AIRPORT COOPERATIVE RESEARCH PROGRAM

Summary

In the last decade, economic upheaval, new security protocols, airline mergers and bankruptcies, and adoption of mobile technology have permanently altered the operating environment at airports. Today, most passengers check in and obtain a boarding pass before they arrive at the airport. However, not knowing how long it will really take to move through the terminal, passengers tend to arrive very early for flights. The ground experience before a passenger boards an aircraft has four distinct segments: (1) getting to the airport; (2) waiting in the terminal before security; (3) passing through security checkpoints; and, (4) finding the gate. Once in the terminal, the greatest uncertainty a passenger faces is the time spent at the security checkpoint. This is the one place where airport management has minimal control.

In the last decade, economic upheaval, new security protocols, airline mergers and bankruptcies, and adoption of mobile technology have permanently altered the operating environment at airports. Today, most passengers check in and obtain a boarding pass before they arrive at the airport. However, not knowing how long it will really take to move through the terminal, passengers tend to arrive very early for flights. The ground experience before a passenger boards an aircraft has four distinct segments: (1) getting to the airport; (2) waiting in the terminal before security; (3) passing through security checkpoints; and, (4) finding the gate. Once in the terminal, the greatest uncertainty a passenger faces is the time spent at the security checkpoint. This is the one place where airport management has minimal control.

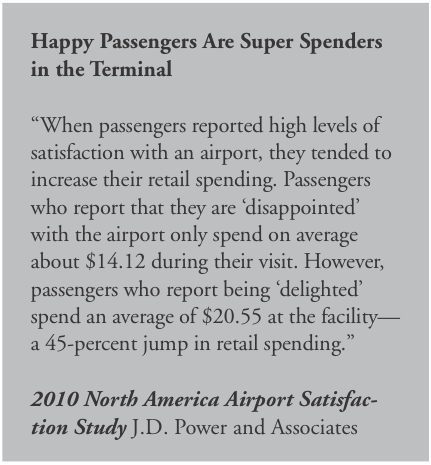

Many airports are working hard to improve efficiency and to offer a positive passenger experience before and after security checkpoints. Why is this? According to J.D. Power, “Happy passengers are super spenders.” Loyal air passengers and increased revenues to the airport sponsors are among the top priorities for airport management.

In the last few years, the airline–airport relationship has continued to evolve in unexpected ways. Domestic airlines were among the few industries that fared reasonably well through the “Great Recession” that began late in 2007. In the early 2000s, airlines had considerable experience with volatile fuel prices, unforeseen events, bankruptcies, and fluctuating passenger demand. The upside of this turmoil was that by 2006, the airlines had effective capacity metrics and cost controls in place. When the recession hit, air carriers were prepared to impose a rapid response to diminished demand for air service that included immediate removal of unprofitable flights and inefficient aircraft, reduced frequencies, attainment of higher load factors, and more widespread impositions of fees for baggage, ticket changes, and seat selection. For many industries, including airlines, 2008 was disastrous. However, by 2009, the major U.S. airlines had put in place capacity controls that allowed them to operate much smaller domestic systems and to achieve net operating profits, which continued into 2010 and 2011.

The airline response to the recession was consequential for most airports. At the largest and busiest airports, capacity reductions concentrated passengers on fewer flights. Imposition of baggage fees translated to more crowded gate areas and a larger number of passengers carrying luggage on board. At smaller airports, capacity controls resulted in fewer flights, and in some cases, termination of commercial service. With fewer airlines and reduced service in many domestic markets, airports competing to retain air service and passengers have become more customer-oriented enterprises. Reduced revenue from the airlines has also required many airports to seek other sources of non-airline revenue. Offering an outstanding passenger experience has become a strategic priority for many airports and increasingly is viewed as a competitive differentiator. Several airports around the world are renowned for their customer service, including Incheon Airport in South Korea and Changi Airport Singapore. In North America, Ottawa International, Indianapolis, and Halifax Stanfield have received awards for airport service quality. For these airports, customer service goes beyond the “built environment.” For example, at Changi Airport, security staffers greet passengers not only by name, but also with an appropriate seasonal or holiday greeting.

Read full report (PDF) here: How Airports Measure Customer Service Performance

About The Airport Cooperative Research Program (ACRP)

www.trb.org/ACRP

”The Airport Cooperative Research Program (ACRP) is an industry-driven, applied research program that develops near-term, practical solutions to problems faced by airport operators. ACRP is managed by the Transportation Research Board (TRB) of the National Academies and sponsored by the Federal Aviation Administration (FAA). The research is conducted by contractors who are selected on the basis of competitive proposals.”

Tags: airport terminal spending, airports, ARCP, Customer Service, Performance, TRB

RSS Feed

RSS Feed