POLICY MATTERS OHIO

Executive Summary

America once led the world in production of rail cars, buses and other forms of transportation capital stock. As national attention shifted to highways and air transit in the second half of the twentieth century, investment in rail and public transit dwindled. New interest sparked by climate change and the dangers of dependency on fossil fuel and foreign oil have brought attention to pent-up demand and investment needs in this sector. National investments to repair existing stock and implement plans already in the works would provide sufficient demand to start rebuilding the public transit manufacturing sector:

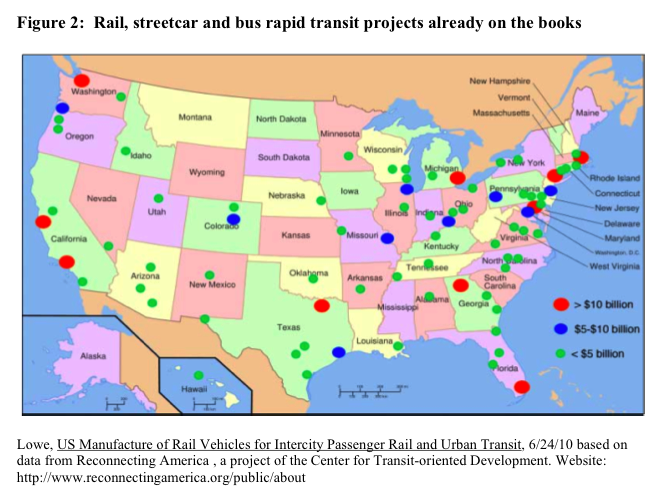

- According to a recent nationwide analysis of transit agencies’ and municipal planning organizations’ long-range plans, at least 400 rail, streetcar and bus rapid transit projects are in the planning stages.

- An FTA assessment of all of the nation’s public transit assets, including rail, bus and para-transit, found 29 percent in poor or marginal condition. The investments needed to bring these 690 separate rail and bus systems to a state of good repair total an estimated $78 billion.

- Amtrak calculates that in the next 14 years, it will need to buy 1,200 railcars, 334 locomotives, and 25 high-speed train sets.

- Re-establishing the national intercity passenger rail network would require capital investments of an estimated $8.1 billion annually through 2050.

A key question revolves around whether America has the industrial base to serve existing, let alone expanded,demand. The Apollo Alliance has partnered with researchers at Duke University to find some answers. Researchers at Duke University’s Center on Globalization, Governance & Competitiveness (CGCC) mapped out the U.S. supply chain in one key industry segment, passenger and transit rail. CGGC researcher Marcy Lowe and her team found that America retains a solid domestic production and supply capacity in that segment of the market. They identified 249 manufacturing locations across the nation that either produce transit capital stock or are top-tier suppliers to the producers. Ohio ranked fifth in number of top-tier firms with 13 first- or second-tier locations in the state.

Data from the Ohio Rail Development Commission (ORDC) paints a picture of the freight rail industry in Ohio. Their research reveals an extensive supply base of freight rail suppliers and contractors in Ohio, in addition to the passenger and transit rail firms identified in the Duke University study. Using Rail Supply Institute listings, which overwhelmingly reflect the freight rail industry, the ORDC found 226 firms in Ohio, supporting 26,516 jobs in the Buckeye State.

Federal and state policy makers can maximize their use of taxpayer funds by investing in public transit, streetcar and rail infrastructure, operations and capital stock. Investment in these sectors supports labor-intensive activity that maximizes job creation. For example, a cleaner transportation bill, as proposed by the advocacy group Transportation for America, could boost employment associated with the federal surface transportation programming by an additional 250,000 jobs. Because of our industrial base, Ohio could be a big beneficiary of federal programming that would create new demand for rail, bus, streetcar and clean heavy truck sectors.

Key public policies to underpin a transportation-led economic development strategy, whether embedded in climate legislation or in transportation legislation, must include the following elements:

- Stabilize demand for transportation capital stock through long-term commitment to public transit through legislation like the surface transportation act (SAFETEA- LU) and climate change legislation. This will ensure a market, limit risk and permit financing of new industrial capacity.

- Incentivize supply and make domestic production profitable through improving Buy America provisions and providing incentives for enhanced domestic content. This too will limit financial and production risk of expanding domestic capacity.

- Provide access to capital to help automotive and related firms retool for new transportation capital stock markets as part of climate legislation investment programming to build a clean energy economy. This also reduces risk and enhances reward for entrepreneurs rebuilding these sectors.

- Create market efficiencies by encouraging greater product standardization for domestic transportation capital stock to make the market work more efficiently. Enhance procurement practices to encourage better economies of scale.

- Provide technical assistance to support a cluster of domestic transportation capital stock producers in Ohio through economic development services proposed by Ohio’s EWI (Edison Welding Institute) to foster continuous improvement, efficiency and research and development in the rail industry.

About Policy Matters Ohio

www.policymattersohio.org

“Policy Matters Ohio is a non-profit policy research organization founded in January 2000 to broaden the debate about economic policy in Ohio. In 2008, the Nation magazine named Policy Matters the most valuable state or regional organization in the country. Our mission is to create a more fair, prosperous, sustainable and inclusive Ohio, through research, media work and policy advocacy. Ohio faces enormous challenges from the global recession, three decades of deindustrialization, rising inequality, and global warming. We also see tremendous opportunity to reinvest in Ohio’s workers, children, cities and infrastructure, to forge an economy that works better for all. Policy Matters focuses on issues that matter to Ohio’s working families. We welcome you to join us in promoting a better Ohio.”

Tags: Apollo Alliance, Duke University, Ohio, Ohio Rail Development Commission, ORDC, PMO, Policy Matters Ohio, T4America, Transportation for America

RSS Feed

RSS Feed