PWC

OXFORD ECONOMICS

How can stakeholders manage capital project investments in a challenging environment?

It’s going to be a bumpy ride for capital project and infrastructure (CP&I) spending, especially in the near term. Volatile economic forces are making decisions about capital spending difficult and inhibiting strategic planning.

A combination of unanticipated concerns – including the decline in oil and commodity prices, a slowdown in China’s growth rate, sluggish gains in the developed world, the strong US dollar and uncertain forecasts for multinationals – have for many companies and governments inevitably put CP&I expenditures on the back burner1.

The UK’s recent decision to exit the European Union came after the research for this report was finalised. It is too early to comment on the specific UK and global impact of Brexit in 2020, however, in the short-term the additional uncertainty and volatility is likely to directly impact the UK CP&I market and indirectly impact the global CP&I market, although the latter is unlikely to be severe.

Yet, unlike cost cutting or an M&A deal, increasing or trimming CP&I spending is not a quick fix. Because it involves long-term considerations – do you need a new factory in Asia; is that highway upgrade necessary; will the electric grid provide sufficient energy for demand in ten years? – and long-term projects, enterprises shouldn’t make capital project decisions based on immediate macro- and micro-economic conditions.

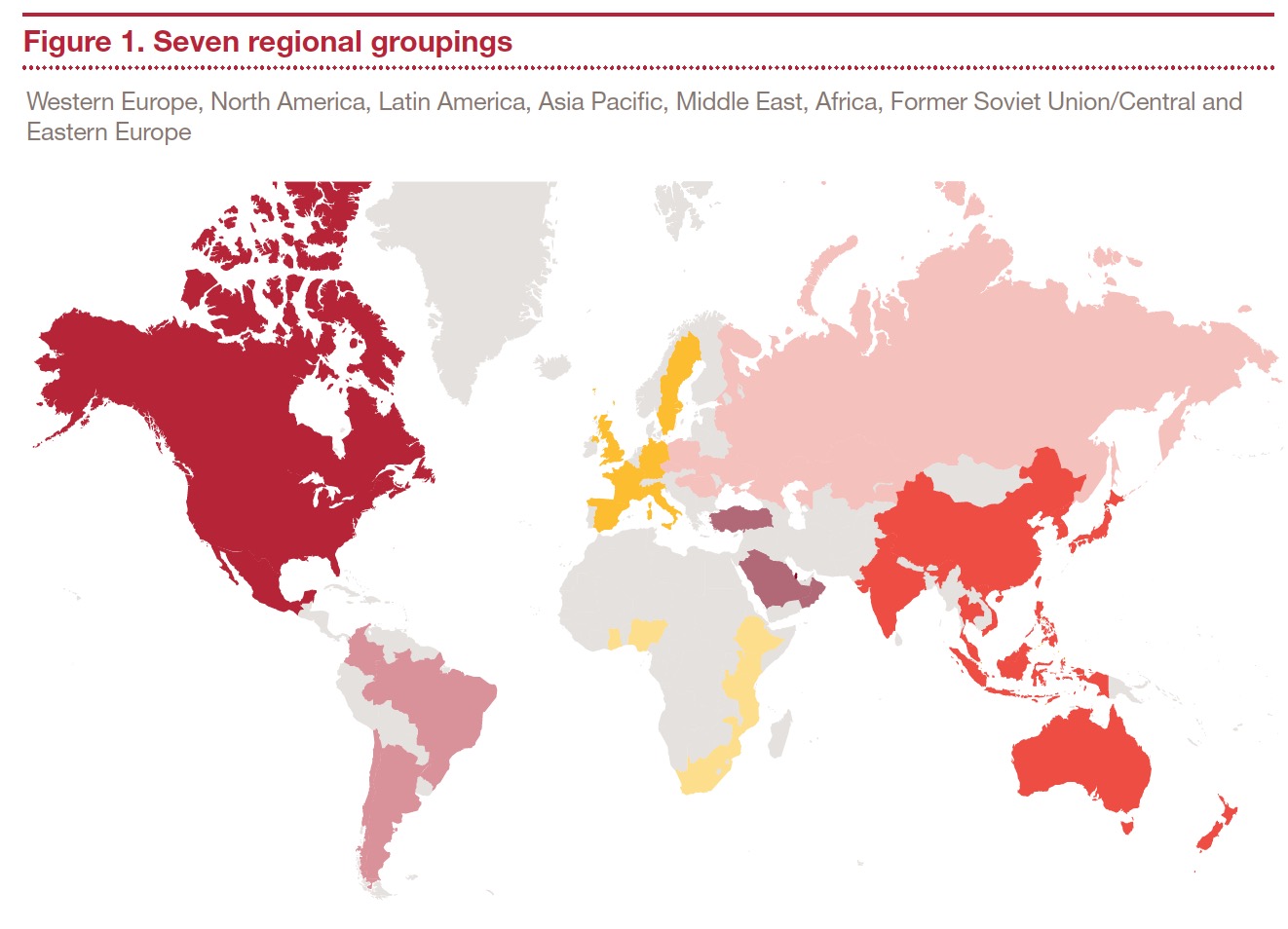

There is no simple way to do this. But to provide analytical insight that could help shape CP&I decisions, PwC asked Oxford Economics to examine the capital projects and infrastructure environment for the next five years through the lens of two opposite scenarios: a hard landing in China and a global upturn. We assessed the prospects for CP&I spending across seven regions (see Figure 1) and six key infrastructure sectors (see Figure 2) under both of these scenarios. And we offer a series of strategic and tactical recommendations for stakeholders to prepare for an unsettled landscape.

Our goal is to provide CP&I stakeholders with options for making the right decisions about capital expenditures. In our view, it is more important than ever for companies affected by CP&I volatility to understand the potential range of possibilities they could face and be sufficiently agile to respond to conditions as they change. Says Peter Raymond, PwC US and global and Americas and Asia CP&I leader, ‘… the challenge is how to manage through the short term so you can be positioned to grow effectively over the long term – after the uncertainty subsides’.

Two scenarios

Oxford Economics estimates that if conditions stay as they are – what we are calling the baseline projection – capital project and infrastructure spending growth will likely remain low, hovering at about 2%, over the coming year, before inching up in 2017 and reaching about 5% in 2020. The improvement would be driven mainly by higher oil. However, even at 5% growth, infrastructure spending growth would be well below its double-digit levels before the global financial crisis. Different pictures emerge, however, under the two opposing scenarios that we examined (see Figure 3):

The downside

Overview

The downside scenario would be a Chinese hard landing, a real possibility considering the recent serious slowdown in Chinese GDP growth, from 14% in 2007 to half that now. To explore this and its impact on capital investments in infrastructure, Oxford Economics assumed a Chinese economic environment in which the yuan would depreciate by as much as 10%, housing sales would slump sharply, consumers would postpone new purchases and wage growth would decline. Moreover, the pressure on developers’ cash flow, under this scenario, would trigger a renewed decline in Chinese house prices and a sharp fall in housing construction. Domestic and external confidence would abate, resulting in a scaling back of private investment.

Under the China hard landing scenario, CP&I spending between 2015 and 2020 would fall by 4%, and CP&I spending growth would likely hit almost zero in 2016 and pick up only slightly in 2017. In dollar terms, a China hard landing would reduce CP&I expenditures by US$1.1 trillion between 2015 and 2020 (compared to the baseline) – from US$28.2 trillion to US$27.1 trillion.

Regional view

Over 60% of the decline in infrastructure spending would occur in Asia Pacific, by far the most affected region (see Figure 4). In large part this is because of China’s economic dominance in Asia Pacific. Any slowdown in China would have palpable ripple effects among its neighbors, who rely on Chinese demand for their goods and services to stimulate their economies.

On the other hand, Asia Pacific countries would not be greatly affected by lower demand for commodities and extracted materials, at least relative to other areas of the world. So, in that regard, China’s hard landing would most impact regions like Latin America and the Middle East and countries like Russia, whose economies are heavily invested in exports of oil and other extracted products. Without those revenue streams, investments in public or private development projects would sharply decline.

In fact, in Latin America, the recent steep drop in commodity prices, mainly a result of current Chinese economic slowdown, has already weighed upon infrastructure spending in the region. And there is not much optimism that this will change.

Sector view

The impact of a China hard landing would widely spread out among the key sectors (see Figure 5). Extraction would take the worst hit because weakness in Chinese infrastructure and manufacturing development would significantly slash demand for oil, steel and other commodities. Even without further economic instability in China, capital investment in extraction efforts would be diminished, a victim of depressed prices, especially in the oil patch, given that energy majors suspended some hundreds of billions of dollars of investment on new projects over the past year. This is because many upstream Independents and National Oil Companies (NOC’s) have slashed capital budgets, by more than 50% from their already reduced 2015 capital budgets, and Independents are selling non-core assets to raise cash and managing capital spending within their cash flows in this leaner for longer macro-economic environment.

The forecast for the extraction sector would also likely weaken, particularly in regions such as the Middle East and Former Soviet Union/Central and Eastern Europe (FSU/CEE), which rely heavily on the extraction sector. ‘Oil and gas companies are rebalancing or restacking their portfolios and have cut investments,’ says Neil Broadhead, PwC UK and Europe and Middle East CP&I leader. ‘They’re looking to cut costs in their supply chains as well, and they are reprioritising projects based on expectations of oil and gas prices as well as progress along the project continuum’.

Transport and utilities account for about half of CP&I infrastructure spending in Asia Pacific, and these sectors would also fare poorly if conditions in China worsen. In fact, in absolute terms, transport, extraction and utilities would account for almost three-quarters of the reduction in global infrastructure spending between 2015 and 2020 under the China hard landing scenario.

Even without Chinese shortfalls, utilities have been under some pressure globally, buffeted by a combination of subsidy cuts in Europe for renewable energy projects; sluggish global economic and trade growth, which reduces demand for electricity; and diminished private sector thirst for capital projects in the face of a negative commodities price environment.

Similarly, investment in transport projects will likely have a rocky few years ahead no matter how global conditions turn out. Although many governments are not as wedded to austerity budgets as they were a short time ago, few are willing to open wide the coffers to fund major infrastructure projects. And in the Middle East, where transport infrastructure development has had a lot of attention and funding for the past few decades, the fall in oil prices is dampening enthusiasm for these big efforts.

And while investment in manufacturing might not take too big a hit under the downside scenario, this sector, too, may not be on firm ground. The potential scaling back of petroleum refining plants may be one problem; however, refining only accounts for around

16% of manufacturing infrastructure spending. Equally problematic, though, would be the outlook for investments in chemicals and heavy metals, which also face price constraints.

The upside

Overview

The global upturn scenario analysed by Oxford Economics assumes that recent market gloom would fade, confidence would increase, and growth would pick up in a number of economies. US investment would rise, amid renewed expansion in lending to business. And investment in Western Europe also would strengthen, supported by robust business sentiment, rising profits and increased capacity utilisation.

Under this plot line, in some parts of the world, governments would pursue more expansionary fiscal policies. With greater confidence that bond markets will remain accommodative, countries with fiscal flexibility would increase public investment in infrastructure projects. And there would be one surprise in this scenario: with renewed economic optimism, oil production would rise more than expected under normal conditions. With more supply on hand than the baseline forecast anticipated, the global upturn scenario predicts slightly slower increases in oil prices.

In this analysis, global infrastructure investment between 2015 and 2020 would hit US$28.8 trillion, about US$1.7 trillion more than the outcome of a Chinese hard landing and US$600 billion more than the baseline.

Tags: China, Europe, Oxford Economics, PwC

RSS Feed

RSS Feed