STANDARD & POOR’S RATING SERVICES

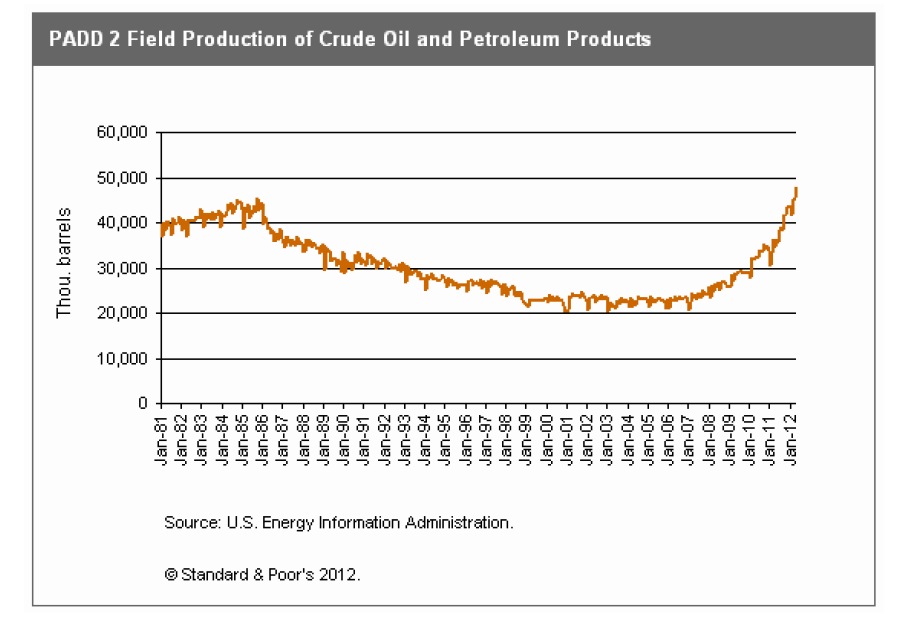

Hydraulic fracturing, commonly referred to as fracking, and horizontal drilling technology have helped transform the U.S. energy industry in recent years. By combining the two, exploration and production (E&P) companies have greatly increased their access to previously untapped oil and natural gas reserves, which has led to a significant boost in output.

The result of this pairing has been a significant rise in energy production—a trend that we believe will continue to grow. Today, the U.S. is sitting on an oversupply of natural gas, largely because we currently lack the infrastructure needed to export it. In terms of oil production, fracking and horizontal drilling have become so material that some economists believe the U.S. will be able to slowly cut back—and possibly one day stop—importing oil from abroad.

Overview

- While they’re not new technologies, fracking and horizontal drilling have significantly reshaped the U.S. energy industry in recent years.

- By using these techniques, E&P companies have dramatically increased their ability to tap previously uneconomic oil and natural gas reserves.

- The resulting energy production in the U.S. has led to an overabundance of natural gas, which we currently have no way to export, and prospects for reducing our long-term dependence on oil imports.

- We believe fracking and horizontal drilling will continue to boom, particularly in the U.S., but they will be accompanied by increased regulatory oversight regarding environmental and health concerns.

While fracking and horizontal drilling have been a boon in terms of energy production, the chemicals used in fracking do pose some environmental risks. As such, the rapid ascent of its usage has garnered some noteworthy opposition alongside its legions of supporters, which range from energy companies, equipment suppliers, and municipalities where energy production creates jobs and stimulates the economy. We believe the usage of these technologies will continue, particularly in the U.S., but it will be accompanied by further regulatory oversight regarding environmental and health concerns.

Fracking involves the injection of millions of gallons of water, sand, and chemicals at extremely high pressure into wells drilled many thousands of feet below the earth’s surface. Horizontal drilling is the process of drilling a well parallel to the oil zone, as opposed to drilling a well vertical to the oil zone. Horizontal drilling requires considerably more fracking fluid than vertical drilling—upwards of 20 times as much, according to some E&P issuers. While fracking technology has been around since the 1940s, it didn’t become a true game changer until about a decade ago, when E&P companies began to drill horizontal, or directional, wells to access significantly more of each formation’s “hydrocarbon window” than they could with traditional vertical wells. Fracking also increased rock permeability, which allows more of the hydrocarbons trapped in the rock to flow to the opening, or bore, of a drilled well.

Horizontal drilling and fracking dramatically broadened U.S. gas and oil exploration by enabling operators to extract from shale plays and tight gas formations that were previously too costly to produce hydrocarbons economically. The term “play” typically refers to a geographic area that has been targeted for exploration due to favorable geoseismic survey results, well logs, or production results from a new well in the area. Shale plays are unconventional resource plays that are characterized by very tight rock with insufficient permeability. This lack of permeability prevents hydrocarbons from flowing to the wellbore in traditional vertical drilling scenarios. We believe the development of shale plays is reshaping the energy landscape. The Energy Information Administration (EIA) has estimated that shale gas represents 44% of resources for the lower 48 U.S. states and that shale gas will account for 46% of U.S. natural gas production by 2035.

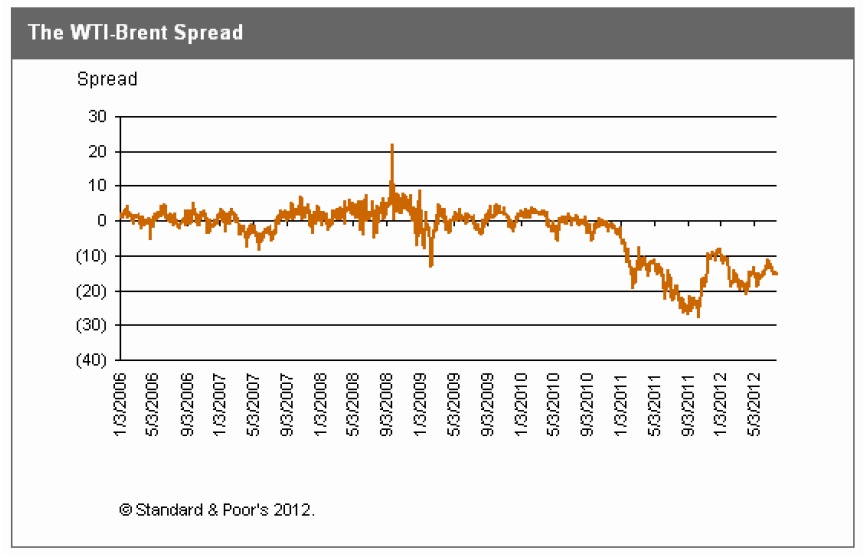

While horizontal drilling and fracking have been a boon with respect to energy production, they have contributed to an oversupply of natural gas, further widening the price spread between oil and gas. The use of horizontal drilling and fracking for oil extraction has also created a noticeable price difference between two key oil benchmarks: West Texas Intermediate (WTI) and Brent crude.

About Standard and Poor’s

www.standardandpoors.com

“With offices in 23 countries and a history that dates back more than 150 years, Standard & Poor’s is known to investors worldwide as a leader of financial- market intelligence. Today Standard & Poor’s strives to provide investors who want to make better informed investment decisions with market intelligence in the form of credit ratings, indices, investment research and risk evaluations and solutions. “

Tags: Fracking, Hydrofracking, S&P, Standard & Poor's

RSS Feed

RSS Feed