THE NEW CLIMATE ECONOMY

THE GLOBAL COMMISSION ON THE ECONOMY AND CLIMATE

Overview

About US$90 trillion in infrastructure investment is needed globally by 2030 to achieve global growth expectations, particularly in developing countries. To achieve this, infrastructure investment needs to be both scaled up, and, due to climate risk, integrate climate objectives.

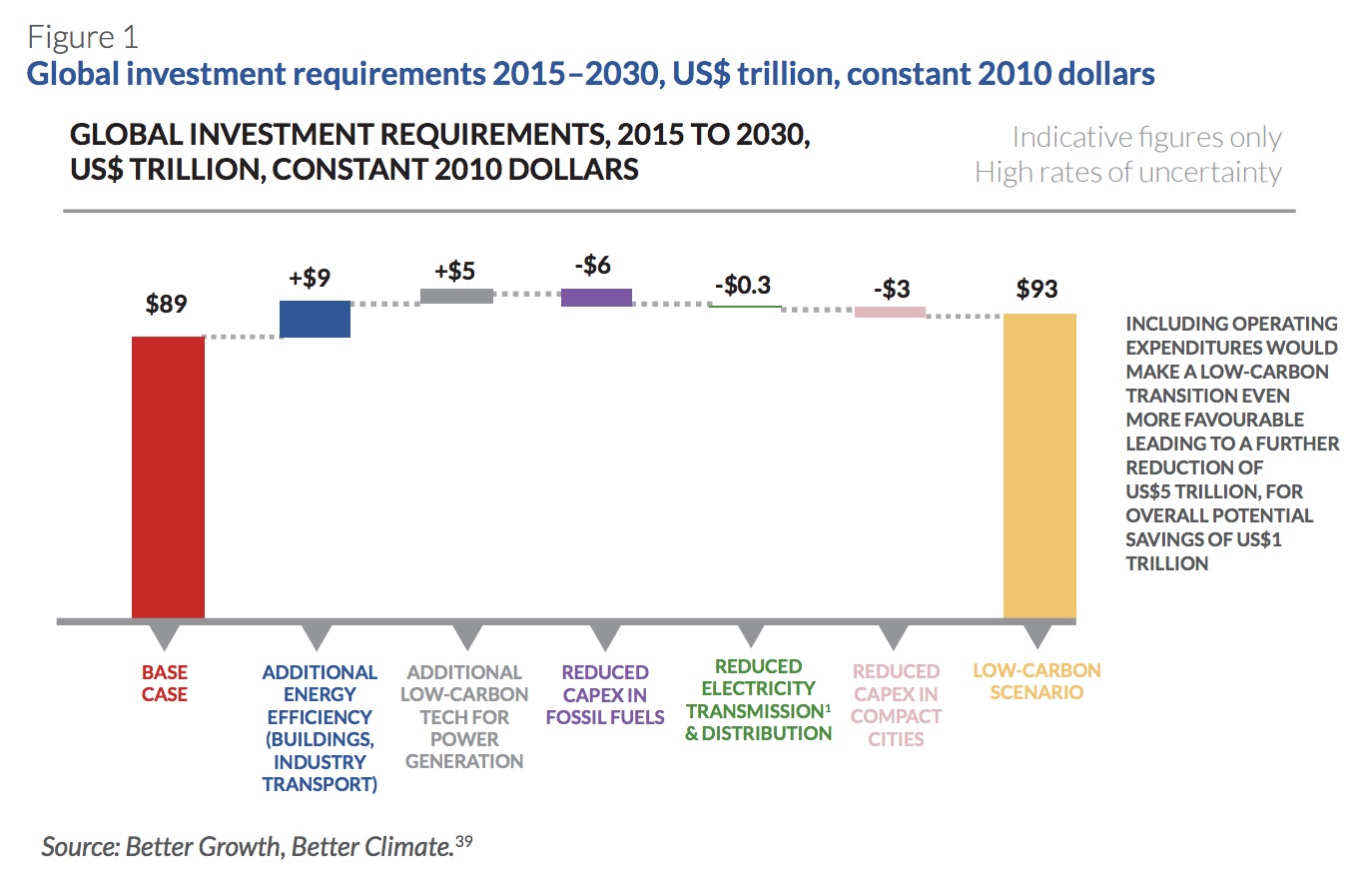

Infrastructure investment has become a core focus of international economic cooperation through the G20 and also for established and new development finance institutions. Integrating climate objectives into infrastructure decisions will increase resilience to climate change impacts, avoid locking in carbon-intensive and polluting investments, and bring multiple additional benefits, such as cleaner air and lower traffic congestion. Shifting to low-carbon infrastructure could add as little as 5% to upfront investment costs in 2015-2030. These costs could be offset by resulting energy and fuel savings.

A number of institutions have already started integrating climate risk into their investment decisions, but this needs to be done in a far more systematic way, making best practices the norm. For example, several international institutions are working to halt unabated coal project financing, but this effort will need to extend to national development banks and newer multilateral development banks (MDBs).

International finance will also have to be significantly scaled up to deliver the US$90 trillion. This includes increasing capitalisation of both national and multilateral development banks.

The Global Commission on the Economy and Climate recommends that G20 and other countries adopt key principles ensuring the integration of climate risk and climate objectives in national infrastructure policies and plans.

These principles should be included in the G20 Global Infrastructure Initiative, as well as used to guide the investment strategies of public and private finance institutions, particularly multilateral and national development banks. Governments, development banks and the private sector should cooperate to share experience and best practice in mainstreaming climate into infrastructure policies, plans and projects.

1. Introduction

Infrastructure is a foundation for economic growth. Robust, efficient power grids, water and sewer systems, transportation systems and communications networks are essential to modern economies and societies. They shape our economies in profound ways, determining whether people drive, walk, cycle or ride public transit, whether we remain dependent on fossil-fuelled power or move towards renewables and enhanced energy efficiency, and whether heavy downpours cause devastating floods or landslides, or storm water is efficiently channeled out to sea.

Better Growth, Better Climate estimated that over the next 15 years, about US$90 trillion in infrastructure investments will be needed in cities, energy and land use systems around the world. These investments will largely determine the path of economic growth and the future of the climate system. Getting infrastructure investment right can provide a foundation for sustained growth and prosperity, while also reducing climate risk. Getting it wrong will waste resources on assets that may be damaged by climate change or devalued or stranded if policy changes, and will increase the risk of severe climate impacts that undermine future economic growth and development.

In recent years, infrastructure investment has become a core focus of international economic cooperation, notably through the G20 and the development finance institutions (DFIs). The G20 established a new Global Infrastructure Initiative (GII) in 2014, along with a Global Infrastructure Hub (GIH) to implement it, with the aim of catalysing both public and private investment. New multilateral and national development banks are being established with a specific infrastructure focus, notably the Asian Infrastructure Investment Bank and the New Development Bank. Yet the G20 Global Infrastructure Initiative largely ignores the close links between infrastructure investment and climate change, as do many national and local government planning processes: too often infrastructure and climate policies exist in separate silos.

However, some institutions are now pioneering new methods of “mainstreaming” climate concerns into infrastructure planning and policy. The multilateral development banks (MDBs) and the International Development Finance Club of national development banks (IDFC) have agreed to work together to develop best practices for “greening” finance, including principles for tracking climate change adaptation finance. In the private sector banks and pension funds are collaborating to boost investment in climate-smart infrastructure–Bank of America’s Catalytic Finance Initiative, for example, is collaborating with DFIs, insurers and other financial institutions to develop de-risking instruments for clean energy projects. There is now significant scope for stronger international cooperation, including both among governments and with the private sector, to share best practices and methodologies on the integration of climate into infrastructure investment decisions.

This paper explores how this can be done. It starts by looking at the infrastructure “investment gap” and how the aim of closing it has risen to the top of the international economic agenda in recent years. It then discusses the importance of integrating climate change issues in infrastructure decision-making, and examines how governments, businesses and investors can individually or together help to mainstream climate into infrastructure planning and policies, proposing two principles for climate-smart infrastructure. The final section sets out the Global Commission’s recommendations.

Download full version (PDF): Ensuring New Infrastructure is Climate-Smart

About the New Climate Economy

newclimateeconomy.report

The Global Commission on the Economy and Climate, and its flagship project The New Climate Economy, were set up to help governments, businesses and society make better-informed decisions on how to achieve economic prosperity and development while also addressing climate change.

Tags: Global Commission on the Economy and Climate, New Climate Economy

RSS Feed

RSS Feed