THE URBAN LAND INSTITUTE

Introduction

Aggressive government belt-tightening and financial market deleveraging restrain worldwide infrastructure investments for 2012 and probably the next five years. The need to invest the dollars that are available on projects that have the greatest effect on economic productivity, real estate demand, and global competitive position has never been more urgent. However, financial austerity and political fractures can stand in the way of better infrastructure decision making.

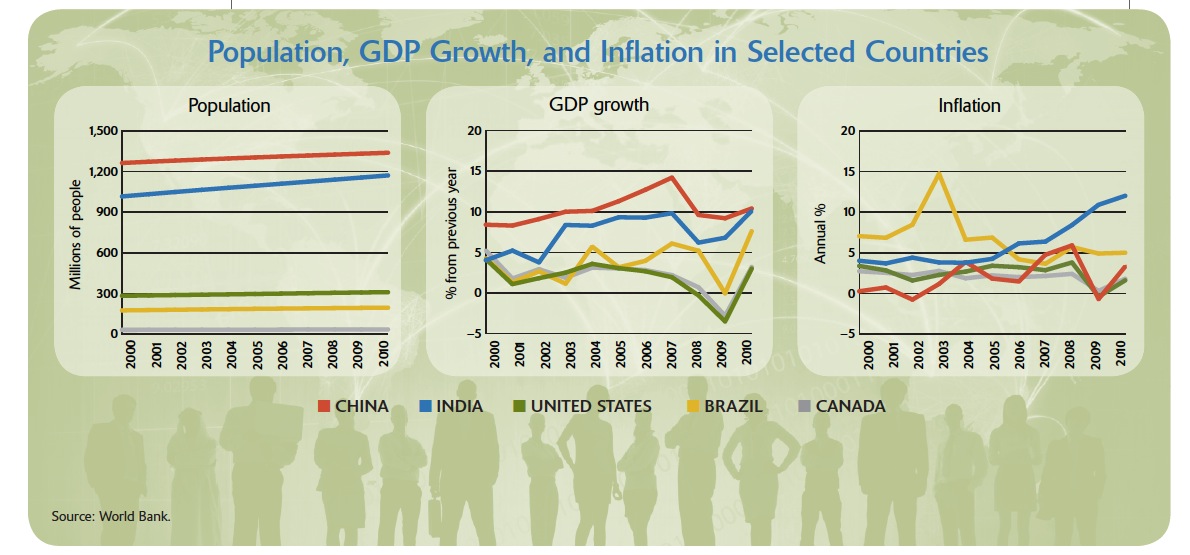

Mature economies—the United States, the United Kingdom, and nations in the European Union (EU)—struggle against widening funding gaps just as emerging-market countries, particularly India and Brazil, face increasing hurdles to meet aspirations for promoting growth. Even China hits speed bumps after an unequaled spending spree that has helped transform its economy into a global power.

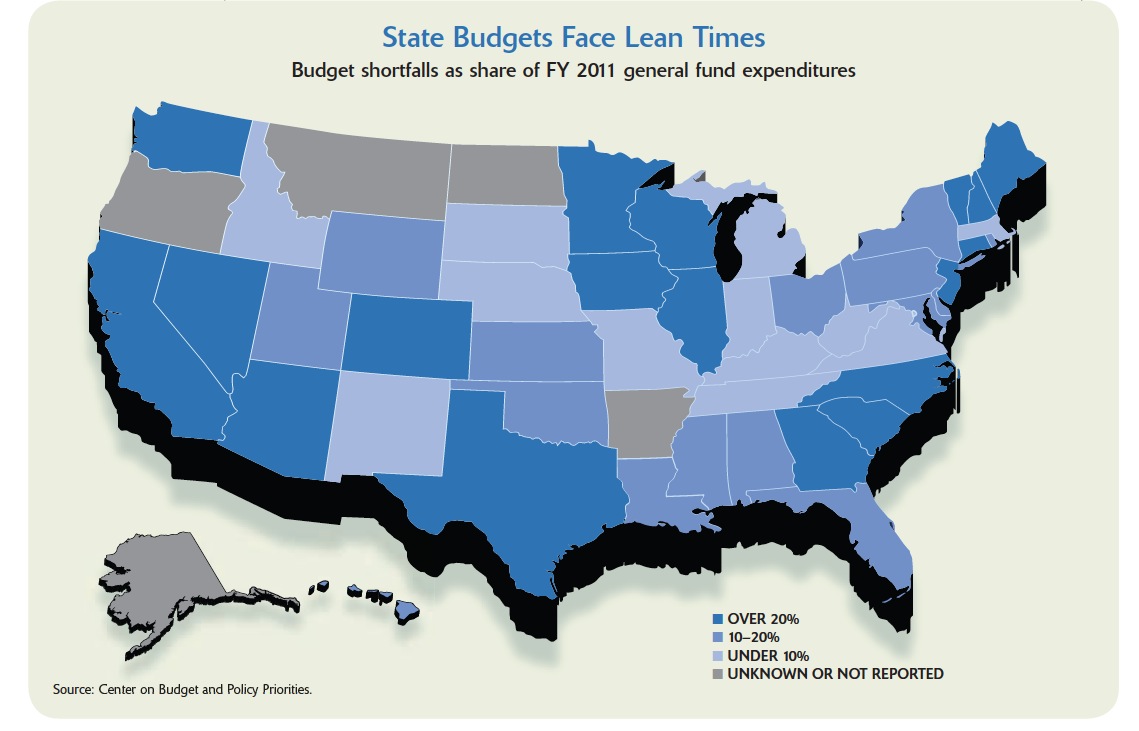

In the United States, tightened budgets and daunting challenges begin to force government officials to rethink infrastructure approaches, especially at state and local levels where the already heavy funding burden is growing. they can no longer depend on generous handouts from a congress embroiled in partisan battling over the depth of federal deficit reduction. Expensive, potentially game-changing plans for cutting-edge

networks like high-speed rail (HSR) get sidelined, at least temporarily. The urge to spread money around to reach all constituencies ebbs, replaced by a focus on trying to attain better outcomes for every dollar allocated. Still, the absence of a national policy on transportation and freight infrastructure continues to hamper U.S. ability to compete globally.

The fiscal gloom means responsible local leaders must set strategic priorities and focus available funding on critical needs, particularly maintaining existing systems. They must find creative ways to fund major projects for necessary improvements or new systems by increasing or implementing user fees such as road tolls or raising taxes. More jurisdictions mount ballot measure drives to gain constituent approvals for sales tax hikes and bond issues, which often pass when framed as beneficial for future economic growth and property values.

In more metropolitan areas, highway, transit, and housing departments consider integrated land use solutions to reduce congestion, decrease travel times, and improve quality of life for the next generations. Some jurisdictions start to pool resources for regional transportation and water planning rather than engage in increasingly unsustainable battles for dwindling federal funds. They realize they can do better by working in concert to achieve common objectives, rather than competing for tax dollars. A dose of necessary funding triage also concentrates resources on infill areas: extending infrastructure such as roads, sewer lines, and water mains to fringe areas can no longer be justified at the expense of shoring up business centers and places where populations and commerce converge.

State and local governments also step up efforts to engage private capital and expertise in partnerships to help ensure more cost-effective project design, construction, operations, and future maintenance. After early missteps, more states enact public/private partnership (PPP) enabling legislation and reach out to contractor-funder consortiums to achieve workable procurement practices that can deliver projects on time and on budget. Institutions, including pension funds, heighten interest in infrastructure investment—a growing pool of private capital becomes available to help finance properly structured government projects.

Although governments may have greater success in finding efficiencies by doing more with less, the overall state of the nation’s infrastructure will continue to deteriorate unless the political will and funding to make the needed investments materializes. And—despite recent progress—that is still a tall order in the infrastructure world.

Download the full report (PDF): Infrastructure 2012: Spotlight on Leadership

About the Urban Land Institute

www.uli.org

“ULI, the Urban Land Institute, is a 501(c) (3) nonprofit research and education organization supported by its members.

Founded in 1936, the Institute now has members in 95 countries worldwide, representing the entire spectrum of land use and real estate development disciplines working in private enterprise and public service.

As the preeminent, multidisciplinary real estate forum, ULI facilitates an open exchange of ideas, information, and experience among local, national, and international industry leaders and policy makers dedicated to creating better places.”

Tags: China, EU, European Union, U.S., United States, Urban land Institute

RSS Feed

RSS Feed