FEDERAL RESERVE BANK OF SAN FRANCISCO

ECONOMIC RESEARCH DEPARTMENT

Written by Sylvain Leduc and Dan Wilson

Highway spending in the United States between 2008 and 2011 was flat, despite the serious need for improvements and the big boost to state highway funds from the Recovery Act of 2009. A comparison of how much different states received and spent shows that these federal grants actually boosted highway spending substantially. However, this was offset by pressures to reduce state highway spending due to plummeting tax revenues. In fact, analysis suggests national highway spending would have fallen roughly 20% over this period without federal highway grants from the Recovery Act.

The aging U.S. transportation infrastructure has been steadily deteriorating for many years now and needs serious maintenance and repair. The American Society of Civil Engineers gave the nation’s roads a “D” rating in 2013, indicating that they are mostly below standard, with a large portion of the system exhibiting significant deterioration. Similarly, the World Economic Forum ranked the United States 18th in the world in terms of road quality in 2013. While it’s widely acknowledged that the country’s highways need repairs, policymakers disagree about how to pay for these improvements.

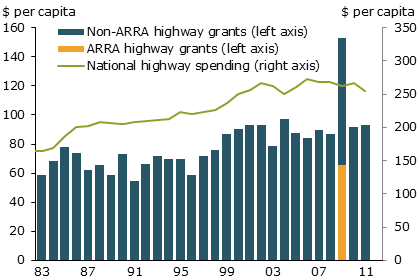

During the Great Recession, a surge in federal government spending was one option frequently called for as a means to sustain and stimulate the economy. Given the substantial perceived need for infrastructure improvements, many commentators argued that highways should be near the front of the line for any stimulus dollars. It is no surprise then that the 2009 fiscal stimulus package known as the American Recovery and Reinvestment Act (ARRA) contained $48 billion in transportation funding, $27 billion specifically for roads. These funds generally took the form of grants to state governments and were in addition to the usual federal transportation grants sent to state governments every year from the national Highway Trust Fund. Thanks to ARRA, federal highway grants to states jumped nearly 75% in 2009. Still, road spending by state and local governments nationwide—which is the source of virtually all road spending in the United States—was roughly flat between 2008 and 2011.

Because highway grants from the Recovery Act essentially had no strings attached, state governments were free to use the additional funds as they saw fit. This, together with the lack of increase in highway spending nationally between 2008 and 2011, caused many people to conjecture that state governments must have used the funds either to pay down debt or for other purposes, rather than actually spending the money on roads.

Yet, using national statistics to infer the outcome of stimulus spending is problematic because it doesn’t tell us how highway spending would have evolved without the extra funds from federal highway grants. State tax revenues declined dramatically during the Great Recession, and because states are quite limited in their ability to borrow or tap into savings during downturns, highway spending might well have declined dramatically also.

In this Economic Letter, we turn to the more detailed state-level transportation data to examine the extent to which highway grants from the Recovery Act led states to increase their spending on roads. Strikingly, these data show a very strong positive relation between how much a given state received in ARRA highway grants and how much the state spent on roads over 2009 to 2011. Additional analysis suggests this correlation reflects a causal effect of federal grants on state highway spending. In fact, we find that state highway spending was boosted over these three years even more than dollar-for-dollar with the ARRA highway grants, as initial spending appears to have spurred complimentary investment in subsequent years.

About one-third of the total cost of the ARRA came in the form of grants to state governments. Many observers have argued that the federal government relinquishes much of its control over how stimulus funds are ultimately used when it gives such grants to states. They argue that the federal government instead should allocate stimulus dollars to direct federal purchases. But in the case of highway infrastructure, this would be difficult since road construction and maintenance are primarily administered by state and local governments. Nevertheless, our findings indicate that, at least in the case of road infrastructure, conducting countercyclical fiscal policy through changes in grants can indeed be effective at boosting state government spending on the targeted activity.

Highway grants in the Recovery Act

The financial crisis in the fall of 2008 and the rapid decline in economic activity that followed led to the enactment of the American Recovery and Reinvestment Act (ARRA) in February 2009. The latest estimates put the 10-year cost of the package at roughly $800 billion, with the vast majority of the costs incurred in the first three years. The Recovery Act involved a combination of tax cuts, representing roughly one-third of the cost, and increased spending.

The financial crisis in the fall of 2008 and the rapid decline in economic activity that followed led to the enactment of the American Recovery and Reinvestment Act (ARRA) in February 2009. The latest estimates put the 10-year cost of the package at roughly $800 billion, with the vast majority of the costs incurred in the first three years. The Recovery Act involved a combination of tax cuts, representing roughly one-third of the cost, and increased spending.

Of the spending, about half took the form of grants to state and local governments. Specifically, the Bureau of Economic Analysis (BEA) reports that between 2009 and 2012, $282 billion was paid out in federal transfers to help support health, education, infrastructure, and other programs at state and local levels. Capital grants for transportation infrastructure constituted nearly $48 billion of these transfers between 2009 and 2012, with $27 billion going toward highway grants to state governments. This was on top of the usual grants states receive every year out of the federal Highway Trust Fund.

The importance of ARRA grants relative to other highway grants is shown in Figure 1. The bars in the figure show that states received between $50 and $100 per capita in highway grants annually between 1983 and 2008, valued in 1997 dollars. The Recovery Act added about $70 per capita ($27 billion) in 2009, a jump of nearly 75% in a single year. Yet, national spending on highways remained roughly flat between 2008 and 2011 (green line).

Download full version (PDF): Fueling Road Spending with Federal Stimulus

About the Economic Research Department

www.frbsf.org

The Economic Research Department conducts research on monetary policy, macroeconomics, banking, financial markets, applied microeconomics, and the regional economy in support of the Federal Reserve Bank’s policy and public outreach functions. In addition, the department hosts a research center, the Center for Pacific Basin Studies.

Tags: American Recovery and Reinvestment Act, ARRA, Dan Wilson, Federal Reserve Bank of San Francisco, Federal Stimulus, Sylvain Leduc

RSS Feed

RSS Feed