WASHINGTON STATE DEPARTMENT OF TRANSPORTATION

EXECUTIVE SUMMARY

This report responds to an inquiry by the State of Washington about the viability of natural gas as an alternative source of energy for transportation. The report is organized around responses to several key research tasks. These tasks are to: 1) Document the increase in supply of natural gas, estimate future price, and availability; 2) Assess the extent to which natural gas is likely to substitute for petroleum; 3) Estimate the extent to which price and performance effects will influence VMT trends in Washington State; 4) Estimate changes in GHG emissions in Washington State attributable to increased use of natural gas; 5) Estimate potential loss of fuel tax revenue attributable to substitution of natural gas for petroleum fuels.

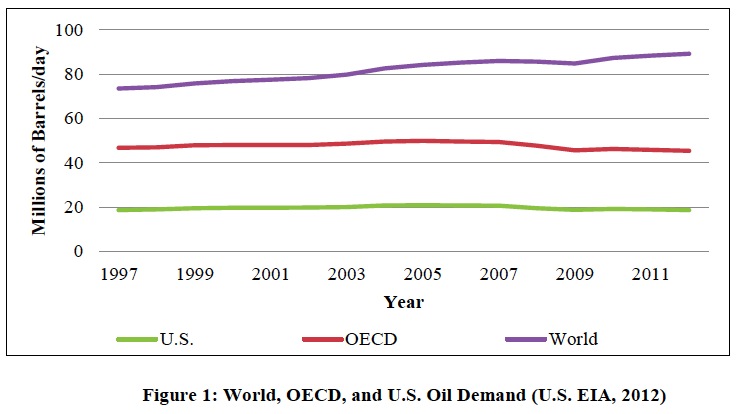

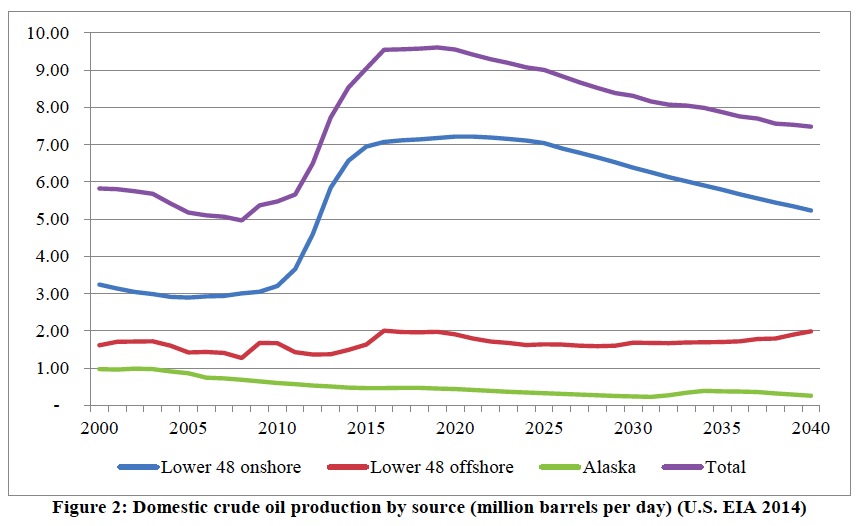

The report finds that natural gas enjoys a per-BTU cost advantage over petroleum in the United States and this price advantage is likely to persist for the foreseeable future. This price advantage is largely the result of the lower natural gas prices that have followed the increased supply created by new extraction technologies. Moreover, petroleum prices are likely to remain at or near historically high levels due to increasing demand and rising extraction costs. This price difference is also likely to persist because of the high cost of transporting a pressurized gas over long distances where pipelines are not present. Unlike petroleum, which is relatively low-cost to transport, natural gas markets tend to be regionalized, with low prices in areas that are near large reserves of natural gas. The relative abundance of natural gas in the United States and the extensive domestic pipeline network suggest that natural gas prices will enjoy a significant price advantage over petroleum as an energy source for many years.

Although natural gas is a low-cost source of energy, as a transportation fuel natural gas competes with many alternatives, including some that have been (or are) the recipients of heavy government subsidies. These alternatives include gasoline-hybrid vehicles as well as alternatives like plug-in electric and bio-fuel vehicles. Moreover, widespread adoption of natural gas vehicles (NGVs) requires substantial investment in natural gas fueling infrastructure. While some states have been particularly aggressive in creating this infrastructure, natural gas vehicles represent only a small fraction of the vehicle fleet even in these areas.

Observed adoption rates for natural gas vehicles are low for several reasons. On the supply side, very few natural gas vehicles are available directly to consumers from manufactures and fueling infrastructure is undeveloped in many areas. On the demand side, natural gas vehicles have several disadvantages and limitations that limit appeal to consumers. In particular, natural gas vehicles tend to be substantially more expensive (or are expensive to retro-fit), and are typically less powerful, heavier, have less storage/trunk space, and have more limited range due to the smaller capacity fuel tanks. Despite the fuel cost savings, these disadvantages tend to make natural gas vehicles an uneconomical choice for most consumers. These models of consumer preferences suggest that a substantial decrease in the price of natural gas vehicles would be necessary to induce a notable increase in light-duty NGV adoption rates. Moreover, the model predicts that, even at very low conversion costs or manufacturer price differentials, NGVs are likely to remain a minority in the vehicle fleet. In contrast, natural gas may represent an attractive alternative for a substantial portion of the heavy-duty vehicle fleet and there is evidence of increasing adoption rates in this sector. However, data limitations preclude estimating the adoption rates in this sector using the same techniques used to estimate adoption rates in the light-duty sector.

Vehicle miles traveled (VMT) and VMT per capita in Washington State were modeled. It has been found that VMT is more highly sensitive to variables that are correlated with overall population size (the number of registered vehicles and total employment) than to fuel prices. Additionally, it has been found that per-capita VMT has been declining in recent years, aggregate VMT in Washington State has been increasing steadily due to increased population. Higher fuel prices do have a negative effect on VMT, although the estimated elasticity is relatively low. Finally, the results indicate that adoption of natural gas vehicles is unlikely to have a substantial effect on VMT.

On a per-unit of energy basis, natural gas is about 20% less carbon intensive than gasoline. NGV adoption therefore represents an opportunity for the State of Washington to reduce carbon emissions from the transportation sector. The potential for reduced carbon emissions are estimated based on this model of consumer adoption of light-duty NGVs and based on reasonable assumptions about NGV adoption in the heavy-duty vehicle sector. Also, under current price conditions, these models suggest only about a 0.02% decrease in carbon emissions from the light-duty vehicle sector due to NGV adoption. If price conditions become much more favorable, this figure could rise to 1.16%. Emissions from the heavy-duty vehicle fleet depend heavily on adoption rates, which, unfortunately, are not directly estimable with existing data. However, reasonable assumptions suggest that reductions from this sector of the fleet are unlikely to exceed 7%, even under conditions of extremely optimistic adoption rates. Overall, transportation sector emissions (light- and heavy-duty fleet combined) are unlikely to be reduced by more than 4% overall.

Finally, the report investigated the threat of increased fuel efficiency on fuel tax revenues. Alternatively fueled vehicles such as natural gas vehicles and electric vehicles have started to erode fuel tax revenues. In addition, as a result of Federal fuel efficiency standards, automobile manufacturers have started to make all vehicles more fuel-efficient. If the current taxing structure continues into the 2020s then WSDOT will experience significant decreases in the amount of revenue generated by the current state fuel tax. This reduction in revenue may necessitate shifting to other revenue sources to replace the fuel tax revenue that is no longer collected.

About the Washington State Department of Transportation

www.wsdot.wa.gov

The Washington State Department of Transportation (WSDOT) is the steward of a large and robust transportation system, and is responsible for ensuring that people and goods move safely and efficiently. In addition to building, maintaining, and operating the state highway system, WSDOT is responsible for the state ferry system, and works in partnership with others to maintain and improve local roads, railroads, airports, and multi-modal alternatives to driving.

Tags: Fuel Efficiency, Natural Gas, WA, Washington, Washington State Department of Transportation, WSDOT

RSS Feed

RSS Feed