TAX FOUNDATION

By Joseph Henchman

A key issue for state governors and legislators is how to pay for transportation expenses. In the last year, Virginia and Massachusetts raised a number of taxes for transportation purposes, a handful of states raised gasoline taxes, Oregon began testing a “vehicle mileage tax” (VMT) pricing system, and other states proposed new or expanded toll roads.[1]

The lion’s share of transportation funding should come from user fees (amounts a user pays directly for a service the user receives, such as tolls) and user taxes (amounts a user pays, based on usage, for transportation, such as fuel and motor vehicle license taxes).[2] When road funding comes from a mix of tolls and gasoline taxes, the people that use the roads bear a sizeable portion of the cost. By contrast, funding transportation out of general revenue makes roads “free,” and consequently, overused or congested—often the precise problem transportation spending programs are meant to solve.

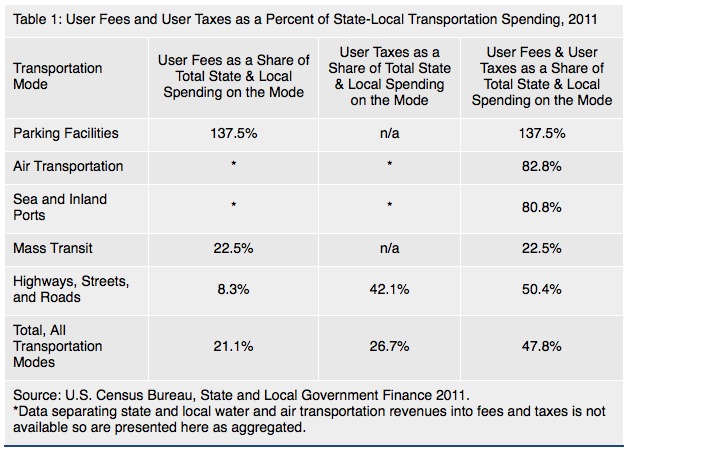

Nationwide in 2011, highway user fees and user taxes made up just 50.4 percent of state and local expenses on roads. State and local governments spent $153.0 billion on highway, road, and street expenses but raised only $77.1 billion in user fees and user taxes ($12.7 billion in tolls and user fees, $41.2 billion in fuel taxes, and $23.2 billion in vehicle license taxes).[3] The rest was funded by $30 billion in general state and local revenues and $46 billion in federal aid (approximately $28 billion derived from the federal gasoline tax and $18 billion from general federal revenues or deficit financed).

The ratios do not improve when adding in all transportation modes. In 2011, state and local governments spent $58.7 billion on mass transit, $22.7 billion on air transportation facilities, $1.6 billion on parking facilities, and $5.2 billion on ports and water transportation, in turn raising $13.2 billion in mass transit fares, $18.8 billion in air transportation fees, $2.2 billion in parking fees and fines, and $4.2 billion in water transportation taxes and fees.[4] While state and local governments generated surplus revenue from parking facilities and fines, no transportation mode was free of subsidy (see Table 1).

About the Tax Foundation

taxfoundation.org

“One of the nation’s most trusted think tanks, the Tax Foundation has since 1937 provided Americans with basic information and policy analysis to promote simple, sensible tax policy at the federal and state levels. Best known for our annual calculation of “Tax Freedom Day,” we work to raise economic awareness among taxpayers, lawmakers, and media.”

About Joseph Henchman

taxfoundation/staff/joseph-henchman

“Joe Henchman is an attorney and policy analyst who supervises the Tax Foundation’s state policy (since 2009) and legal (since 2007) programs, analyzing state tax trends, constitutional issues, and tax law developments. In 2010, he was identified in State Tax Notes as among four people who “will likely dominate the field in the next 10 years,” and the state program was honored as most influential in state tax policy by State Tax Notes for 2011, 2012, and 2013.”

Tags: Gas tax, Joseph Henchman, Tax Foundation, VMT

RSS Feed

RSS Feed