AMERICAN ROAD & TRANSPORTATION BUILDERS ASSOCIATION (ARTBA)

By Dr. Alison Premo Black, ARTBA Senior Vice President & Chief Economist

Executive Summary

This analysis is the first research that has looked at the:

- Weekly fluctuation in the average retail price of a gallon of regular gasoline at the national and state levels since January 2005; and the

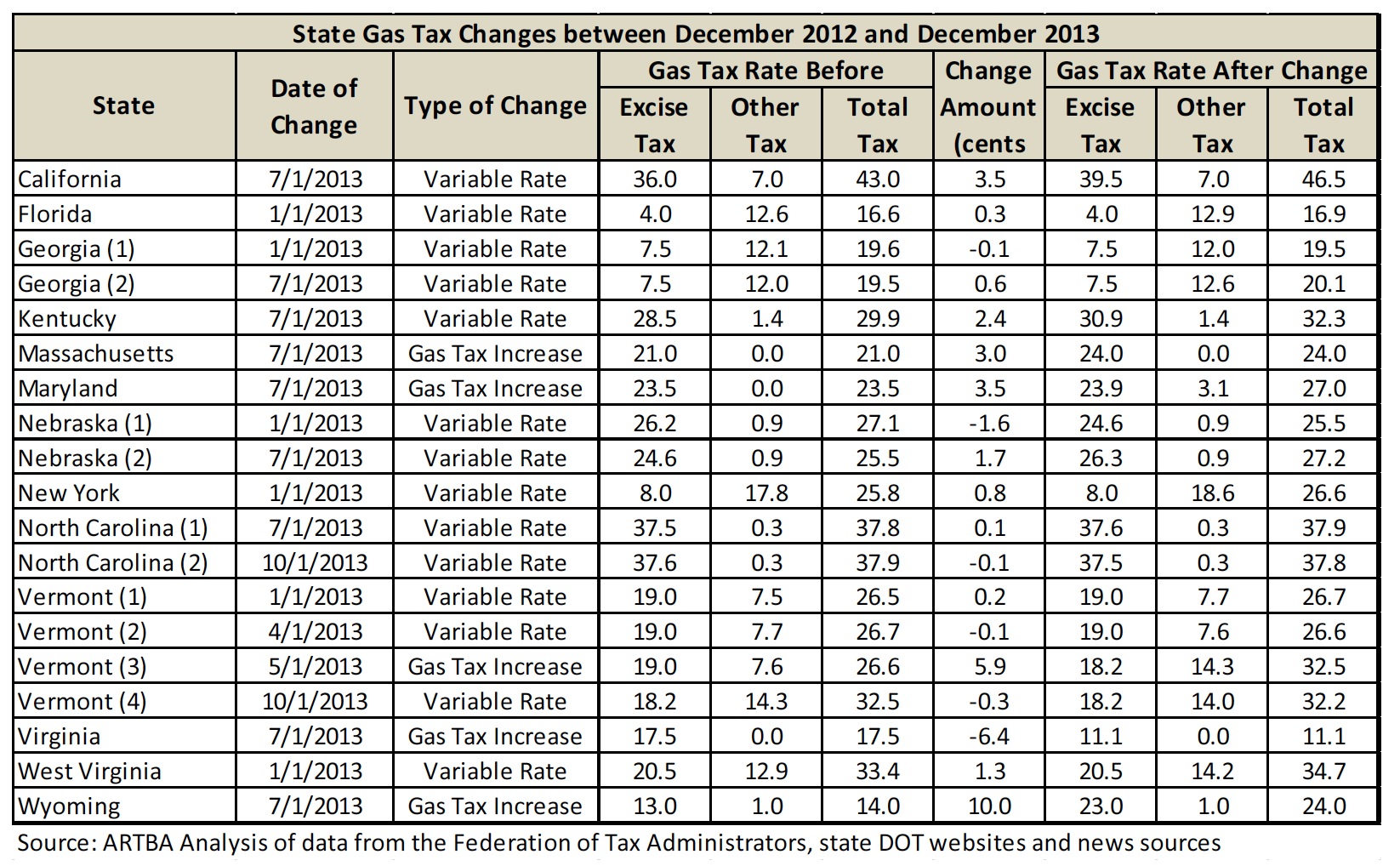

- Actual market impact gas tax increases in five states during 2013 and January 2014 had on the average state retail price of a gallon of regular gasoline the day of and the day after enactment, as well as a month and year later. The states were Massachusetts, Maryland, Pennsylvania, Vermont and Wyoming.

Based on the real world pump price impacts observed at the state level, we can forecast with a high degree of confidence the likely retail pump price impact of a 15 cent per gallon increase in the federal motor fuels excise.

For the analysis, we used data obtained from the U.S. Energy Information Administration (EIA) and the Oil Price Information Service (OPIS), one of the world’s most comprehensive sources for petroleum pricing and news information.

We found:

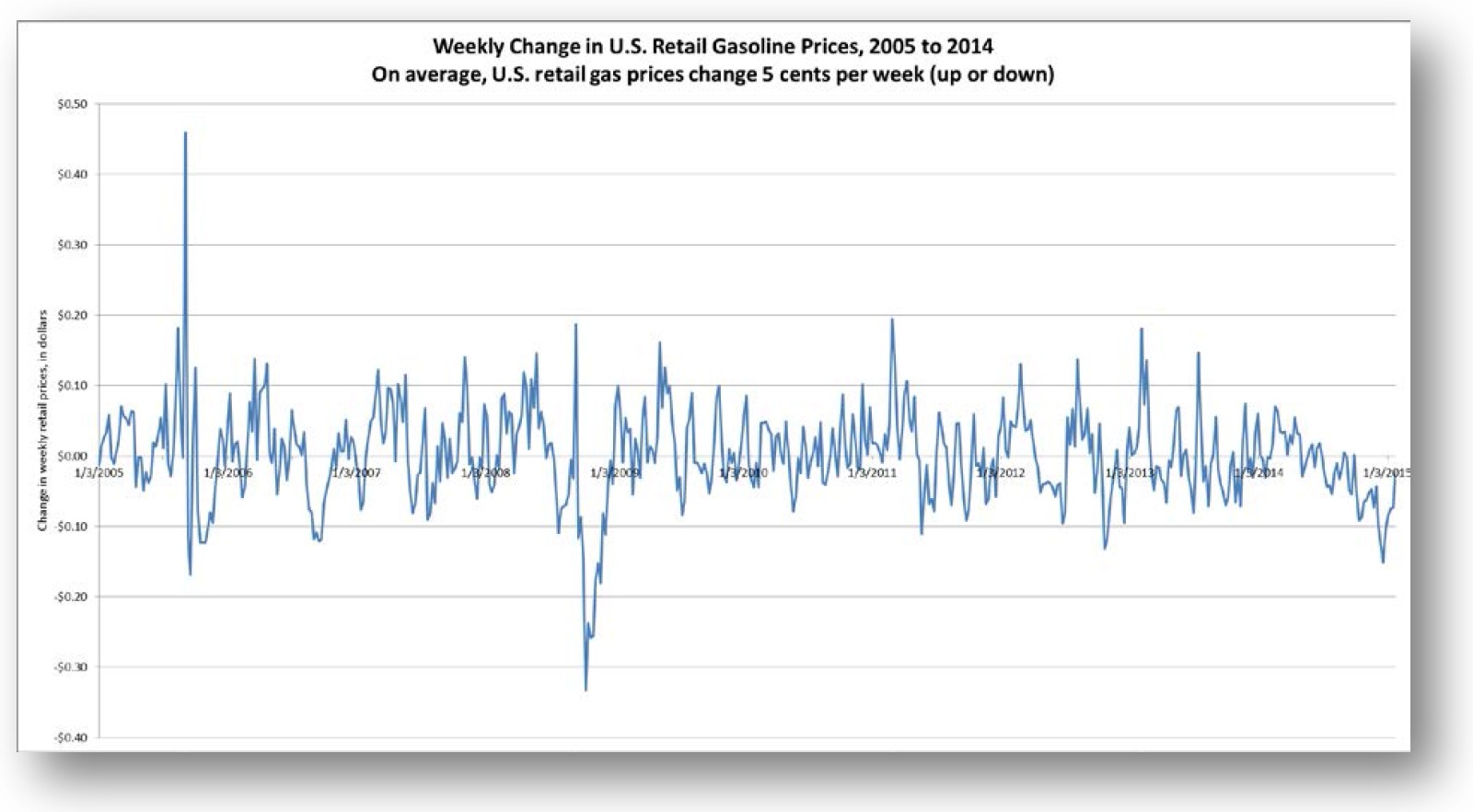

The national average retail price for a gallon of regular gasoline has fluctuated an average five cents-per-gallon week-to-week since January 2005. Compared to the average state pump price for regular gas the day before the state gas tax increases went into effect:

- On the day the tax increase went into effect, the average state pump price increased by just over one cent-per-gallon, or 15 percent of the enacted tax hike;

- On the day after the increase went into effect, the average state pump price increased only another 0.3 cents per gallon, to 1.4 cents, a total of 22 percent of the enacted tax hike;

- One month after the state increase went into effect, the average retail price of gas had risen nine cents per gallon—or 2.5 percent above the baseline price. Over the same period of time, however, the national average retail price of gas had risen 2.1 percent;

- One year after the state gas tax had gone into effect, the average price for a gallon of regular gas in those states had dropped 13 cents-per-gallon below the average baseline price—a 3.7 percent decrease. Nationally, over the same period, the average pump price had dropped 3.3 percent.

The findings corroborate the results of an empirical study of the same 2013 data using a fixed effects econometric model to examine 19 changes in state gasoline related tax rates on the retail price of gasoline. Our analysis included one-time changes as well as variable gas tax related rates.

In an interesting side note, EIA data show the U.S. average retail price for all grades of gasoline was $1.045 per gallon the week before the federal gas tax was last adjusted by 4.3 cents (up to 18.4 cents) in October 1993. The retail price of gasoline increased to $1.047 the week the increase took effect. A month after initiation of the adjustment, the average price per gallon had increased to $1.09 per gallon, but prices fell again over the next four weeks to $1.036 cents per gallon the first week of December, two months after the increase took effect.

Based on these findings, it is projected that a 15 cents-per-gallon gas tax increase at the federal level would likely result in a 5.9 cents-per-gallon increase in the pump price the week of enactment plus an additional 2.4 cents-per-gallon within four weeks of enactment. Thereafter, it would be a relatively insignificant pricing factor. In fact, the impact of a 15 cent increase in the federal gas tax would likely be “lost” in the week-to-week price fluctuation that has occurred at the gas pump for the last 10 years.

Download full version (PDF): How a Gas Tax Increase Affects the Retail Pump Price

About the American Road & Transportation Builders Association (ARTBA)

www.artba.org

The Washington, D.C.-based American Road & Transportation Builders Association is a federation whose primary goal is to aggressively grow and protect transportation infrastructure investment to meet the public and business demand for safe and efficient travel. In support of this mission, ARTBA also provides programs and services designed to give its 6,500+ public and private sector members a global competitive edge.

Tags: Alison Premo Black, American Road & Transportation Builders Association, ARTBA, Gas Prices, Gas tax

RSS Feed

RSS Feed