MCGRAW HILL FINANCIAL

GLOBAL INSTITUTE

Executive Summary

We review recent trends in federal infrastructure spending and the policy case for dynamic scoring of revenue and spending legislation. The use of dynamic scoring depends upon the magnitudes of near‐term impacts on economy‐wide spending and the long‐run impacts on productivity. We conclude that federal infrastructure investment should be dynamically scored.

A simple example suggests that $100 billion in new infrastructure spending could generate an extra $62.5 to $165.5 billion in national output over the next twenty years, based on a range of scenarios. Assuming a 20 percent effective tax rate, this $100 billion infrastructure investment would generate a 20‐year revenue offset ranging from $12.5 to $33.1 billion.

Introduction and Overview

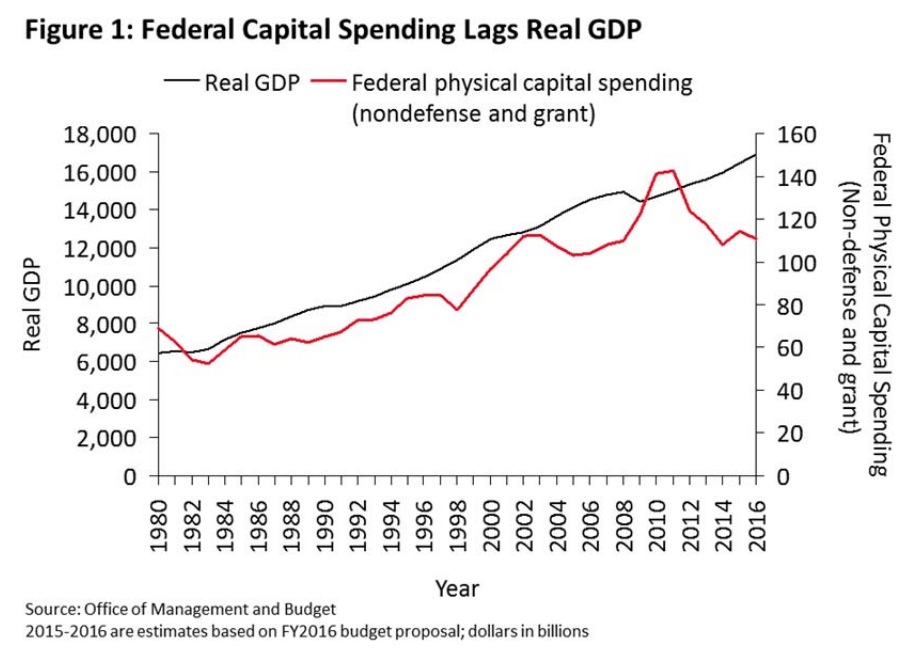

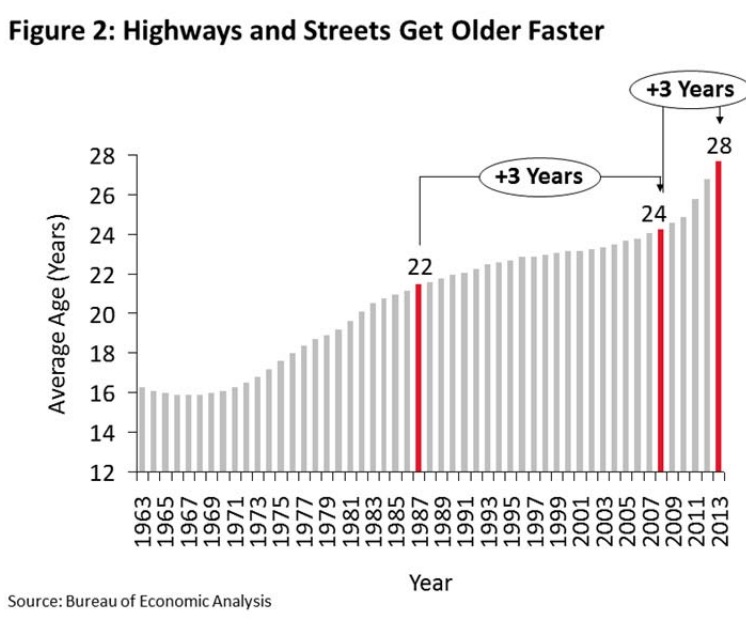

Modern economies rely on networks of transportation and other infrastructure. Many commentators have expressed concern over the quality of the U.S. infrastructure, leading to calls for increased federal infrastructure spending.1 These calls, however, have run directly into federal budgetary realities: a large amount of debt, entitlement programs that consume ever‐ greater fractions of budget resources, and no broad‐based desire to raise taxes.

In this setting, dynamic scoring becomes important. Conventional budget scoring incorporates the full range of private sector work, saving, and other responses to new policies like infrastructure spending. It does not, however, take into account the impact of spending on the overall size of the economy. Dynamic scoring incorporates these growth effects, permitting policymakers to distinguish between policies beneficial and detrimental to growth.

In theory, the logic behind dynamic scoring is irrefutable. Most legislation has economic consequences, and those consequences should be considered when assessing or ‘scoring’ the budget impact of that legislation. Until now, a combination of political pressures and economic disagreements has effectively pushed dynamic scoring to the sidelines. Depending on whether it was applied to spending legislation or tax changes, dynamic scoring could potentially be used to support the agenda of one side or another. At the same time, normally confident economists have been forced to admit that different economic models and assumptions applied to the same legislation could produce widely differing results.

The 114th Congress has adopted a budget resolution that requires dynamic scoring to be used for “major legislation.” Major legislation is defined as tax or mandatory spending bills that lead to a change in revenues, outlays, or deficits of more than 0.25 percent of GDP.

In general, infrastructure bills would not be dynamically scored because they are discretionary spending, and the dynamic scoring rules are built on the Budget Act’s requirement that the Congressional Budget Office (CBO) provide cost estimates for tax and mandatory spending bills, but not discretionary spending bills. In addition, the size of the changes involved would likely be less than 0.25 percent of GDP.

However, House leadership can designate other bills for dynamic scoring. In this paper, we argue that dynamic scoring should be extended to major infrastructure legislation.

This report makes both economic and political arguments in favor of dynamic scoring for infrastructure legislation. First, in the aftermath of the Great Recession, economists have focused on getting a better understanding of the economic impact of infrastructure investments. In particular, in 2014 the International Monetary Fund released a broad study of the short‐term and medium‐term economic impact of infrastructure investments across both developed and developing countries. Also, in 2014 two economists, Pedro Bom and Jenny Ligthart, published a meta‐analysis of 68 previous studies of the long‐term productivity impact of public infrastructure spending.

Using these studies, this report develops a range of reasonable multipliers that can be used for dynamic scoring of infrastructure spending. In particular, section five shows how they can be used to estimate the budget impact of an infrastructure bill, both short‐term and long‐term. Based on these reasonable multipliers, $100 billion in new infrastructure spending could generate an extra $62.5 to $165.5 billion in national output over the next twenty years, taking the initial investment into account. Assuming a 20 percent effective tax rate, this $100 billion infrastructure investment would generate a 20‐year revenue offset ranging from $12.5 to $33.1 billion.

The remainder is organized as follows. Section two reviews trends in federal infrastructure spending. Section three provides a framework and empirical evidence for the impact of federal investment spending on the near‐term path of total spending in the economy. Section four provides a corresponding analysis for the long‐run productivity impacts. Section five provides an example of dynamic scoring of a stylistic $100 billion infrastructure expenditure. Section six is a summary with conclusions.

Download full version (PDF): Dynamic Scoring and Infrastructure Spending

About McGraw Hill Financial Global Institute

www.mhfi.com/mhfi-global-institute

The McGraw Hill Financial Global Institute leverages essential intelligence from the world’s leading data and analytics company to guide and inform public policy debates. Through its unparalleled and expansive research, the Institute equips global leaders with insights to promote sustainable economic growth.

Tags: Douglas Holtz‐Eakin, McGraw Hill Financial Global Institute, McGraw-Hill, MHF, Michael Mandel

RSS Feed

RSS Feed