WILLIS TOWERS WATSON

Executive Summary

Transportation keeps the global economy moving. Any operational disruptions have wider consequences for society, making the management of the associated risks a priority that should transcend industry boundaries

Transportation keeps the global economy moving. Any operational disruptions have wider consequences for society, making the management of the associated risks a priority that should transcend industry boundaries

The world economy has surged over the last half century, and that growth has been largely driven by globalization and the consequent increase in trade. International trade in goods and services has increased from around $4 trillion in 1990 to $24 trillion in 2014, according to 2015 data from the United Nations Conference on Trade and Development.

This increase in trade would not have been possible without an equivalent rise in the capabilities of the global transportation sector. More than just a mover of goods and people, transport is a key driver of economic and social development. It brings opportunities for the poor and helps economies to be more competitive. According to the World Bank, “transport infrastructure connects people to jobs, education and health services; it enables the supply of goods and services and allows people to interact and generate the knowledge and solutions that foster long-term growth.”

The transportation sector’s intimate relationship with the global economy means that the risks faced by the industry are influenced by factors such as increasingly complex markets, transient workforces, disparate regulatory frameworks, the inexorable march of technology and geopolitical shifts. Far from being isolated in silos, these factors interact with each other in complex ways that are difficult to understand, let alone predict.

To better understand the hazards and opportunities inherent in this dynamic landscape, we asked 350 senior executives in the transport industry to rank the greatest threats to their businesses over a ten-year horizon.

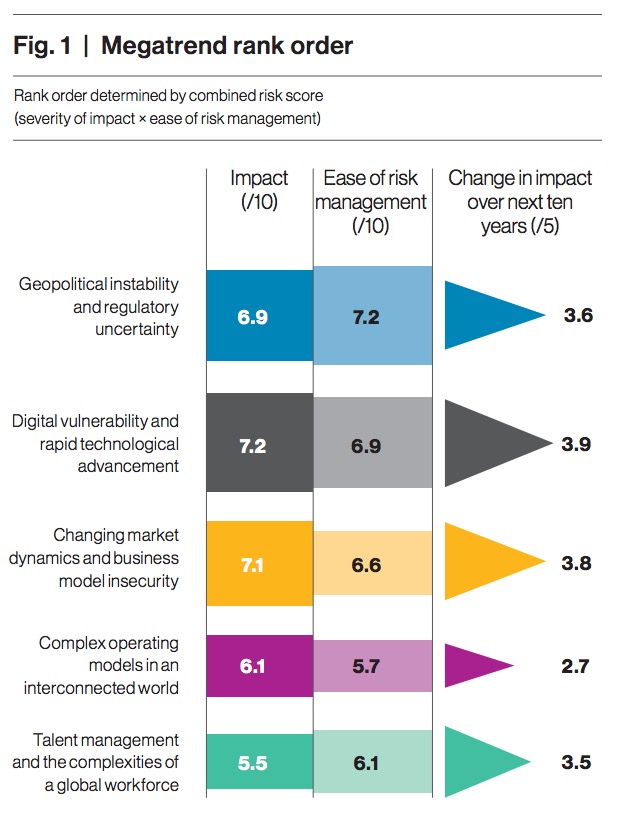

Participants were surveyed about their attitudes to 50 specific risks from five broad categories, or megatrends:

- geopolitical instability and regulatory uncertainty

- complex operating models in an interconnected world

- digital vulnerability and rapid technological advancement

- talent management and the complexities of a global workforce

- changing market dynamics and business model insecurity

In-depth interviews were then conducted with executives from each mode of transport – across passenger and freight services – to gain deeper insights into the challenges they face.

In a world where the so-called Islamic State, Brexit, European migration and US elections are dominating headlines, few may find it surprising that risks from the geopolitical instability and regulatory uncertainty megatrend (see page 10) rate most highly among respondents. The digital vulnerability and rapid technological advancement megatrend (page 14) runs a very close second, and the effects of changing market dynamics and business model insecurity (page 30) rank third.

The top four rated individual risks in the geopolitical megatrend were the domain of government, regulators or the judiciary; indicating that transport providers are at least as worried about a state’s potential to disrupt their business as they are about non-state forces.

But there are also clear and influential dissenters. Sir Jeremy Greenstock, the UK’s former permanent representative at the United Nations, warns of the perils of ignoring the “fragmentation of the political identity.” He says: “Politics, the construction of states and the organization of human affairs in structures is not behaving as we have been used to for the last 70 years.”

No one size fits all

While the megatrends give a broad overview of the threat landscape, the specific sector and regional data highlight the disparities that continue to make global solutions so elusive for multinational transport providers.

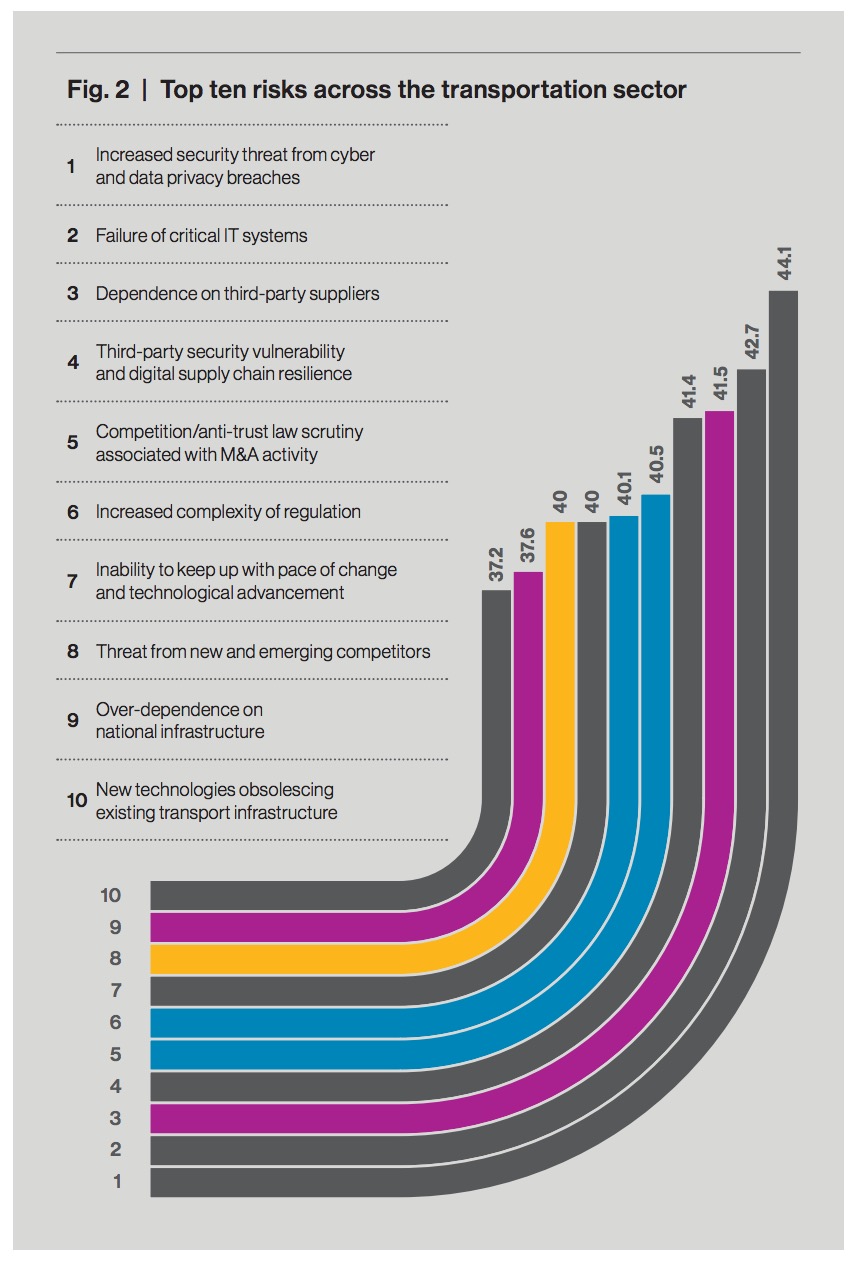

In general, the prolonged economic struggles of most shipping lines have made the maritime sector more sensitive to risk than other modes of transport: its top four individual risks are all rated above the air sector’s top risk. Maritime transport providers perceive cyber-threats and data privacy breaches to be their top risks. For aviation, failure of critical IT systems is the biggest concern.

However, all transport sectors in all regions share concern about another product of globalization: the growing reliance on third-parties for everything from quality assurance and contract delivery to cyber resilience and the maintenance of corporate reputations. Nowhere has this risk been more clearly illustrated than with the recent bankruptcy of South Korea’s Hanjin Shipping. Its demise is a case study of the transport industry’s interdependence – impacting on alliance partners, ship lessors, port operators, freight forwarders, insurers and cargo owners – stranding more than $14 billion in goods at sea.

The single biggest individual threat across all modes of transport is the potential for cyber and data privacy breaches. Dissenters from that view argue that cyber-risk fears are fuelled by an alarmist media environment where discussion is dominated by hacking horror stories, ill-intentioned insiders and suggestions that the critical systems of most top corporations have already been compromised (the owners just don’t know yet).

But there is no denying that the skillsets of the digital threat actors are growing, just as the transport industry’s increased reliance on third-parties is multiplying the potential points of entry.

Clearly, an increasingly connected world requires a community response to many risks. No company, no matter how vigilant, is an island.

Download full version (PDF): Navigating Risk in the Transportation Sector

About Willis Towers Watson

www.willistowerswatson.com

Willis Towers Watson (NASDAQ: WLTW) is a leading global advisory, broking and solutions company that helps clients around the world turn risk into a path for growth. With roots dating to 1828, Willis Towers Watson has 39,000 employees in more than 120 countries.

Tags: survey, Willis Towers Watson

RSS Feed

RSS Feed