PricewaterhouseCoopers (PwC)

Infrastructure spending has begun to rebound from the global financial crisis and is expected to grow significantly over the coming decade.

That is the main finding of Capital project and infrastructure spending: Outlook to 2025, our in-depth analysis of 49 countries that account for 90% of global economic output. Our thanks to Oxford Economics for providing research support.

In developing this analysis, Oxford Economics used data sets to provide consistent, reliable, and repeatable measures of projected capital project and infrastructure spending globally as well as by country. Historical spending data is drawn from government and multinational organization statistical sources.

Projections are based on proprietary economic models developed by Oxford Economics at the country and sector levels. For more information on the methodological basis for these projections, please see page 6 of Capital project and infrastructure spending: Outlook to 2025 research findings.

Worldwide, infrastructure spending will grow from $4 trillion per year in 2012 to more than $9 trillion per year by 2025. Overall, close to $78 trillion is expected to be spent globally between 2014 and 2025.

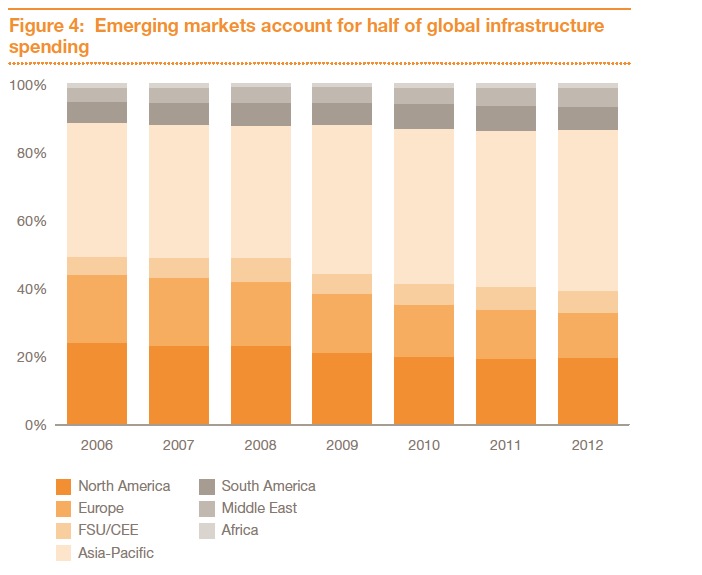

But the recovery will be uneven, with infrastructure spending in Western Europe not reaching pre-crisis levels until at least 2018. Meanwhile, emerging markets, unburdened by austerity or ailing banks, will see accelerated growth in infrastructure spending, especially China and other countries in Asia.

And megacities in both emerging and developed markets—reflecting shifting economic and demographic trends—will create enormous need for new infrastructure. These paradigm shifts will leave a lasting, fundamental imprint on infrastructure development for decades to come.

Among our conclusions:

- The Asia-Pacific market, driven by China’s growth, will represent nearly 60% of global infrastructure spending by 2025. In contrast, Western Europe’s share will shrink to less than 10% from twice as much just a few years ago.

- To realize the expected surge in infrastructure spending, emerging markets will need to provide the proper mix of economic, social and environmental factors, sometimes referred to as the enabling environment. Some also will have to create a more conducive business environment for investors, engineering and construction firms by overcoming such obstacles as unpredictable regulations, bureaucratic delays, and struggles to secure land rights.

- Growing urbanization in emerging markets such as China, Indonesia, and Nigeria should boost spending for such vital infrastructure sectors as water, power, and transportation.

- Increasing prosperity in emerging markets will impel infrastructure financing toward consumer sectors, including transportation and manufacturing sectors that provide and distribute raw materials for consumer goods.

- Demographic changes will vary by region and country, affecting both the amount and type of infrastructure spending. Aging populations in Western Europe and Japan, for instance, will require additional healthcare facilities, while countries in Sub-Saharan Africa, the Middle East, and many parts of Asia-Pacific will need more schools for their youth.

This report offers public officials and private-sector organizations—investors, engineering, and construction firms, as well as other organizations participating in the capital projects & infrastructure market—a roadmap to the fast-changing market for capital projects & infrastructure over the next decade.

With a clear understanding of the landscape, you are better equipped to identify the most promising opportunities, manage the challenges, and secure the best returns.

Download full version (PDF): Capital Project and Infrastructure Spending

About PwC

www.pwc.com

“We bring a global perspective along with in-depth knowledge of local, state and US issues. In 1998, Price Waterhouse and Coopers & Lybrand merged to create PricewaterhouseCoopers. We have a long history of delivering value-added professional services to our clients. Our accounting practice originated in London during the mid-1800’s…PwC focuses on audit and assurance, tax and consulting services. Additionally, in the US, PwC concentrates on 16 key industries and provides targeted services that include — but are not limited to — human resources,deals, forensics, and consulting services. We help resolve complex issues and identify opportunities.”

RSS Feed

RSS Feed