation.”

As part of our analysis, we have reviewed energy production and real time pricing information from the Nation’s grid operators to understand the production characteristics and bidding behavior of wind producers and to assess their impact on essential conventional electric resources.

We find that:

The PTC undermines and distorts price signals in wholesale electricity markets by incenting PTC-subsidized wind producers to sell electricity at a loss to earn enormous tax subsidies.

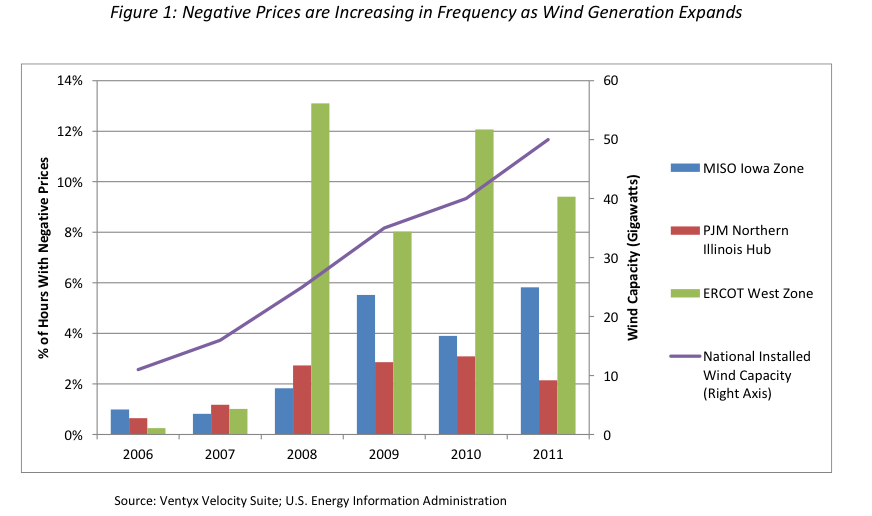

This taxpayer-funded subsidy artificially depresses wholesale power prices, and in hours of the year when demand for electricity is low it can result in negative pricing. Figure 1 shows the frequency of negative prices in a number of particularly wind-rich areas over 2006-11 alongside the growth in national installed wind capacity over the same period. This figure demonstrates the clear linkage between wind generation and negative prices.

Read full report (PDF) here: Negative Electricity Prices and the Production Tax Credit

About The NorthBridge Group

www.nbgroup.com

“The NorthBridge Group is a leading economic and strategic consulting firm serving the electricity and natural gas industries, including both regulated utilities and other companies active in the competitive wholesale and retail markets. We apply market insights, rigorous quantitative skills, and regulatory expertise to complex business problems, always seeking to preserve and build our clients’ shareholder value.”

Tags: Electricity, prices, PTC, The NorthBridge Group, Wind Energy

RSS Feed

RSS Feed