GLOBAL INFRASTRUCTURE HUB

A global study of investors launched by GI Hub and EDHEC Infrastructure Institute reveals the characteristics of infrastructure investors that can unlock the current record levels of private capital.

This factsheet outlines key insights that will help policy and market makers understand how to meet investor expectations and expand the infrastructure market.

What did investors say about infrastructure?

Investors are increasingly interested in infrastructure, and are not concerned about the lack of liquidity

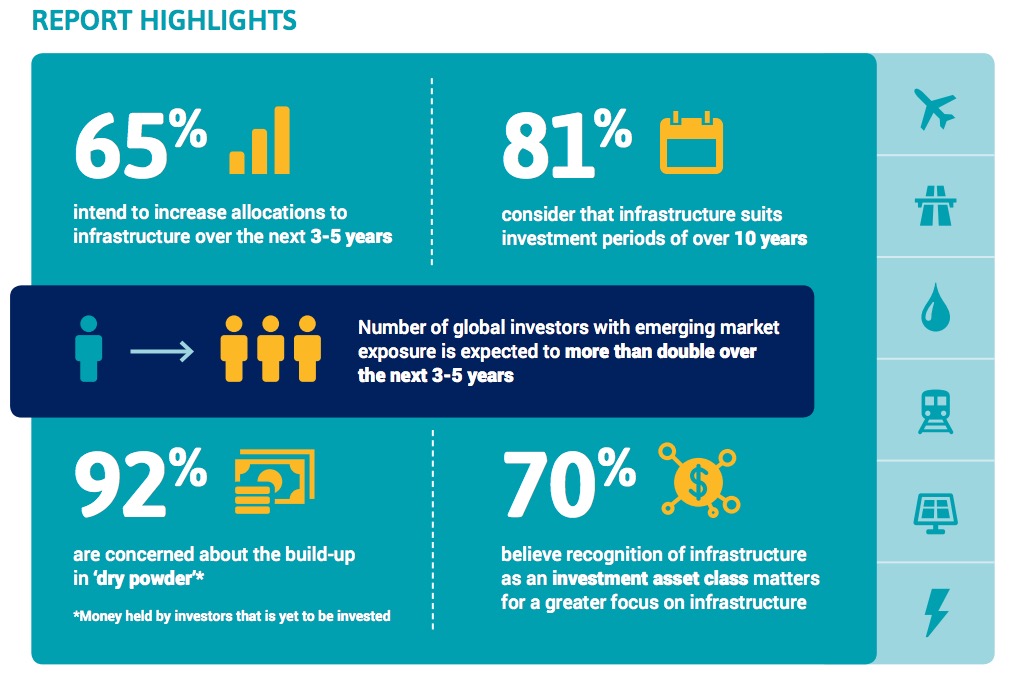

Infrastructure continues to increase in popularity: 65% of investors intend to increase spending allocations to infrastructure over the next 3-5 years.

In making investment decisions, investors say that the most desirable features are:

Investors are increasingly comfortable with long investment periods, with 81% of them expecting to keep investments for at least 10 years.

However, there is a lack of attractive investments

Increasing investment allocations to infrastructure is fuelling concerns that available capital will far exceed the number of available opportunities. 92% express concerns about the build-up in ‘dry powder’.

Delivering stability and certainty matters most to investors

Infrastructure has a greater dependence on secure long-term contract environments, more so than most other asset classes. The research surveyed investor’s views on the importance of the 6 factors that define infrastructure investments. Investors ranked the stability of regulatory and contractual framework as the most important factor of infrastructure investments, not whether it is a brownfield or greenfield asset.

Creating an infrastructure investment asset class matters to drive greater finance to infrastructure

70% believe recognition of infrastructure as an investment asset class is important to the future growth of the market. Steps towards this goal would be improved measurement of how infrastructure investments perform and a broader variety of investment products.

This can give rise to a greater allocation of investment finance. Improved performance data would be valuable for prudential regulators as they consider the risk profile of infrastructure investments.

How investors access infrastructure opportunities is changing. 45% prefer direct investing, and 82% signal that the previous private equity models are out of date.

Investors want to increase their exposure to emerging markets. Governments can better facilitate access by addressing policy reversals and counter-party risks

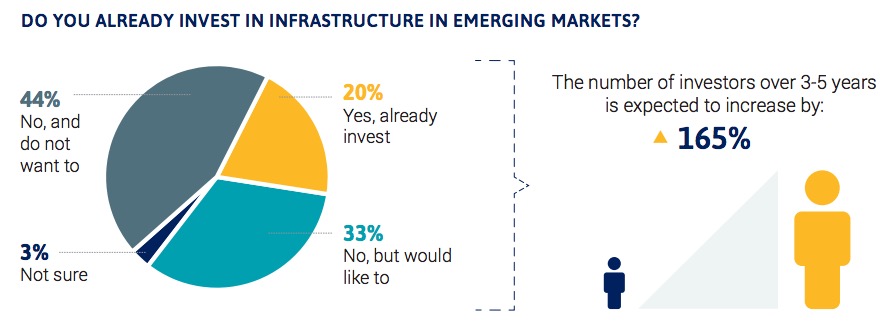

Survey participants were heavily focussed on OECD markets, with only 20% currently invested in emerging markets. However, investors are on the cusp of much higher allocations to emerging markets. 33% of investors want exposure to emerging markets for the first time. Competition and lack of pipeline in OECD markets will likely encourage this trend to new markets.

Reasons and Risks of Emerging Market Investment

Main Reasons:

- Higher returns

- Lack of investment opportunities in OECD markets

Main risks:

- Public policy reversals

- Enforceability of contracts

Implications for reforms that will expand the market?

Investor insights suggest four important reforms that would help meet the infrastructure challenge:

- Focus on creating bankable projects – the need for a consistent pipeline of bankable projects to attract large pools of private capital.

- Investments that are bankable need regulatory, contractual and revenue stability.

- Creating an infrastructure investment asset class matters to drive greater investment. The asset class should be defined based on its most distinguishing characteristics: the prevalence of long-term contracts and the high impact of counter-party risk.

- To attract investment into emerging markets, governments need to minimise public policy reversals and counter-party risks.

Download full version (PDF): Investor insights about infrastructure growth

About the Global Infrastructure Hub

globalinfrastructurehub.org

The Global Infrastructure Hub has a G20 mandate to grow the global pipeline of quality, bankable infrastructure projects. By facilitating knowledge sharing, highlighting reform opportunities and connecting the public and private sectors, our ambitious goal is to increase the flow and quality of private and public infrastructure investment opportunities in G20 and non-G20 countries.

Tags: G20, Global Infrastructure Hub, OECD

RSS Feed

RSS Feed