CITI GPS

Throughout history, economic and social development have gone hand in hand with infrastructure development, be it the road networks and sanitation advances of the Romans (what did they do for us?), the Silk Road, or the maritime advances which led to the age of exploration and resulting global trade. Our modern era has been similarly transformed by the availability of energy, electronic communications, and modern travel which have made the world a much smaller place.

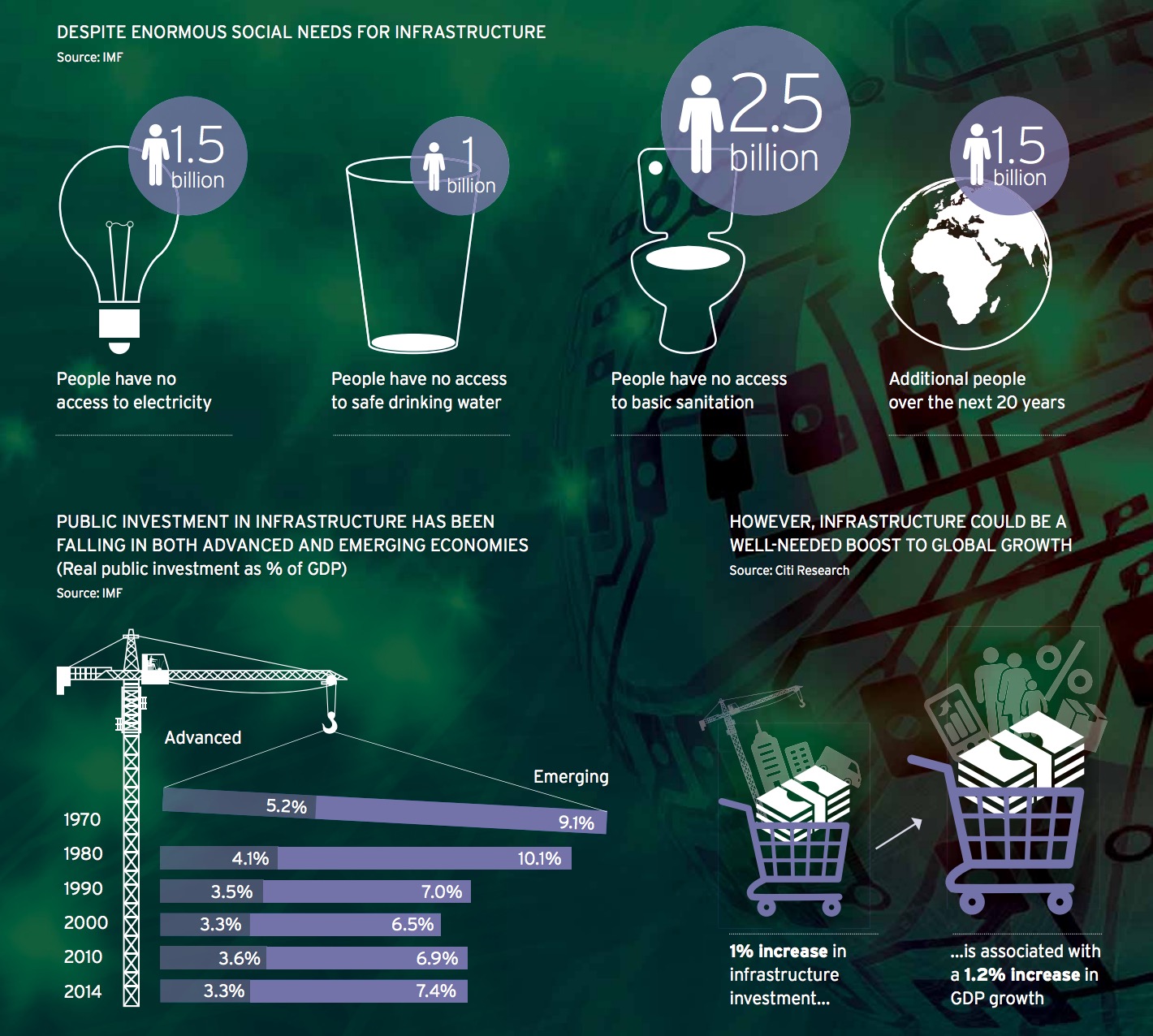

However, the amount which we spend on infrastructure has gradually been falling as a percentage of GDP, and, while there are justifications for this, the stock of infrastructure compared to global GDP has fallen.

At the same time, there is an enormous social need for infrastructure investment. Over 1.5 billion people have no access to electricity; just under 1 billion still live without safe drinking water, and over 2.5 billion are without access to basic sanitation. If the UN are right, and we need to accommodate an additional 1.5 billion people in the next 20 years, most of whom will be in emerging markets, and most of them in infrastructure-heavy urban centers, then there will be an ever more pressing need for infrastructure investment.

The global economy though seems mired in a period of sluggish growth. With interest rates close to zero, or in some cases negative in real terms, and the bazooka of QE already widely deployed, policymakers are running out of monetary levers to pull. This leaves us with the potential of fiscal stimulus, one aspect of which is infrastructure spending which can boost growth using both short-term demand effects, and longer-term supply effects, with the so-called multiplier effect implying that, if done correctly, the resulting GDP boost is larger than the initial investment.

However, developed market governments find themselves with debt at typically 100% of GDP, and hence limited capacity to spend, and, while emerging markets are less indebted at 40%, they are reluctant to boost debt and place sovereign ratings at risk. Traditional sources of infrastructure finance such as banks find themselves constrained by regulations such as Basel III, while insurance companies are constrained by Solvency II. Two factors, however, offer an enormous opportunity for the world. Firstly, governments can borrow at historically low rates (if not for free) for incredibly long durations. Perhaps most importantly, though, and the focus of this report, is the potential offered by private sector investment.

Returns on equities and bonds have in recent years been at historic lows, and Investors are crying out for yield, in particular for long-dated, stable cashflows and income streams. Infrastructure assets lend themselves perfectly to this need, with often predictable operating characteristics, and very long, multi-decade, useful lives.

Moreover, the scale of the opportunity is vast — we estimate a global need for infrastructure spending of $58.6 trillion over the next 15 years. In this report we examine why now could be the time for a global infrastructure push, and where the most exciting opportunities are by region and industry. Most importantly, though, with a need for infrastructure from a social and economic perspective and with funding keen to participate, we examine why it isn’t happening, and what stakeholders, both government and financial, need to do to make it happen.

We are faced with a rare opportunity to create and grow a new asset class, build a better world that is fit for the future, and create millions of jobs in the process; and who knows, we may just kick-start the global economy in the process.

The Case for Infrastructure

What exactly is infrastructure? We all use it every day, but rarely stop to think about it. As Margaret Thatcher once put it, “You and I come by road or rail, but economists travel on infrastructure.”

Infrastructure is not a term that’s very well defined, which is the first problem for the industry. Our attempt to define it would be to say that infrastructure refers to the assets that allow the efficient operation of economies and societies, and are an important driver of productivity (i.e., the amount of output we get, measured in GDP or its elements, per unit of input, such as labor or capital).

It is usually split into four main areas of activity, namely:

- Transportation – including rail, road, air, airports, maritime, and ports.

- Telecommunications – encompassing fixed line networks, broadband networks, mobile networks (including towers), and satellite networks.

- Energy – including electricity generation, transmission, distribution, storage, and for oil & gas, upstream activities, refining, conversion, transportation, and distribution and storage, as well as coal mines, nuclear facilities, renewable assets, etc.

- Water & Sanitation – assets such as water treatment facilities and distribution networks, wastewater collection and treatment, sanitation, irrigation, and potentially broader waste collection and treatment.

That list alone captures an enormous amount of activities, but should we include educational infrastructure such as schools, healthcare institutions such as hospitals (that’s still the easy bit), social housing, before we even start to think about government buildings, let alone the quality of the judiciary and government?

For the purposes of this economically-focused report we will limit ourselves to the four key sectoral groups, given our focus on economics, financing, and facilitating private sector investment, as it is most applicable to these areas.

Historic spending

If we start by looking at what we have spent on infrastructure historically, one thing becomes very clear: considerably fewer resources are devoted to infrastructure today than was the case in the past.

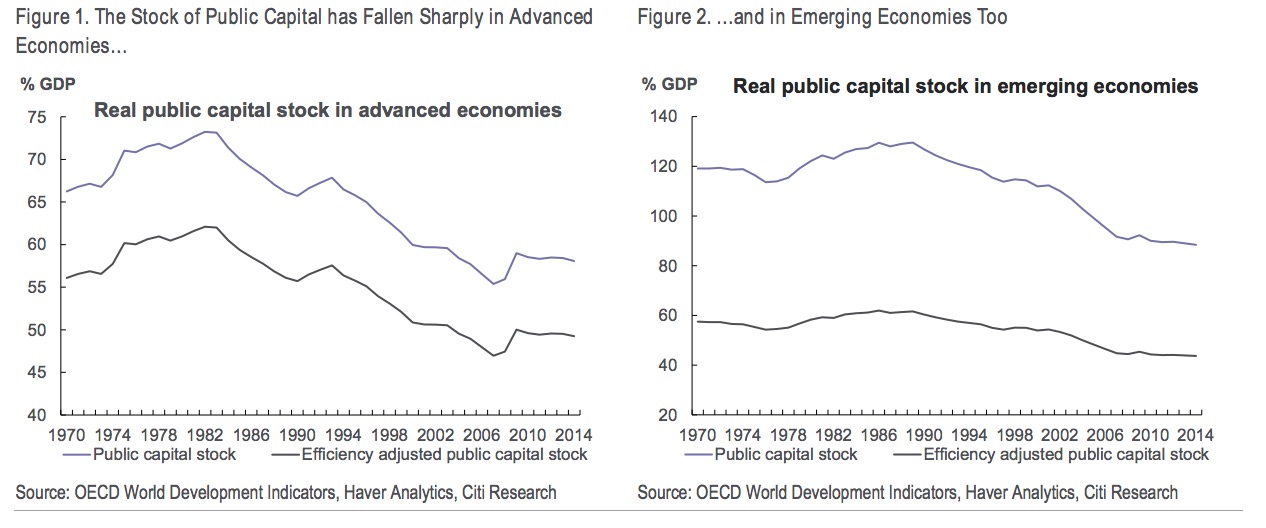

This is true both in advanced and emerging economies, as illustrated in Figure 1 and Figure 2. These charts adapt a methodology used by the International Monetary Fund (IMF) to calculate the real stock of public capital. That stock has fallen from an early-1980s peak of almost 75% of GDP to just below 60% today. In emerging economies, the stock has fallen from a late-80s peak of around 130% GDP to a level nearer 90% today.

About Citi GPS

www.citivelocity.com/citigps

“As our premier thought-leadership product, Citi GPS: Global Perspectives & Solutions is designed to help our clients navigate the global economy’s most demanding challenges, identify future themes and trends, and help our clients profit in a fast-changing and interconnected world. Citi GPS accesses the best elements of our global conversation and harvests the thought leadership of a wide range of senior professionals across our firm.”

Tags: Citi GPS, Citi Group, Citi Velocity

RSS Feed

RSS Feed